|

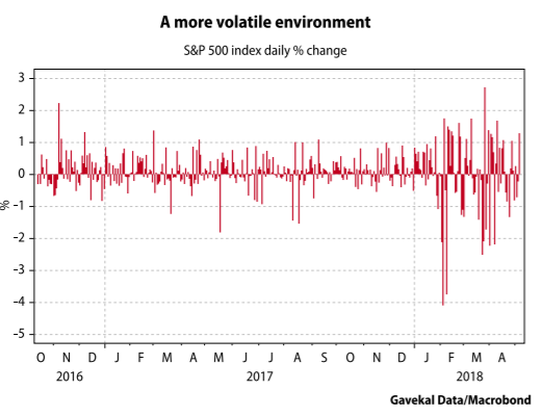

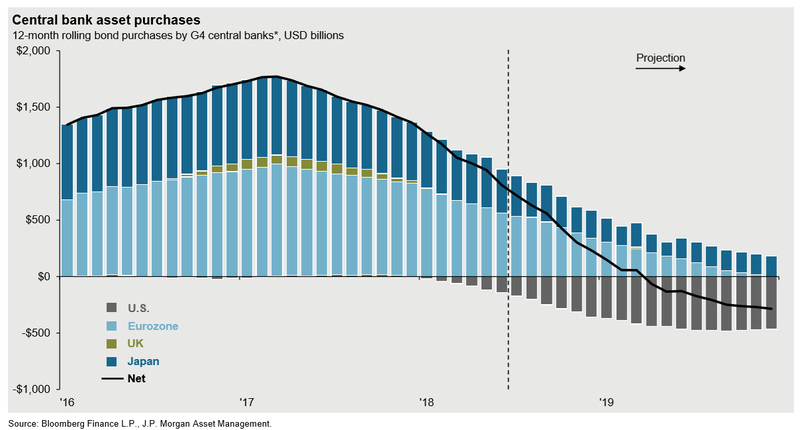

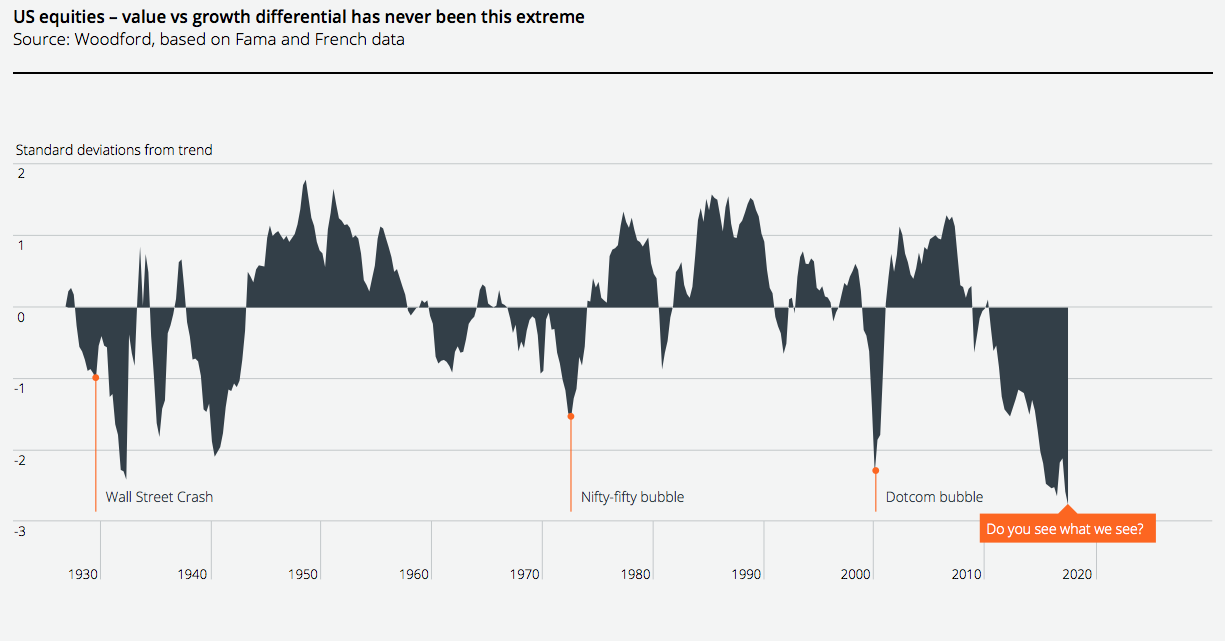

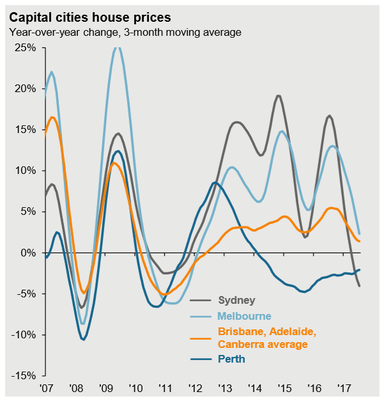

TAMIM Joint Managing Director Darren Katz takes a look at the financial world in month passed. Sometimes I get the feeling that I am harping on a subject. This is normally accompanied by my kids rolling their eyes at me when they don't think I can see them. Well at the risk of repeating myself, volatility is back! The first quarter of 2018 was tough from a long only equity investment perspective but the second quarter reversed the negative returns and delivered good returns for investors that remained invested. The ASX/S&P 200 was up by 8.5% taking the 2018 return into positive territory - up 4.3%. Global equity markets, represented by the MSCI World Index, were also up through the quarter (+3.8%) taking the year to date gain to 1.6%. Across fixed income Australia once again stood out with the Bloomberg Ausbond composite up by 1.7% year to date versus the Global fixed income index, the Barclays Global Aggregate down -1.5% after a poor second quarter of -2.8%. Property in Australia, or should we say residential property prices, has weakened. We still continue to see strong demand for property in the retail, commercial and industrial segments though. Globally, property was up strongly during the quarter with the FTSE NAREIT Index up 9.8%. One must bear in mind the broad nature of this index and, as usual, property and its return is really governed by local conditions. The increase in volatility across US equity markets has obviously carried across to other global equity exchanges with Chinese indices falling approximately 10% over the quarter with most of this occurring in June. The Shanghai index is now down about 20% from its peak. This is not just about the Trump trade wars though. Tighter monetary and fiscal policies have caused the Chinese economy to soften. The People’s Bank of China is working hard to curb off-balance-sheet lending which is weighing on growth. This short term pain will help lead to the longer term goals of financial stability and reduced leverage in the financial system but that does not help our short term focused world. While China was weak, US equities were strong in the first two weeks of June but retreated as trade war tensions returned to the fore. As we have discussed in previous monthly reports, we need to understand that the tariffs are really of little consequence currently. BUT, as the negative news flow continues it may start to have an impact on business and consumer confidence which will then start creating an issue for investment markets. The Fed raised rates in June and has signalled two more increases this year plus another three next year. We should paused here and consider the amount of debt currently swilling around the US, I don’t only mean government debt of $21.2T - think corporate debt and unfunded pensions with total US debt at $70T!!! These interest rate increases will start to hurt going into 2019 (interest paid of $2T per year). US debt levels and a large current account deficit will weigh heavily on the US dollar. In Europe, the ECB has confirmed that rates will stay on hold until June of 2019 however their quantitative easing program will likely start to be curtailed by the end of this year as can be seen in the chart below. We still find it difficult to believe that the wholesale reduction of these asset purchase programs will continue over the next two years. Is it possible that there will need to be further QE with “debt forgiveness” programs over the next decade in order to help remove the massive debt burdens across the globe? At this stage I am moving from thinking this is going to happen to believing this will be the only way out (apologies to Robert Swift) Over the last 12 months the Eurostoxx index has delivered no return in local currency terms. June was no different with a flat return. This is despite the fact that earnings for European companies across 2017 and 2018 have been steadily increasing. In the US we have seen strong returns with growth stocks continuing to drive returns over value stocks. The Nasdaq is up 24% and the S&P 500 is up 19%. In Asia we have Japanese equities up 10% over the year while we see China down almost 20%. Australian equities are up just over 10% over the past twelve months with a significant portion of this increase (8.1%) coming in the last three months. While we are close to the end of the cycle it is still a good environment to remain long risk. It is interesting that there has been a significant out-performance of growth equities to value equities through this period (see the chart above) and there will be a significant swing back towards value. We have been positioning client portfolios for this albeit too early. Strength in commodity prices (iron ore up 2.7%) across the quarter has helped drive local equity returns with materials and energy accounting for a significant amount of the increase in returns. Year to date materials are up 7.9% and energy is up 11.8% this alongside the best performing segment - health care - which is up 24.5% has been sufficient to more than offset the falls of in telecoms (-23.2%) and financials (-2.1%). From an economic perspective the lack of growth in wages continues to be a concern and the falls, albeit quite moderate in house prices, will keep the RBA on hold. Offshore funding costs and tightening of lending standards may result in out of cycle rate hikes by the banks. In this situation we may even see the RBA lower rates to keep financial stability. To conclude, globally and locally we see corporations in a good position from an earnings perspective and growth remains positive. We are still happy to remain invested into risk assets however we are nearing a period where rising interest rates and a fading of fiscal stimulus impacts will start to hurt. We should be investigating how to immunise our portfolios against these coming changes. Traditionally this role was carried by investing into government or corporate bonds. With yields so low and now increasing as well as compressed credit spreads this is not going to work this time round. Our view is that private debt will act as an excellent ballast to our equity portfolios rather then traditional fixed interest investments.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed