|

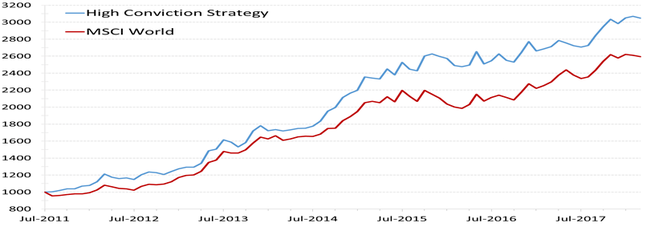

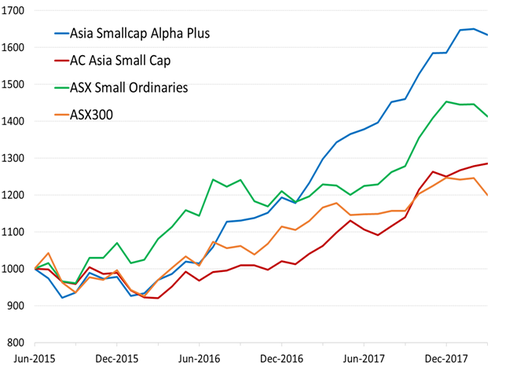

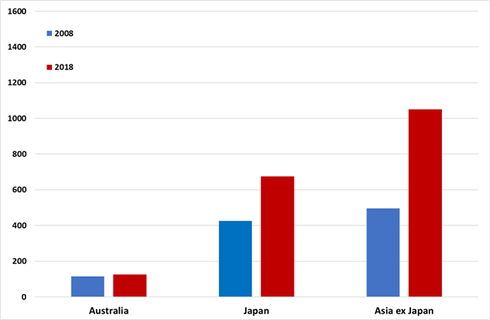

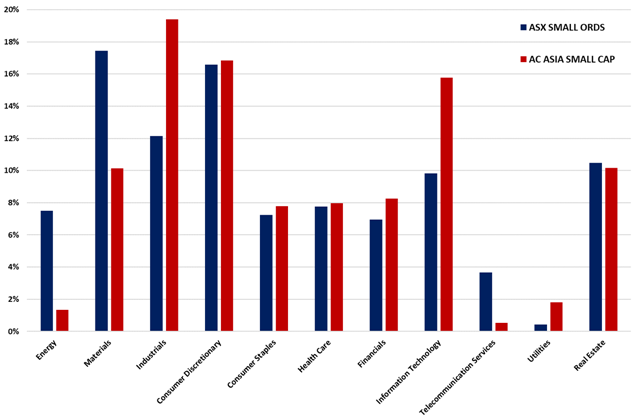

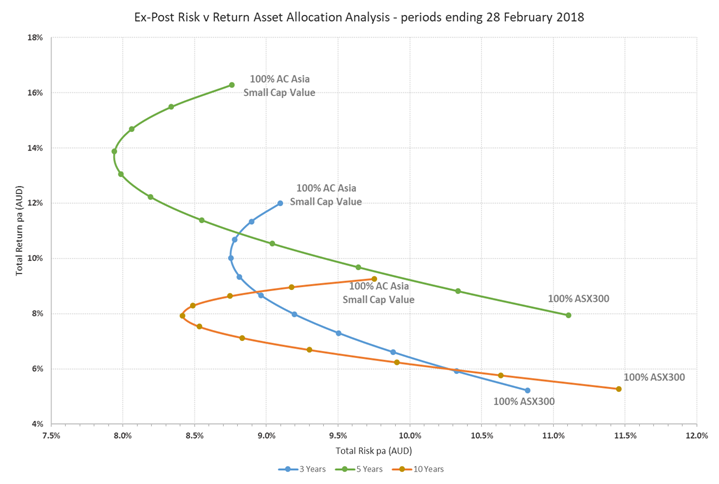

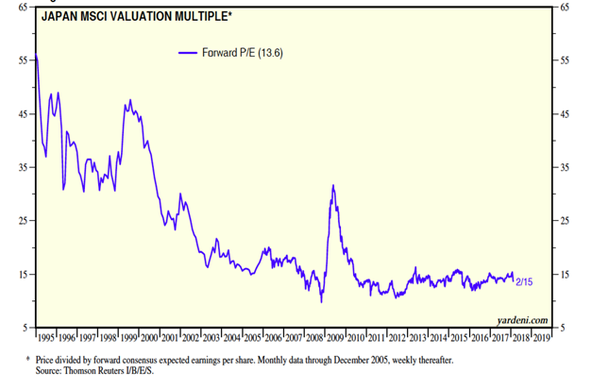

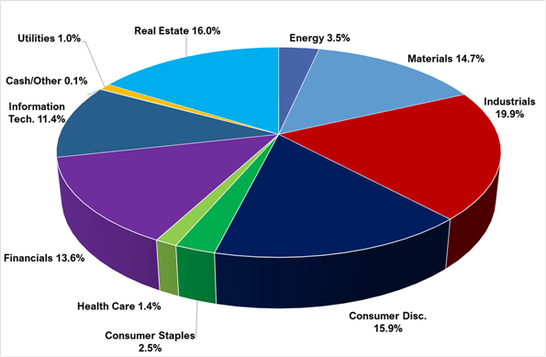

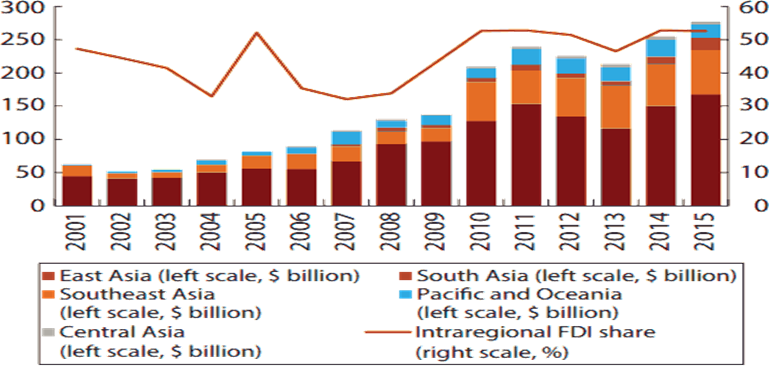

This week Robert Swift takes a look at the opportunity that lies in small cap companies, but not in Australia and not by the Australian definition of "small cap". We have a team in the TAMIM Global Equity High Conviction strategy which has managed many hundreds of billions of dollars in multiple mandates. We know what big asset management looks like and the problems it brings. You can have too much of a good thing. Transaction costs rise rapidly as you have to move more stock through the market and over longer periods. Coordination of larger teams and ensuring that research comparisons between companies are logical, becomes harder. Client service becomes more remote as you find it impossible to meet everybody as frequently as you once did. In short becoming bigger doesn’t mean becoming better. The client suffers from erosion of alpha and a loss of face time with the folks who pull the trigger. Maybe the managers’ profits go up but that’s not the point really? We were always frequently told “bigger isn’t better; better is better”. The same may well be true when it comes to investing in companies? Go smaller. Look for where the under researched companies currently dwell. Look at the companies where analysts are ‘cutting their teeth’ and will make rookie errors. Meet with management grateful for the interest rather than try to meet the public relations deputy director of a fabulously over research global mega cap…along with 50 other buy side firms? We would like to draw your attention to a fabulous opportunity in Asia currently, This is in the area of smaller companies. By smaller we mean companies above $1bn in size but below $10bn. There are plenty of companies listed which are below $1bn in market capitalisation but these are typically very illiquid and expensive to trade as a consequence. There is also typically so very little research performed on such companies such there often isn’t a catalyst for the shares to receive any deserved re-rating. $10bn may sound big in an Australian context but the companies above this size account for over 90% of the available market capitalisation to investors. This range is truly a valid small cap boundary. Small companies tend to have an extra return premium which is paid to investors. Put another way, smaller companies outperform. This seems to occur as a result of the greater volatility of the share prices which necessitates a higher return to compensate, and intuitively this makes sense. Smaller companies will typically have fewer product lines; smaller management teams and fewer and more concentrated clients. We don’t capture the small cap premium in our TAMIM Global Equity High Conviction strategy. This focuses on large companies typically above $10bn and is somewhat dominated by the sheer size and success of US and European multi national businesses. We do have significant exposure to Japan but at 20% it is not the largest country exposure. For reference we show the performance of the TAMIM Global Equity High Conviction strategy below, relative to the MSCI World Index which represents the typical global equity fund. For almost 3 years now we have been incubating an Asian small cap strategy which has been going well. We are now offering this to clients. In the graph below we illustrate the performance of the strategy (Asia Smallcap Alpha Plus) versus the returns of relevant indices – the ASX Small Ordinaries and the All Country Asia Small Cap. We show the ASX 300 for comparison to show that the outperformance of small caps holds true in Australia as well. The exciting aspect of the Asia small cap opportunity is that many new companies are being listed and consequently made available to investors. We show in the charts below how the number of Asian small caps between $1bn and $10bn has grown much faster than the number in Australia between 2008 and 2018. This results from greater capital formation by larger populations, and economies, but the brutal truth is that the opportunity is far too big to ignore. Confining yourself to Australian smaller companies means you are only looking at less than 10% of what is out there. Additionally, the sector exposures are different which means you can have better returns from investing in Asian smaller companies AND improve your Australian equity portfolio. The sector exposures are shown below. Note how the Information Technology weights are different as well as the Energy weights. Therefore combining your Australian equity portfolio with Asian small caps gives you better portfolios – more return and less volatility of return. To illustrate this we have created different combinations of Asia and Australia in the graph below. The blue is looking back 3 years; the green 5 years and the orange 10 years. each node represents a 10% shift between the two combinations. Thus bottom right in green is a 100% ASX 300 return and risk experience. Not too bad but had you mixed even 30% of your portfolio with Asian smaller companies, you would have received over 2% pa more in return and significantly moved your risk lower from 11% to 9%. Over all time periods we analysed this would have been true. We believe it will hold into the future. As for valuation and thus future return we believe the market is still attractively priced. We show the Japanese equity market PE ratio below and you can see how much the market has reverted back to a ‘normal’ PE ratio since the years of wild overvaluation in the twenty year period from 1995. Our long stated stance on Japan is that the prescription of a stagnant economy is wrongly construed on poor analysis. It is the demography that represents the cause of low nominal GDP growth but adjusted for that, the Japanese per capita GDP numbers are superior to just about everywhere. This story is gaining traction. The last 3 years has seen Japanese smaller companies achieve returns of about 15% p.a. Any fund manager who tells you that nominal GDP is a relevant statistic for equity market returns is looking in the wrong place and being too simplistic. This will continue we believe since the rate of innovation remains superior in Asia compared to Australia and just about anywhere. Companies in China, Korea and Japan accounted for almost 60% of global patent applications in 2016, and Asian companies account for 82 of the top 100 patent companies globally. We continue to see American business school trained executives return to Asia to start and manage companies. A combination of Eastern opportunity and Western business school discipline? Lastly we show the sector weightings of our existing strategy. We believe it is essential to include Japan in any Asian portfolio. The number of Japanese companies in which to invest is very large and varied. This is a boon to active managers such as ourselves. More importantly the amount of economic integration between Japan and Asia is increasing from a low point in 2007, as you can see from this chart below. Japan is investing more in Asia and the region is becoming more integrated. Managers often separate Japan from the rest of Asia on the basis of ‘economic growth’ but we believe this is a marginal consideration when looking at optimal portfolios and asset classes. Asia small cap including Japan, is definitely something to consider.

1 Comment

Bruce Baker

24/4/2018 09:49:08 am

Is this Asian Small Cap strategy only available as a separately managed account? if not, how else is it made available?

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed