|

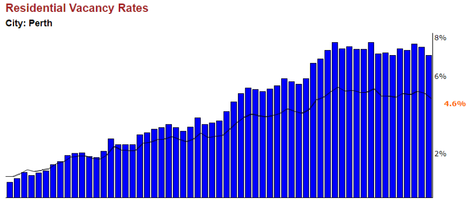

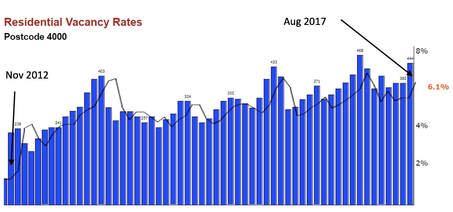

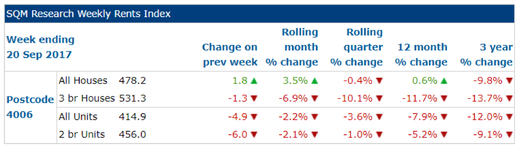

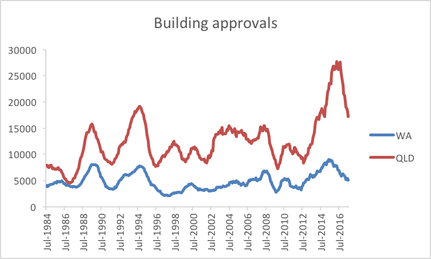

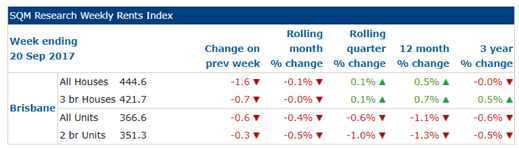

This week we take a look at the Brisbane property market. Is there an opportunity to be had or should we continue to flee the sinking ship? With the Australian cash rate at a record low, over the last 8 years we have seen a boom in property prices across the East Coast. Over this period, residential property prices have risen by roughly 100% across Sydney and Melbourne, creating what many speculate to be a property “bubble” - pricing out millennials and leaving little room for new investment. However at TAMIM we believe this provides a unique investment opportunity, especially in the Brisbane apartment market. In order to understand why, it’s important to first take a look at a brief history of the Perth property market. Perth The Australian mining boom started around 2005 and continued into 2015. During this period, there was a large influx of migrants into WA, with the number of full-time employed persons increasing from 718,300 in December 2004 to 976,700 in December 2013. The period from 2013-2016 saw the estimated resident population of WA grow at a rate almost double that of Australia’s (28.4% and 18.4% respectively). A rapid influx of workers resulted in an increased demand for residential property, triggering a Perth housing boom. Perth’s Residential Property Price Index (RPPI) – an indicator of price changes in all residential dwellings - skyrocketed during the mining boom, from 48.3 in September 2003 to 98.4 in December 2006. However once the boom was over around 2014, the RPPI started to track downwards from its December 2014 peak of 114.5 to its present value of 105.5 (chart below). As people emigrated, the end result was an oversupply in the property market, which saw a decrease in prices and drastic increase in residential rental vacancies from approximately 2% in January 2012 to 4.6% in August 2017. Brisbane We believe a similar situation has already started to unfold in the Brisbane apartment market. Similar to Perth, the Brisbane economy is heavily influenced by the mining and resources sector. In November 2016 approximately 20% of the Brisbane workforce were employed by the resources sector. Despite the imminent end of the mining boom, there are an estimated 5,200 apartments under construction in Brisbane CBD alone due for completion over the next 5 years, with another 3800 approved for construction. Major developments such as the Queen’s Wharf Precinct are adding 2,000 apartments to the residential market. Vacancy rates in Brisbane CBD have increased from roughly 2% in January 2013 to 6.1% in August 2017. Combined with relatively lower estimated resident population increases when compared to other capital cities such as Sydney and Melbourne over the past few years, all signs indicate that a stagnating demand and increasing supply have resulted in a supply glut in the apartment market. This trend is starting to emerge as some inner Brisbane suburbs such as Fortitude Valley (postcode 4006) have already started to suffer a fall in median unit prices. From July 2016 to June 2017, the median unit sales price for units had decreased roughly 7.78% from $450,000 to $415,000 (Source: RP Data). 64% of this decline had occurred by December 2016, as vacancy rates rose to over 6.5%. Furthermore since 2015, suburbs sharing the 4006 postcode have seen a staggering amount of apartment completions – over 2000 completions excluding the stage 1 completion of a 650 apartment complex and stage 1 completion of a 922 apartment complex. During this period, apartment rental incomes have plummeted as can be seen below. Building approvals for private dwellings excluding houses across Queensland and WA have recently reached all-time highs. In Western Australia, apartment building approvals –which are a lead indicator of construction activity - peaked in June 2015, signalling the end of a construction boom. With Queensland’s peak trailing behind WA – August 2016 - the outcome looks all but disastrous (chart below calculated on a rolling annual basis). Increasing vacancy rates, declining rental income and a large number of approvals and completions are all symptoms of an oversupplied apartment market. Despite our view that there is an oversupply, property prices can still be driven upwards by two factors – interest rates and rental income. As TAMIM Australian Equity All Cap Value manager Guy Carson mentioned in an earlier article, the RBA are not in a position to decrease interest rates. Australia has the second most indebted consumer in the world with respect to Household debt to GDP. When coupled with record low wage growth, this makes the Australian consumer sensitive to interest rate changes. Since decreasing interest rates isn’t a likely option, it is unlikely that monetary policy will drive prices up further. In addition, a decrease in rental income generally indicates an oversupply of apartments and/or insufficient demand. This extends to property prices and as such, dwindling rental income across the Brisbane region (table below) is likely to further suppress prices. The question is, how do we obtain value? Our view is to wait for an inevitable correction and investigate areas with strong fundamentals such as large infrastructure spend on education. Queensland Deputy Premier Jackie Trad stated it is “Expected that 3000 extra students will move into inner-Brisbane in the next 5 years”. Capacity constraints in inner-Brisbane state schools such as the West End State School have required an expansion of the school as well as the construction of a new school in South Brisbane. Now, whilst the potential increase in demand is heavily outweighed by the upcoming supply, indicators such as this compel us to further investigate these suburbs and their surrounds.

Ultimately, when investing in property, we want to invest at a price lower than the fundamental value and understand the dynamics of the area we are investing in, especially when identifying triggers that may boost demand e.g. infrastructure spend. As a result, we look towards apartments in inner city Brisbane – an oversupplied area with the potential for stronger, future demand. In our view this correction is inevitable - it’s no longer a matter of if, but when and then we should be ready and willing to buy!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed