|

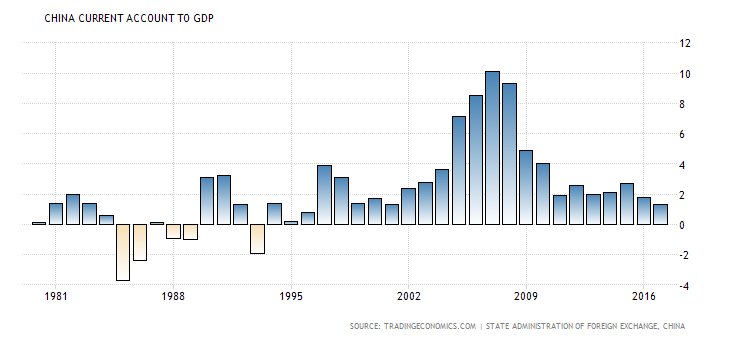

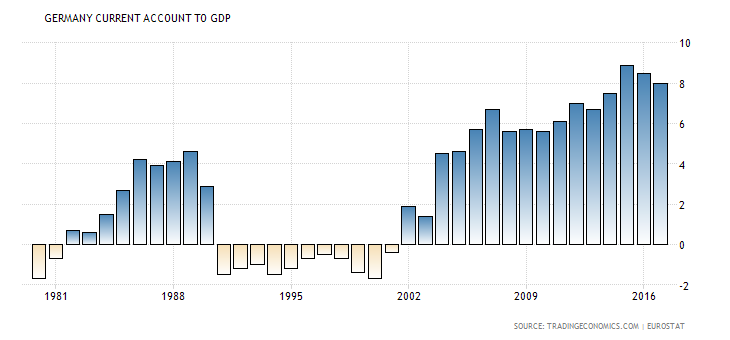

Robert Swift, of API Capital and the TAMIM Asia Small Companies strategy, tackles confirmation bias in an examination of the China-USA trade war situation. One of the most dangerous mindsets a portfolio manager can have is that of confirmation bias. This is the human tendency to take a position and then only seek reinforcing and not contrary evidence. This is dangerous because the chances of being wrong in portfolio management are high and it is the ability and willingness to change your mind that prevents you from the mistake becoming large, and preventing the deployment of the capital to a better, winning, position. Consequently we spend a fair bit of time trying to listen to opposing views and we therefore re-print below, an article from one of our more cynical contacts regarding China and the USA. Stewart Paterson (whom we cited recently and is the author of a book on China’s entry into the WTO) is effectively arguing that this trade war is not temporary but marks the start of a new ‘cold war’ and that investors had better be prepared for the consequences. Since we are constructive on Asia we thought we should take this contrary view point seriously. Has The New Cold War Started? Foreign Investors in China Take Note and Get Out. Sat, 6 Oct 2018 00:53 EXECUTIVE SUMMARY Anyone with investments in China (and for that matter anywhere else) should listen to Vice-President Pence's speech to the Hudson Institute. He was not reading from "China, Trade and Power" (available here) but he may as well have been. The speech, I think, will be seen in the future as marking the end of the era of indulgent engagement with China and the start of a new cold war. Investors in China run the risk of being pawns in the renewed struggle between democracy and authoritarianism. Elsewhere, the process of disentangling China from the global supply-chain will present opportunities but the age of deflationary pressure being met with inflation targeting, easy monetary policy, that has been so beneficial to the owners of financial and real assets may well be at an end. The full speech is available here. 1. The age of financial and real asset price inflation that has defined the careers of most existing current market participants may well be at an end. The era was defined in many ways by two policies that were clearly outlined in two speeches. President Clinton, speaking at the John Hopkins university in 2001, laid out the objectives of economic engagement with China. Many of the consequences were unforeseen at the time, but the deflationary pressure that trade with China created led in turn to the Ben Bernanke speech at the National Economists Club in 2002, in which he spelled out the Fed's determination to meet the deflationary pressure with whatever monetary tools it took to create inflation. 2. Vice-President Pence's speech at the Hudson Institute spells out that the policy of economic engagement with China has failed. The "trade spat" as some observers like to call it, will unlikely be ephemeral. Geopolitical necessity and domestic political considerations (that have been shaped by the unbalanced impact of globalization) now determine that the US and its allies adopt a more confrontational approach to relations with China. 3. International investment always carries risks but investors have largely forgotten about jurisdictional risk. When you buy the right to a cash-flow stream in another country, you are dependent on that country's legal system enforcing your rights. How confident can a foreign investor in China be that it remains in the Communist Party of China's interests to enforce your legal rights? There is much to ponder here. This escalation of rhetoric (deliberately?) comes at a difficult time for investors and not just in Asia. Interest rates appear to be finally on the way up; the European political scene is fractious and the absence of any solution to unified fiscal policy is causing bond yields to widen within the Eurozone, thereby threatening the Euro; Chinese bad debts are being recognised and realised; and valuations for bonds, equities and private equities are high. Just when we need adults in the room to discuss how to rebalance the global economy between creditors, debtors, haves and have nots, and to have fiscal policies to raise productivity, we have to deal with the spectre of a repeat of the Smoot Hawley tariffs which are acknowledged as worsening the 1930s depression and allowing all that followed. On the other hand, while we may have to dust off our Clausewitz (along with Keynes the most quoted while simultaneously being the least read?), it is possible to view this dispute as other than the deliberate and ignorant dismantling of globalisation and the loss of all the benefits of increased trade and information flows? It is well known the disregard that the USA administration holds for the various global ‘talking shops’ such as the United Nations, the IMF, the Climate agreement accords etc. Consequently the tactic to get China and others to the table has to be such a shock rather than ‘just talk’ which never works? Is it likely that the current tension has been created because every so often a country needs a bogeyman against which to rally? Once the USA mid terms are out of the way by end November, will we be ‘back to normal’? Sometimes as they say, “you have to throw a sprat to catch a mackerel”? We would argue that there are two disputes here. One is “unfair and unequal market access” where China gets to export to the USA while the reverse is made difficult. The other is tech theft by Chinese companies, and the military, of USA and European technology. The latter objection is more justifiable as a policy stance but it is not just the USA which has been robbed and this consequently makes the likelihood of this dispute being resolved more easily. The Chinese current account surplus with USA as % of economy is small. It’s the Germans who should be held to account for anti social trade policies, not the Chinese, nor the Japanese. On the other hand, the issue of tech theft is real and has bi-partisan support in Congress.

So if there were adults in the room could we deal with the latter and find a way to reduce the unnecessary tension of the former? If so, this would be fantastic for investors and for citizens. There is a chance in this happening that it is a tripartite coalition of the USA, Europe and Japan against Chinese theft and forced ‘technology transfer’, which therefore has more chance of succeeding. Note also that the USA can be accused of once indulging in the same sort of property theft as are now the Chinese! See here. It doesn’t make it right, but it makes it more understandable as a Chinese tactic? With 3 powerful blocs against 1, can we see this separated from trade and resolved? With two protagonists and ‘victory’ or ‘defeat’ for each there are four possible outcomes.

We are going to opt for 1 and 3 as the most likely outcomes. Outcome 3 won’t be as clear as a roll over but we would argue that China is a rational player unlike the last cold war protagonist, the USSR. Consequently some accession is likely. In fact we have already heard the Chinese Premier make conciliatory speeches regarding opening up the Chinese economy further. Something it is bound to do as a WTO member. Note also that the Chinese have removed withholding tax on foreign investment in their bond market. Again a sign of a willingness to increasingly play by the rules? Also read this if you have a moment. The Russians didn’t seem to give a damn about their population’s wealth or well being, and this is not the empirical evidence we get from China with “capitalism with Chinese characteristics”. Vast infrastructure spending; and the provision of social security for example are not hallmarks of an economically ignorant, incapable, and morally deficient country? So, if they have a brain they would not go head to head as did Russia to the detriment of their economy, but want some form of continued economic engagement with the USA, Japan and Europe? We suspect the markets would be happy with outcome 1 or 3 – both of which are easily attainable. Would the full adoption of WTO rules albeit belatedly, make the situation immediately better? By this we mean the adoption of a fully convertible currency and open and transparent capital markets, albeit 20 years after they should have been. In this regard the Chinese are at least moving in the right direction while the Europeans are...er, somewhat going the other way? We agree that political risk and equity volatility is going to be elevated relative to the recent past. 10 years of free money and constant hand holding guidance by central bankers with an implied free put option for large sized risk taking, has made many investors and companies, unprepared for anything different. We think we should be watching Powell, chairman of the Federal Reserve!

2 Comments

David Gibson

18/10/2018 10:48:04 pm

Not many conclusions here

Reply

19/10/2018 09:44:53 am

David,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed