|

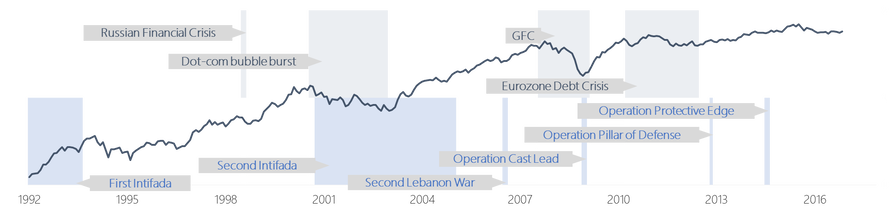

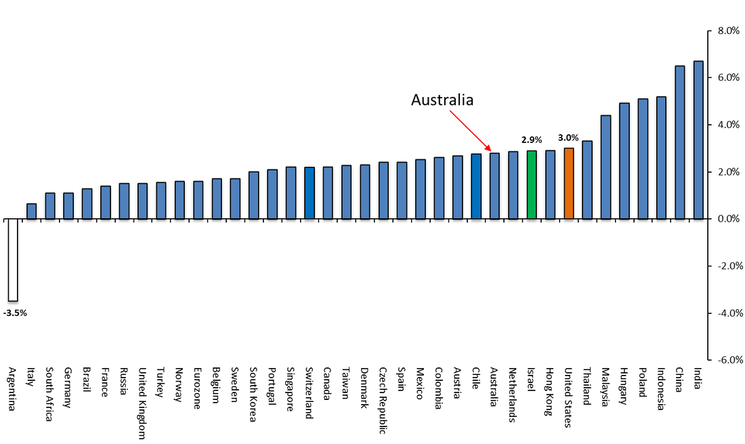

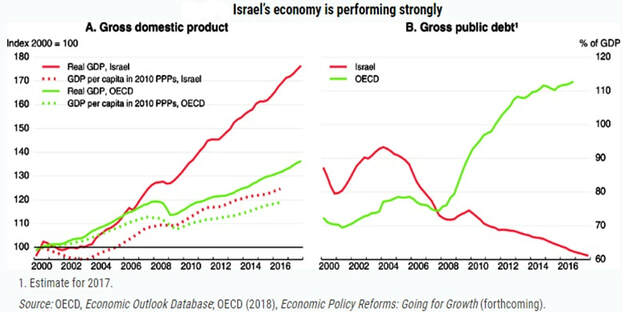

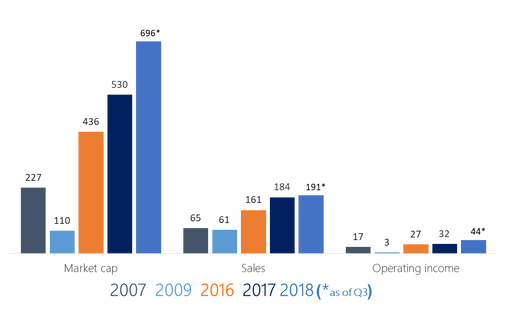

All of us are familiar with the saying ‘necessity is the mother of all innovation’ and nowhere is this more applicable than the land of Zion. The remarkable feats achieved by this small, industrious nation over the past few decades speak for themselves. Ranging from agriculture, pharma down to cutting edge new age technologies in cybersecurity and renewables, Israeli companies have had a phenomenal tendency to think on a grand scale and often dominate their relevant sectors and industries. This is even more astounding given the nature of the domestic market and the geopolitical backdrop that most of us are at least somewhat familiar with. We would like to tell the story of Israel and why we at TAMIM believe that it creates a unique and exceptional investment opportunity for Australian investors. Understanding the Israeli Way - A brief walk down history lane When speaking of Israel, perhaps the first thing that comes to mind is the geopolitical context. But here are a few statistics you might not be aware off, did you know that it also happens to have the highest number of PhD’s, engineers and patents filed per capita in the world? Or that it is one of the biggest R&D hubs for multinational corporations, including the likes of Microsoft, Intel, SAP, Alibaba and Google who all have facilities located there? You would be forgiven if you are genuinely surprised by these facts, since such achievements are often overshadowed by the constant political tensions and strife within the region. Ever since the inception of the modern state in 1948, one of the most enduring characteristics of the Israeli economy has been its dynamism and orientation towards promoting the national interest. Initially, this meant that most businesses were oriented towards agriculture and feeding an ever-growing population with very little arable land. Indeed, one of the first major innovations to come out of the country was in drip irrigation where a father and son duo perfected the use of plastic emitters to create a device that revolutionised agriculture and drastically increased yields. A uniquely Israeli facet of this story was the way in which their inventions were commercialised. The inventors by the name of Simcha and Yeshayahu Blass did not go out and establish the company via securing bank loans or registering a company by themselves, rather they signed an agreement with a Kibbutz (i.e. Kibbutz Hatzerim). In conjunction with the Kibbutz they then went on to establish Netafim which in the 54 years since inception became a market leader in drip irrigation with 30% of global share. For those of you unaware of what a Kibbutz is, it is effectively a collective community which was historically based on agriculture. It is not a new concept, going back to the time of the British Mandate in Palestine. It acted as a mechanism for the new migrants to pool resources together and as time progressed became an intrinsic part of the state-building process. Within these communities there is no private property and resources/decisions are the purview of the collective. As one can imagine, this was an effective way to circumvent issues relating to the lack of official financing mechanisms or systems of capital allocation. Another important element to the development of Israeli business has been the geopolitics of the region itself. The constantly evolving politics has meant that policymakers realised early on that Israel needed to be self-reliant and undertake innovation in order to survive. The first big catalyst that drove this idea further was during and after the Suez Crisis and Six Day War in which the French government managed to do several policy back flips that essentially culminated in an arms embargo on Israel in 1968. This effectively created a scenario whereby Israel had to go towards a blitz since their Air Force was unable to maintain their planes for longer than two months without French spare parts. For better or worse, this has meant that the state started to undertake heavy investments into military R&D and building an industrial complex around it. The creation of this new imperative also had the added advantage of enabling and seeding a broader boom in technology, including fields such as cybersecurity and artificial intelligence. Indeed, as of this year, Israel has the third highest number of companies listed on the NASDAQ after the US and China which is even more remarkable given its population of 8 million people. In addition, the very fact that there is a constant threat of existential crises in the backdrop in and of itself created a certain resilience into the economy. Take the equity markets for example, where local and regional crises hardly dent the indices. In fact, the most significant factors impacting upon the stock exchange are more global macro events: Back to the Present So where does that leave us at present? Despite (and perhaps because of) the environment in which the Israeli’s have found themselves in, they have made prudent economic decisions. The economy has continued to grow at a steady rate of close to 3% whilst implementing policies to lower public debt and it remains one of only two OECD countries to have lowered public debt since the GFC while maintaining growth. Investment in education and expenditure on R&D have meant that it now spends close to 5% of its GDP on it and its workforce is highly skilled. The fact that Intel just announced another US$ 11bn in investments to increase their local manufacturing capacity speaks for itself about how effectively the policies are coming to fruition. Real GDP Growth by Country YoY% In addition and perhaps most importantly for prospective Australian investors, Israel is not reliant on commodities prices and the companies on the exchange are truly global in nature. Here is another important consideration when looking at Israeli companies, they were created out of necessity and have learnt to survive in a harsh environment and the lack of a sizeable domestic market (growing though it is) has meant that they have to be global from day one. An interesting example of this is one of our portfolio companies, Maytronics. Maytronics manufactures robotic pool cleaners and is the world leader in doing so with a 45% market share in the US and a significant chunk of the Australian market under the Dolphin brand. Consider for a moment the almost surreal and comical nature of the story of a company born in an Israeli Kibbutz in a country where there are virtually no private pools (after all, you’re talking about a country that isn’t particularly abundant in water either) not only manufacturing robotic pool cleaners but dominating that niche globally. But that just about sums up the story of Israel analogously, a rather weird and wonderful place where people ask and expect to be taken seriously and the world seems to be waking up to it ever slowly. Indeed it is rather telling that just this year alone a global hedge fund and a consortium of Australian financial institutions (including Sunsuper) bought out 40% of the Tel Aviv Stock Exchange in preparation for its upcoming IPO. Could it be, there might just be some substance to this story after all. We think the answer is definitely in the affirmative and interestingly we think to be found in the hidden gem which is the Israeli listed equity space.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed