|

This week we return to the topic of innovation. Just what is it that allows innovations to take place? And more particularly where should we be placing our bets to take advantage?

As consumers and investors, it is often easy to take for granted and grow complacent about technology and technological change. Even the screens you sit in front of and the investments you make have been made exceptionally easy by the advent of information technology and the world wide web. However, this change is neither a mere coincidence nor just a series of accidents. This week we would like to, as we are prone to do sometimes, take a step back and try to understand the factors and ingredients that create an atmosphere for innovation to take place. This is a particularly important question in a world where the pace of change seems to be constantly accelerating beyond comprehension and staying ahead of the innovation curve can yield fabulous returns for ones portfolio. Just what is it that allows innovations to take place? And more particularly where should we be placing our bets to take advantage?

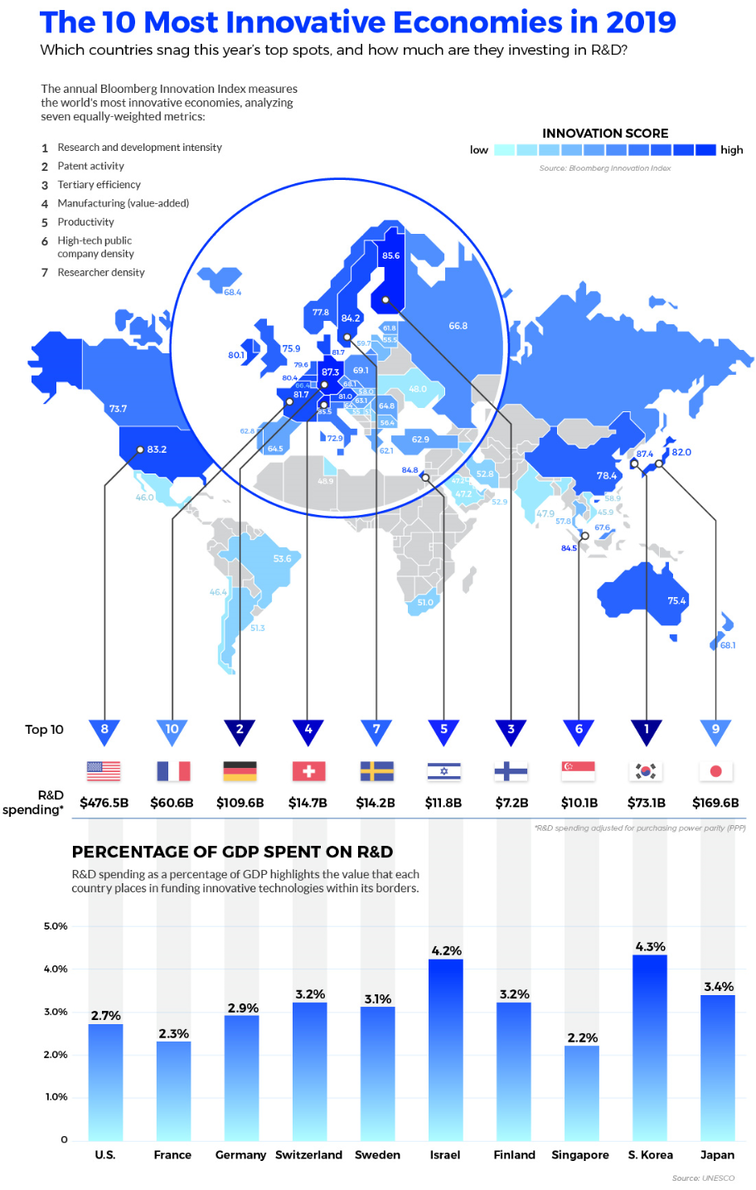

One of the most interesting graphs we have come across and have been touting recently has been the extent to which nations have been investing in what we like to call the capacity to innovate. Innovations come in many forms and, while sometimes big inventions are somewhat a result of luck, we think there is certainly something to be said for the fact that specific conditions can create this luck. Ranging from the necessity to innovate as a matter of survival (eg. Israel) to a complex set of policy instruments that create an environment for this to take place (nations like Japan, South Korea and Taiwan for example). Starting in the post-WWII environment, Japan’s ability to innovate was driven primarily by the need to rebuild. The re-energizing and rebuilding of old family-owned Zaibatsu conglomerates into newly minted Keiretsu firms with special incentives saw what many during the 80’s called the Asian miracle. What many didn’t question or seem to realise was that this was a very deliberate attempt to create national champions. Firms with special treatment and government incentives that allowed them to dominate their respective sectors while being protected from foreign competition. The excess economic rents that these firms were able to achieve created an environment in which they were able to reinvest substantially back in the form of capital expenditure. Indeed the reason for the historically low dividend yield of many of Japan’s largest conglomerates was for this particular reason. While this eventually became a bane for many of the minority investors in Japanese markets, it led to some spectacular results when it came to innovation ranging from robotics to automotive manufacturing. Such policies were copied almost verbatim throughout much of Asia, from South Korea to Taiwan. In South Korea, Chaebol firms spurred by the strongman President Park Chung Hee, the father of the now very infamous Park Guen-Hye were able to grow quickly. Initially through low tech manufacturing and eventually moving up the value chain. Again the story seemed very similar, these firms were essentially rent-seekers using government initiatives and policies to insulate themselves from the competition while building capacity to grow enough scale to move up the value chain. This was so effective that many of these firms came to be dominant players not only in domestic markets but globally, think the likes of LG or Hyundai. This trend was somewhat similar in Taiwan though this has tended to be dominated by much smaller-scale businesses that were still nevertheless helped along with government subsidies and US government support.

And so that brings us to the first two ingredients for technological innovation to take place. Government policy and necessity. This is a policy that has been followed by the Chinese in recent years through their support of state-owned enterprises or through funding companies such as Huawei. Don’t be fooled into thinking that this is an Asian specific example, the recent advances in solar technologies would not have been made possible were it not for EU support/subsidies and Tesla would not have been able to survive its initial years without some very lucrative government subsidies. Looking throughout history, it seems one of the key factors for technological innovations to take place has in fact been (perhaps counterintuitively) a rather uneven playing field that creates enough of an incentive for players to take outsized risks. In fact, the Brits used the same strategy to transfer textile manufacturing technologies out of India and into Great Britain (even going so far as to break the thumbs of the famous handloom weavers of Tamil Nadu to suppress competition for British manufacturers) and the US being caught red-handed in the 18th Century trying to steal technological secrets from Great Britain with the full knowledge of many of the founding fathers (i.e. Andrew Mitchell).

This is not to say that excessive government interference is a precursor to technological innovation otherwise North Korea would be exceptional by now. What we are trying to suggest is that areas where government support or policies create some insulation, especially in infant industries, are more likely than not to succeed. Despite what you might hear about free markets creating some sort of a mystical formula or nirvana for innovation to take place, some of the great inventions that came out of US during its rapid late 19th Century and early 20th Century development was a result of a very closed economy with exceptional support for local companies to innovate. This is the reason why for much of American history, it was the farming South that was pro-free trade whereas much of the industrial North was anti-free trade. One might then question why the subsequent globalisation of the world sped up the innovation process? While it is true that many of America’s industrial leaders in the early 20th Century benefited from high tariffs, this only seemed to work until a certain point. Once many of these companies reached sufficient scale to compete on a global level they also reached enough scale to sustain themselves independently. This should be somewhat intuitive to understand, put simply they were generating enough cash flow and had enough of a dominant position to further expand profits by expanding overseas. This allowed many of the firms to access new markets and new human capital to expand their pipeline for R&D, a self-fulfilling prophecy. As more people become attracted to work in areas, sectors and companies that are in dominant positions, those companies are then able to expand their technological capacities. As an example, think about the sheer amount of Indian immigrants that moved to the US on H1B visas and the massive wave of highly educated Russian’s moving to Israel in the 1980s. In addition, another outcome of this is that the success of many of the companies then attracts new entrants that then creates ripple effects and specific clusters (think Silicon Valley). This brings us to the third and fourth ingredients for technological innovation. This is the generation of clusters and access to human capital. Even here, certain countries such as Israel, have been exceptional in artificially manufacturing this aspect by specific and targetted spending on educational programs. R&D spend targets as a percentage of GDP have also been a prevalent tool when it came to measuring up success. Globally what has been interesting has been the increased use of public-private partnerships and university-commercial linkeages in the commercialisation and funding of new technologies. In fact, this has been how companies such as Sensetime or Huawei were developed in China. So what does all this mean from an investment standpoint? For investors, it always pays to be vigilant in looking for new opportunities. In a world of billions where we are prone to information overload, we would suggest a robust framework and recognising patterns makes it easier to know where to focus. In essence, what we are suggesting is that four key ingredients create a conducive environment for technological innovations to take place:

Based on this, it might be easier to spot markets or companies that could offer good investments. For us, the major markets of focus within this context have been Israel, Japan and South Korea which still offer exceptional opportunities and have all of the four key ingredients.

See more of this infographic at Visual Capitalist.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed