|

This week we would like to discuss a topic that is probably one of the most contentious and hotly debated in the investing world at the moment. This is the future of retail, specifically the commercial viability of the traditional retail sector in the face of increased competition both as a result of online (i.e. the Amazon effect) and low cost providers such as Aldi. This is a topic that is especially relevant to us given the significant exposure to consumer discretionary stocks we currently have in our domestic equity portfolios. In addition to this, the property transaction that we are currently finalising relies significantly upon Woolworths (taking up 91% of the floor space). Given this to be the case, we would like to broadly answer the question below: What does the retail sector look like going forward? Context Firstly and before delving any deeper, we would like to begin with broad secular economic trends both domestically and globally. Namely the following:

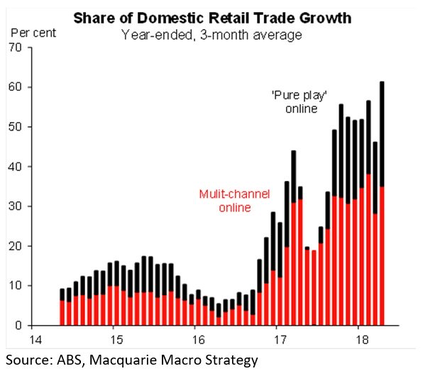

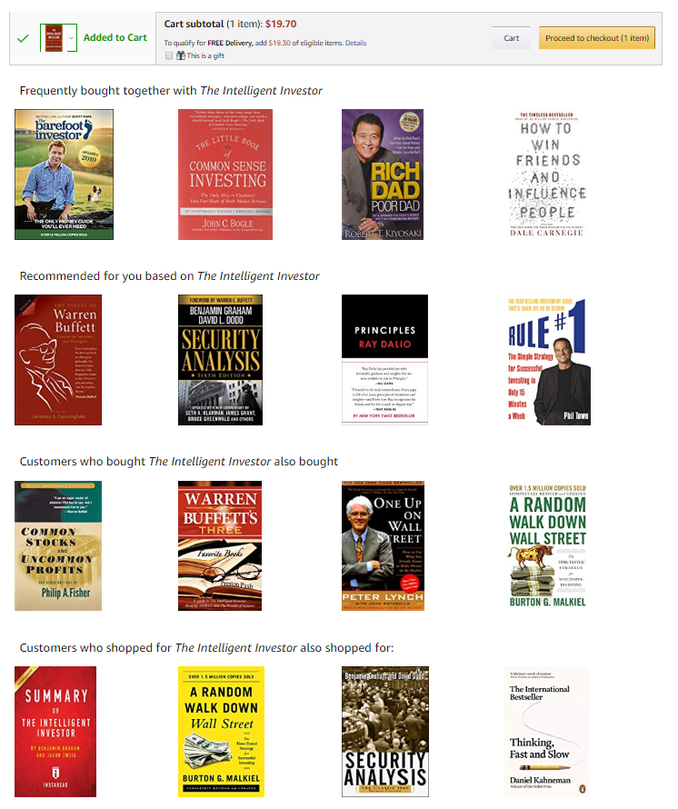

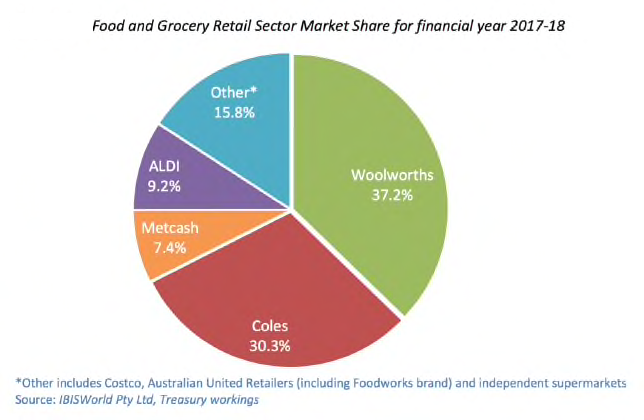

Retail in essence is pro-cyclical, this is especially the case with consumer discretionary spending. This aspect is also the reason that central banks and more broadly the investment community puts such an emphasis on indicators such as PMI and retail spending to understand the state of the economy at any given point in time. As such, the sale of goods and revenue numbers are highly correlated with general consumer sentiment. The traditional retail sector, which we can define as the department stores of the bygone era that focused on foot traffic, are finding the current climate increasingly hard to compete in, especially in an era of pure-play online retailers such as The Iconic (clothing) or Kogan (electronics and white goods). The reason for this is mostly based on margin pressures. For one, online retailers do not have to have the same brick & mortar footprint and the ongoing costs associated with these retailers who are thus able to source product on a much more efficient basis, and do so at a significant cost advantage. Perhaps one of the best examples of the above scenario has played out in the Myer debacle. The stores found it increasingly difficult to compete or maintain competitive position in the face of much stronger competition online. Increased Income Inequality & Wage Stagnation The increase in income inequality and wage stagnation is nowhere more evident than in the retail space where there is an increasing specialisation in terms of consumer segmentation and marketing. The rise in income inequality bodes well for the top end and luxury goods segment of the market. The play here being global companies such as Moet Hennesey, which has seen its share price go from a mere $40 in 2009 to upwards of $400. On the flip side, the wage stagnation also means that the bottom of the market is increasingly being eaten into by new entrants where the competition is based purely on price. In economic terms this is referred to as elasticity of demand. This is evident in the rise of businesses such as Aldi and, more recently in Australia, Costco; another company that has seen its share price go up by over 500% since 2009 to $300 USD. What has been most evident as this trend plays out is the increased tendency of traditional retailers to be hammered in terms of both margins and revenue growth. In other words there is no place for middle of the road retailers, only those that compete purely on price or those at the top end of the market, selling luxury or ‘status-symbol’ goods. In Australia, which as we have previously mentioned tends to be one cycle behind the rest of the OECD countries, this is just starting to play out. We predict that even David Jones will see its gross margins be continuously hit in the face of these trends. In terms of Myer, we might see a turnaround if the new management continues to deliver on its strategy of differentiation and increasing foot-traffic via a retail experience format. It will be increasingly contingent upon retailers to target specific subsets of the consumer market and incentivise them to come in store but at the same time offer an omnichannel experience. Omnichannel, as the name suggests, broadly means that at the end of it the customer should have seamless experience irrespective of the channel in which they wish to interact. For example, I might order online but not like the end product and choose to go in-store to return it as well as make other purchases that are then delivered to my house. Such experiences are where the standouts will come from. We have already seen Woolworths and Coles, with their delivery service, undertake such measures. But this is still in its infancy. The big standout will be their capacity to capitalise upon their existing distribution network in terms of the stores they have in both neighbourhood and regional areas essentially turning them into part-warehouses to deliver product in a speedier fashion. We somehow doubt that Amazon will want to build and replicate the infrastructure to compete on this level of granularity in Australia. In fact, the limitations of the Amazon network in the US was seen given its push into brick and mortar by buying bookstores and its opening of grocery stores. When it comes to the delivery of fresh produce, bricks and mortar will always be required as regional hubs and distribution centres. Amazon has realised this and it’s play here will be to give that omnichannel experience. Increasing commodification and centrality of data In our view companies like Amazon are much more than just retailers, they are in essence data companies that commodify and commercialise data. Given the sheer volume of data that they are able to source within their existing network they are then able to commercialise products that suite and target specific subsets of a truly global market. Hence their moves into both healthcare and cloud infrastructure (Amazon Web Services or AWS). The key will be the acquisition of data and the ability to act upon the intelligence derived from this data. In fact, retailers such as Woolworths, Coles and Aldi are all relying on next generation software ranging from WMS (Warehouse Management Systems) to instore POS data combined with cameras to ascertain and create behaviour patterns in customers (artificial intelligence is not too far away either). Ever wondered why certain items are placed just before checkout? If you are under the impression that this trend was perhaps just a way to place some more product in front of you, think again. It has always been done but it is now increasingly selective, targeted and informed. A lot of thought and data actually goes into figuring out just which chewing gum should be placed in the checkout ailes and which soft-drink should sit next to the self-checkout. It is the same when shopping online but even more targeted and personalised. There are cookies tracking what you are looking at not just when doing one specific shop but every time you shop at that site. The data gathered from both you and other customers is used to build out a profile and make recommendations accordingly. Before you even get to the check-out, just look at what happens when you add Benjamin Graham’s The Intelligent Investor, for example, to your cart on Amazon: Another trend we have consistently seen has been the proliferation of micro-trends within the market. Such as health conscious millennial's or specific profiles within the broader demographic like age or gender. Think the Sukin brands of BWX Ltd. or the undergarments of City Chic, which specifically target middle-aged women. We have also seen this in the acquisition of brands such as T2 by Procter & Gamble and increasing consolidation of the beer companies world-wide. What will be interesting will be the continued rise of niche beer brands and microbreweries such as Gage Roads or Broo Ltd. and whether they might be targets for acquisitive AB InBev or Kirin whose most recent high profile acquisition in the Australian market has been Carlton United Breweries. In terms of grocers, what we are certain of is that there will be an increasing focus on suburban and sub-regional areas. We are quite certain that we will see an increasing amount of attention paid by the big two, Coles and Woolworths, to convenience and neighbourhood centres. These not only have the benefit of lower costs in terms of rent but would maintain the requisite foot traffic to remain profitable. Intuitively, people still go to their neighbourhood store to buy their milk and groceries for the week as opposed to wait for it to be delivered after ordering online. Regional is something we are certain they will maintain given their existing footprint and the potential inability of the pure online retailers to compete. We would find it hard to imagine that Amazon would choose to roll out Amazon Fresh to remote areas given Australia’s low population density and the requisite infrastructure and warehouse capabilities that would need to be built out if this were to be the case. What will be interesting is the competitiveness of Metcash in this environment. While we do not necessarily see Aldi giving either Coles or Woolworths a real run for their money, it will be quite interesting to see how the IGA supermarkets perform in this environment. Especially given the propensity and increasing likelihood of both the majors going towards smaller and neighbourhood centres. From a cursory understanding, we think Metcash might end up with the short end of the stick, given the sheer size and ability of the majors to strangle out the smaller players. Conclusion

The argument we have tried to make is that while retail and consumer discretionary does tend to be pro-cyclical, we firmly remain in the camp that they still present good opportunities. The key will be in identifying brands and specifically brand value. There will be a place for the top end of the market which can distinguish on either the luxury element or retail experience and the bottom of the market where price will be the distinguishing factor. What we do not however see is the potential for a continuation of the status quo of middle of the road retailers. We continue to identify good companies within specific niches such as Noni B or City Chic with either good cost-out stories or revenue growth potential and an awareness and willingness to embrace the online space, another example being Vita Group. Data and the way in which management uses it will also be a key distinguishing factor for the future survival of retail.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed