|

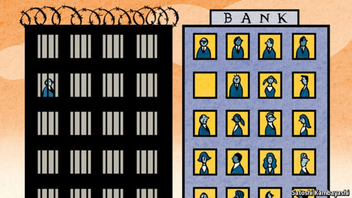

This week TAMIM Joint Managing Director Darren Katz takes a look at the financial world in month passed. April 2018 saw Australian equity markets, represented by the ASX 200, increase by 3.9% taking the calendar year to date return back to almost square at -0.1%. After 2 consecutive years of returns north of 11%, 2018 is certainly turning out to be more difficult for the Australian equity market. With the ongoing Royal Commission hearings, banks and financial services companies found the going tough. Globally we found developed markets out performing emerging markets during the month on the back of a strong US earnings season, however, over the calendar year we still note that emerging markets are 2% higher than their developed counterparts. Volatility remained in the market place with the historic Korean peace talks not quite removing the focus from US-Chinese trade relations and the looming spectre of a US-Russian conflict over Syria. Middle East instability saw the oil price up 7% and, importantly for Australia, iron ore was up 3.1% which made the weakness in the Australian dollar stand out even more. In the fixed interest space we saw 10 year US treasuries touch 3% for the first time in over 4 years.  Terry McMaster Terry McMaster Australia As Terry McMaster would likely attest after collapsing on the stand at the Royal Commission, all is not well with Australian banks and financial advisers. While no sectors detracted from the performance of the equity market during the month of April, the full year picture is markedly different. On a price basis, the financial services sector is down -6.8% after significant fall out from the Royal Commission. Having worked in the investment industry my whole working career, I can say that the revelations of the past month do not come as a surprise. In fact, trying to run an independent boutique investment management businesses has been extremely difficult. Financial planners have been driven, through regulation, to run high standard administration, compliance and investment research operations. Given that most planners tend to be small business the natural outcome was for planners to move to the big bank and insurer dealer groups. There they received administrative support through administration platforms, compliance support through dealer groups and investment research from independent research houses and asset consultants. I can tell you the banks have acted in their shareholders best interest and driven as much investment into in-house product as possible to the detriment of their clients. How do we solve this issue? Given that most of the issues were originally brought about through regulation, well intended if not actually well executed, I highly doubt the best solution will be more regulation. I would posit that competition would be the best way to cure our ills. We do not have a significant enough population to support competitive pressures, given this, I would suggest that a number of high profile executives serving prison terms may be enough persuasion to cause people to behave properly.  An unintended fall out from the RC will be that the banks will now continue their withdrawal from lending markets with house finance a key risk. If banks make it tougher to obtain mortgages going forward then we will face a big issue given that Australian household debt continues to be among the worst levels in the world. It is no wonder consumer confidence declined to its lowest level since November of last year. While unemployment was steady, the number of jobs created was at 5,000 well down from 2017’s averages. Inflation remains benign and given the above discussion, the RBA will find it difficult to raise rates any time soon.  Global Markets European equity markets were up 5.1% in April with strong retails sales growth at 1.8% year on year. The unemployment rate fell to 8.5% with Italy, France and Spain showing improvement. We would expect monetary policy between the US and the Eurozone to continue to diverge as there outlook for inflation diverges. There continues to be little expectation for inflation in the Eurozone with core inflation at 1%. The ECB still continues to provide an accommodative monetary policy which is providing strong support for economic growth. Draghi has emphasised the need for “patience and persistence” and has indicated that the ECB will continue with its quantitative easing beyond September this year. As discussed earlier, US 10 year treasuries hit 3% for the first time in 4 years but with the Fed expected to increase short rates 2 more times in 2018 the yield curve continues to flatten. Core inflation in the US has moved to 2.1% and wage inflation continues to concern market watchers at 2.7% year on year. Over two thirds of the S&P 500 Index have provided the market with their reports and we continue to see strong earnings per share growth of 29%. More than three quarters of companies that have reported have exceeded expectations. According to JP Morgan, one-third of the increase in earnings can be attributed to the tax cut, with one-third from higher domestic earnings and one-third from international earnings. The US equity market was however only up 0.4% for the month lagging its European counterpart. It was also below the Japanese market which returned 4.3% even thought sentiment was hampered with global trade concerns weighing heavy alongside concerns on the currency. From a currency perspective the Euro has declined 1.8% against the U.S. dollar over the month while the yen declined 2.8% and the AUD rounded out the equation by declining 1.6% against the USD.

1 Comment

|

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed