|

Robert Swift takes a look at why Advantest's share price jumped 50% in July and what aspect in particular provides a blueprint for future investments. This article was prompted by the announcement that Verizon was selling Tumblr for a few million dollars. Tumblr is/was a social networking site that allowed users to blog personal stuff to each other. A couple of years ago Tumblr was reckoned to be worth $1bn. Verizon, a telecom company, was probably never a good owner of that business and clearly lost out to Facebook in the search for users and personal data to on-sell. So, did something unique to Tumblr go badly wrong; or is it that Tumblr is another example of a company vulnerable to the increased charges in depreciation and amortisation that have to be applied to the carrying value of assets of companies which operate in fast changing industries? Another recent example of sudden loss of value, and not in the technology sector, has to be Kraft Heinz which suffered another write down in the carrying value of its assets recently. It’s share price is not a pretty picture. You have to invest to maintain an advantage – if you have one at all.

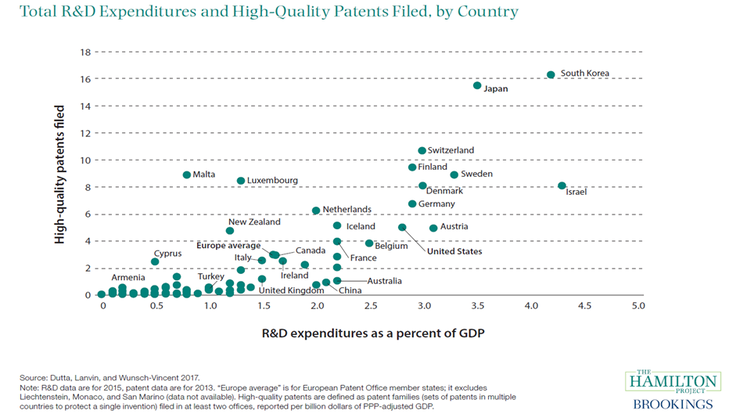

It strikes us as an underappreciated risk, and a paradox, that the proponents of investing everything into digital platform companies, (which they call technology companies), because of their ability to create and capture rapid change in the economy, are then failing to accept the fact that this rapid change may require more aggressive write downs of the existing technology AND higher levels of capital investment and R&D by these companies, to stay ahead? Simply put, faster change and more competition, requires more aggressive depreciation and more spending on R&D. Recent accounting changes now classify R&D as capital investment so even as a ‘capital light’ business, there is still quite a lot of capital/ R&D required. (We actually think there is really no such thing as a ‘capital light’ business. If a business is less reliant on physical plant and equipment then it is likely to be MORE reliant on intellectual capital. If that is the case then it still has to spend on that intellectual capital to keep it ‘fresh’? If it doesn’t then it presumably falls behind and loses its best assets – its people?) If Tumblr can see such a rapid descent from lofty valuations, due to rapid change in the industry, then why can’t it happen to other companies, and how can it be prevented? The answer to the first is it can and should. Capitalism works because capital is free to enter and leave industries. As long as the playing field is level then fair competition will create winners and losers. Monopolies are generally good for the owner of the monopoly but pretty terrible for everyone else. We watch with interest the increasing competition for eyeballs between Netflix, Disney and numerous other entrants to the “digital platform programme ball”. First mover advantage appears to be over and a lot of money will now have to be spent there and if that happens then dividends won’t grow for a while longer; cashflows won’t pay down debt, and generally enterprise risk will rise. The answer to the second question has to be ‘invest more; innovate; spend more on R&D”? This sort of presents a conundrum for investors because companies which have spent less on capital and preferred to buy back shares have tended to perform better in the stock market. So can we reconcile this problem that “to maintain a long term advantage we would like companies to invest more; but to keep short term clients happy we would like companies to invest less”? Maybe and we would recommend that investors look a little more keenly at Japanese companies. They have actually tended to invest TOO much and as anyone who visits companies there can attest, you could eat lunch off most factory floors such is the (too) high level of maintenance. This over investment has caused problems for shareholders but we think this habit is being tamed. One such company which spends sensibly would appear to be Advantest, which we own in the Asian equity trust. The company is a semiconductor test equipment business. Essentially it ensures that the production lines which make DRAM and flash memory, are working and production yields for the chip makers remain as high as possible. Results from Advantest were announced in late July and were not as bad as feared. Actually the company beat expectations of operating profit by 50% (which is actually a problem in that the company didn’t keep the market updated with how well it was doing, and communicating with the stock market is beneficial but we’ll maybe leave that for another time?) Over the month of July the shares rose 50%. Yes 50%. While the industry is cyclical , it is growing and will continue to grow. Quoting from the recent shareholder communications, “Demand for semiconductor test equipment is influenced not only by change in device production volume but also technological evolution trends in semiconductors. Miniaturization further improve the performance of semiconductors, reduces their power consumption, and increase semiconductor test time and the complexity of functional test processes.” The first part is good for users of technology, the second is good for Advantest. It would appear that spending money on R&D is essential for a tech company. Advantest has spent approximately 17% of its revenue on average on R&D pa over the last 5 years. This compares favourably with USA tech companies such as Facebook which has ramped R&D very aggressively in the last few years and Alphabet and more than favourably with Apple (5% of Sales) and Netflix (8&) For Advantest In the last 5 years revenues have increased by over 11% pa and net income grown by over 25% pa. Dividends have grown by 47% and it would thus appear possible to find a company which can grow sustainably; keep a competitive advantage and keep shareholders happy with a dividend? With a prospective P/E of under 16x (approximately the same as Apple and much less than that of Netflix at over 100x) and a dividend yield of 2% which is growing this looks a strangely ignored technology winner well able to deal with increased competition through prudent investment and development over many years. Unlike perhaps some USA companies which may now have to play ‘catch up’ in R&D as more competitors arrive? For what it’s worth, there are more high quality technology companies with sound and defendable positions, listed on the Japanese market. We leave you with this chart which shows high quality R&D spending globally compared with he number of high quality patents filed by country. Our advice? Don’t keep overlooking Japan.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed