|

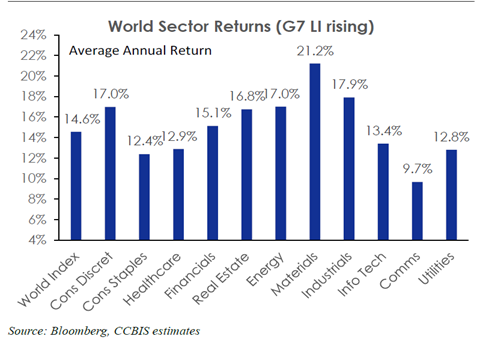

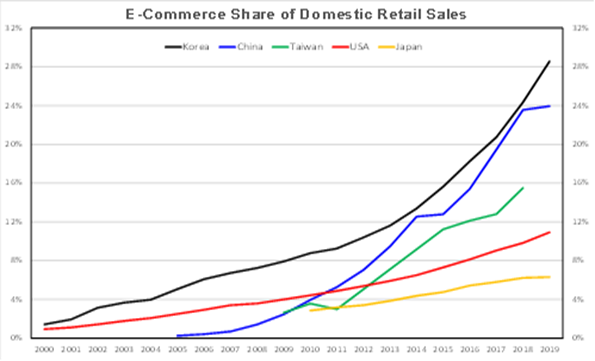

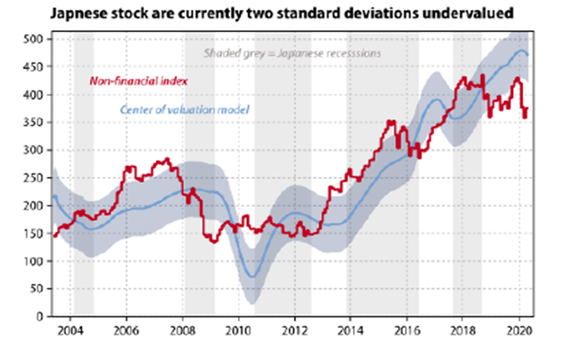

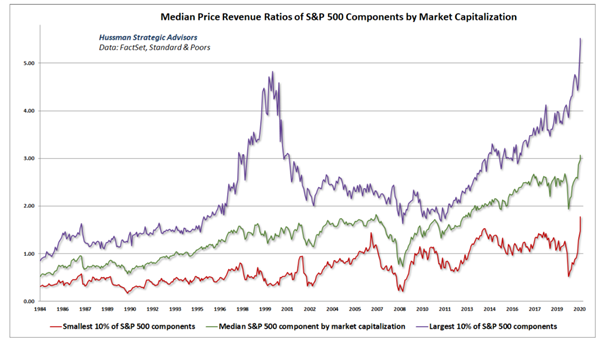

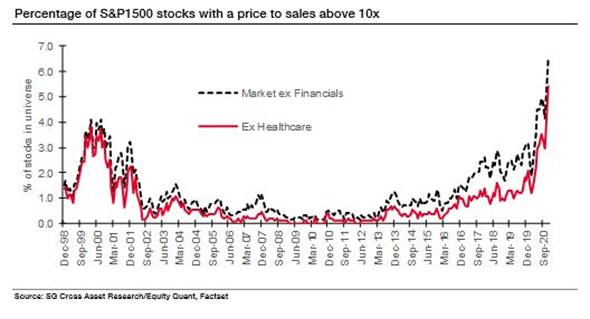

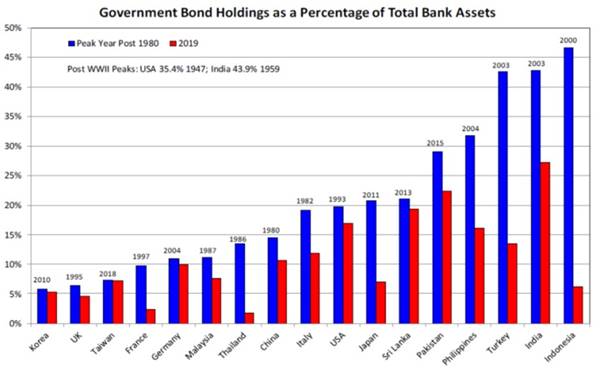

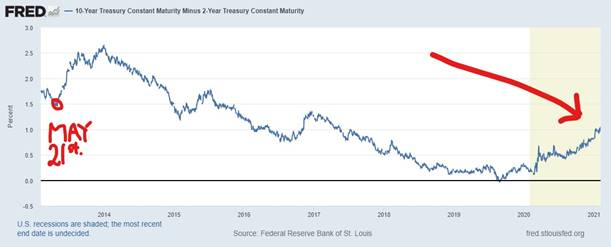

Sometimes you get a piece of good advice early in your career, from someone older, that you respect. You should remember that advice and follow it. One of these is often “never say we told you so; it just irritates”. We’re going to break that rule; in a polite way.  Author: Robert Swift Author: Robert Swift We have been arguing for a while that Japan, Asia and true technology companies were the place to invest. About three years back we added to that list with a bit of a push for infrastructure stocks on the basis that One Belt One Road would see plenty of visible spending and that the third world country formerly known as the USA would finally produce a politically bipartisan solution to its dilapidated infrastructure, further boosting global and local infrastructure companies. So convinced were we that we launched a listed equity infrastructure strategy as well as an Asian Smaller Companies Trust. The case we made for industrials, cyclicals, smaller companies, and Japan:- For reasons we can’t fathom, (but “never fight the Fed” is also a piece of good advice) we realised a couple of years back that amongst central bankers there was a desire for an underwritten and compulsory re-introduction of inflation and inflationary expectations. Even with the GFC well behind us they would not take their feet off the money accelerator. This was always going to have implications for equity style rotation and the kinds of companies in which one should invest. We showed the chart below in many different media. We’ll show it again in case you missed it. Smaller companies now look to be coming back too. Along with a shift to Value and therefore smaller companies we argued for exposure to cyclicals and JAPAN. These are now running but it’s not too late; certainly not too late to get on the Japan train. Its problems have been misunderstood and misdiagnosed, and most investors have missed the first part of the re-rating. Again we state, GDP is a very poor proxy for equity market returns. Don’t let other “global” managers from Australia talk about lack of innovation or lack of growth in the economy as to why they haven’t invested. Japan was cheap, governance was improving, corporate cashflow was being directed to the right places finally, and the true technological innovations are world leading. Check out Advantest, Shin-Etsu Chemical, Ibiden, and yes even Sony. There are lots more but you’ll have to contact Kevin Smith who manages the Asia strategy, to hear which. That there is much more to go for can be illustrated by the chart below which compares the (as yet) lack of digital penetration in Japan with other Asian countries and the USA. Just think what will happen to productivity when this does change, as the new Prime Minister is insisting it must? The Nikkei 225 (not our favourite measure of Japanese equity returns but it’s the most cited) is back above 30,000 for the first time in over 30 years. Given the geopolitical shift toward Asia economic cooperation, and the strong fiscal position of the region, we think the tea leaves look very good for a systematic overweight. Japan remains still cheap. You can safely take some money out of the US mega caps. Expensive, over owned, and failing in many dimensions of ESG analysis, (oh yes they are) they look likely to continue to underperform. Underperform you say? Well, since we purchased AES , a boring US utility, about 3 years ago, it has outperformed the S&P handily and actually outperformed Facebook. Over one year it looks worse for FB. Oh, and unlike FB which promotes the idea of using the electricity supply of a small country to mine for crypto currency, AES is actually reducing the energy from carbon based sources and increasing the renewable content. So don’t get us started on the cognitive dissonance that currently passes for ESG ‘analysis’ and differentiation. G matters. E and S are riddled with complexity and from what we can see, we are still in ‘short pants’, i.e. not very sophisticated. EV makers are noisily promoting their ESG credentials alongside their executive punting and spruiking digital currencies whose creation consumes more energy than a small country. To the best of our knowledge no one puts them in the ESG naughty corner for this questionable duplicity. However the moaning and groaning about companies whose products provide shelter, sanitation, and are essential to solar power…..(that’s enough – Ed) So back to “the mega caps are expensive bit”. Check out the charts below. The big are expensive and there are a lot of companies whose price to sales requires non-payment of wages, taxes and 100% margins for you to get your money back in a reasonable time frame. Need more evidence? Scott McNealy who ran Sun Microsystems, said it best a couple of years after the dot-com bubble broke. “At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?” Quickly onto Infrastructure before we highlight the risks out there. Along with the promise of a large spending bill ($1.9 trillion is about 8% of US GDP) we are going to see a return to National Industrial Policy adopted by most large economies and economic blocs such as the EU (they would like to be one country). This has been clearly articulated by political analysts at the Hinrich Foundation and they pointed to President Trump’s use of the Defense Procurement Act of 1950to force GM and 3M to make respirators and masks for the US government in the early days of the Covid-19 crisis. MAGA has morphed into “Build Back Better” with an added “Buy American” slogan on the side. The EU is at it, as is the UK and China’s has a “Made in China 2025” masterplan to circumnavigate the tricky problem of being prevented from further IP theft. All this is going to lead to incentives to bring production ‘back home’, viz Japanese government incentives to move production out of China but also a reformulation of supply chains and procurement and verification policies. This means logistics companies will do rather well. We own Kerry Logistics which has just received a bid from a mainland Chinese company, SF Holdings, as well as Japanese logistics and freight companies like Kintetsu World Express, Kamigumi, NYK, Nippon Express and Sumitomo Warehouse. Financial risk will also rise from NIP and so we invested in Hong Kong Exchanges on the basis that it would become the de facto capital raising locale for Chinese mainland companies. Has worked rather well? So we did tell you. We’re also going to tell you what to watch out for because like all parties, this one may have too much punch (money) provided. As William McChesney Martin said, "the job of central bankers is to take away the punch bowl just as the party gets going”. It’s probably had too much punch already but for the moment the bond vigilantes are asleep, shrinkflation doesn’t seem to bother too many people (it should for a number of reasons), and rising house and asset pries aren’t in the inflation indices, so no one seems to notice? We’ve recently been told that 2% average inflation will be ok by the Fed, although they haven’t said how the average will be calculated. You would fail maths 101 if you described how to calculate the average of a number that way, but let’s leave that alone? We think you should watch out for the conflict that will occur when the long end of the US Treasury curve starts to back up MORE. It has already started to do so. While the short rates can be held down, it is typically not the remit of the central banks to try and set long rates. Or rather it hasn’t been for a while since the 1950s. When the US 10 year note reaches 1.6% then assuming that short rates are still at zero, we have the same yield curve shape we had in May 2013 when the taper tantrum was set off. Now we can’t predict when the bond vigilantes will wake up but they should be stirring. Commodity prices are through the roof; we are probably going to see less efficient global supply chains for a while due to NIP and Covid (automakers are already short of computer chips and having to scale back production/raise prices); and the fiscal injection we are about to get will be the proverbial gasoline dump to put out the fire. The Fed may well intervene to keep the long end of the yield curve from rising but if it does so then we are looking at a rerun of the 1950s when essentially we had centrally directed capital allocation and capital and exchange controls. Prospect for banks which will be forcibly stuffed with government bonds, won’t be so good. Nor will your holiday in Aspen be so easy to afford. On the other hand we did have a decent amount of centrally directed money spent on the capital stock including schools so it wasn’t all bad? If they don’t intervene, and we hope they don’t, then the equity market is looking at a very different set of discount rates to apply to future profits (some listed companies don’t have profits! -Ed). Here is where we are on the yield curve shape. As of today the 10 year note yield is through 1.2% - so the curve is steeper than the chart. Expect turbulence and volatility then as we approach this juncture. After this, you should be positioned for more mild/controlled/managed inflation – in other words in equities to a reasonable %. These should favour the “we told you so themes”. We can’t predict the timing of this yield curve change, so you can begin to invest now, or wait for the volatility and go to cash. We have had a real laugh at managers who time entry into, and exit from large cash positions, and how easy and expensive it is to get it wrong. We don’t do it.

We’ll leave you with one scary scenario – inflation returns and the bond vigilantes never awake. Inflation becomes even more clearly present and apparent to everyone and does the damage it always does, but the central bankers who don’t have to buy a house, pay for university, or an annuity or food, deny its return. So it runs, builds, and does the damage it always does. Read “When Money Dies -The Nightmare of the Weimar Collapse” by Adam Fergusson and have a look at the below. That should wake you up to the dangers of a return to the 1970s.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed