|

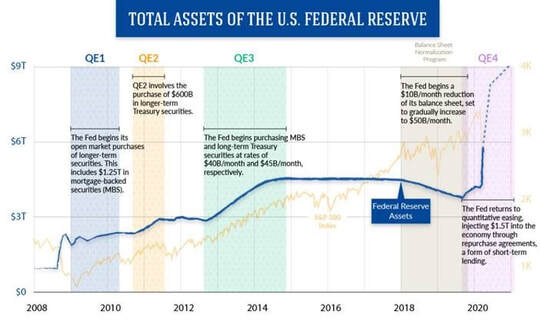

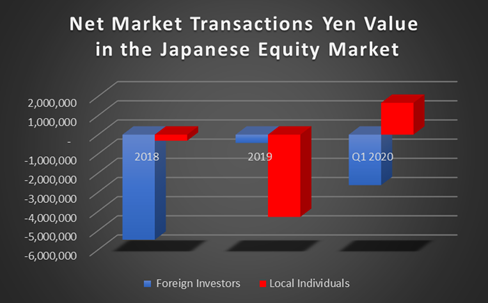

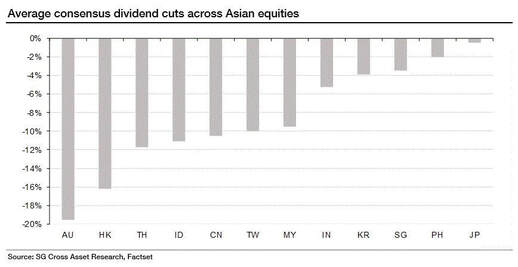

After a strong rebound and some signs of a relaxation of the lock downs we are now entering ‘Phase 2’. The actual damage done will become clear and fears about a viral resurgence are likely. Consequently, we expect a sideways market for a few months. Long term returns are unlikely to be impaired however, although a temptation to unleash modern monetary theory would be alarming. Japan remains our favourite equity market.  Author: Robert Swift Author: Robert Swift We have now had the ‘V’ shaped bounce in equity markets which has probably caused the maximum amount of distress for investors, as we feared? We have been investing for a long time in global equities, but this IS a tough market to navigate! Bad news is interpreted as good and vice versa and governments can make decisions in a trice that end years of precedent and prudence. For example, the balance sheet of the Federal Reserve has doubled and doubled again in the last 10 years! It doubled in the last year alone. It took almost 100 years to get to $1 trillion since inception in 1913; but only 10 years to get to $6 trillion. One other curve we are going to have to flatten is the debt curve. However, every time the Fed floats that policy proposal, the market panics, the Fed then panics and the government yells at the Fed on behalf of investors, and in the game of “who blinks first”, the Fed loses and back tracks. “Lord make me chaste, but not yet” as St Augustine said? Maybe he should be in charge of the central bank? As for the pandemic, we may well be at the end of the beginning as it were, with lockdowns being relaxed imminently, but if so, this is not the beginning of the end. We now have to navigate the possibility of a new spike in infections as we try to kick start the economy and wind up social interactions, and the markets will also be assessing the damage done to short and long term prospects for company profits. Early signs are that damage is considerable in some regions and sectors. This need to now navigate ‘Phase 2’ after the ‘V’ bounce, makes us believe that markets will move sideways, but be choppy/volatile and stock selection will (thankfully) matter. In jargon this is known as high cross-sectional volatility and low momentum; which gives active managers a chance to add value over simple factor benchmarks since the spread of returns between winners and losers will be large. Given our investment approach for clients is to be fully invested against the mandated benchmark, that has saved us from being whip sawed. One more time we are going to highlight Japan. As Australian companies look to preserve or raise equity and debt capital, and reduce or cancel dividends, one country with the potential to increase dividends is Japan. With over 6 trillion yen of cash on the balance sheet of corporate Japan, they are well placed to reward shareholders even as profits are dampened by the COVID induced shutdown. Read again about one such opportunity in the 'true tech’ sector - Advantest. On Monday Advantest (6857) rose 8.4% as they declared a 4Q operating profit 11.6b yen vs analyst estimate 9.8b yen; 4Q orders +38% y/y to 90.7b yen; full-year dividend 82 yen/share vs previous guidance 75 yen. We own this company in our TAMIM Fund: Asia Small Companies portfolio. We don’t think Advantest will be alone in Japan. We remain flabbergasted that ‘global’ equity managers still focus almost exclusively on USA companies. How ‘global’ is that? Clearly USA companies do get revenue globally, but the price of an equity tends to be set by the risk tolerance of local investors. Put another way, the omission of Japan from consideration removes a very attractive set of companies whose prices are not highly correlated to those in the USA. Japanese investors will drive the prices of Japanese equities and Japanese investors are wealthy and returning to their equity market. Diversification benefits are being lost by ‘global’ managers who don’t understand portfolio construction. Since diversification is a key pillar in investing, this is a mistake. Japan remains under researched, under-appreciated for its strengths, and undervalued. Oh, and by the way, local investors are buying – see below. For a regional assessment of dividend cuts and the contrast between Australia and Japan please check out the table below which is a consensus forecast of dividend cuts in Asia. After ‘the beginning of the end’ has ended, we will then have to see how the pendulum between profits and wages, private sector enterprise and government bureaucracy, capitalism and socialism will be swinging. With profits so high relative to wages, and ever encroaching central bank action to subdue price signals from market participants, the pendulum is likely to swing away from rewarding shareholders. A 7-8% p.a. long term return from equities will be the best we can expect.

Some of the best work we have seen on the long-term implications of COVID-19 can be found from Northfield Risk Systems. Their conclusions are that long-term returns will only be marginally affected by the impact of COVID-19 and the response. This is seriously detailed and mathematically rigorous. Our philosophy is that if you start with a 3-4% dividend yield and a good balance sheet, that target return of 7-8% p.a. gets a whole lot easier and more certain. We continue to favour companies with these characteristics.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed