|

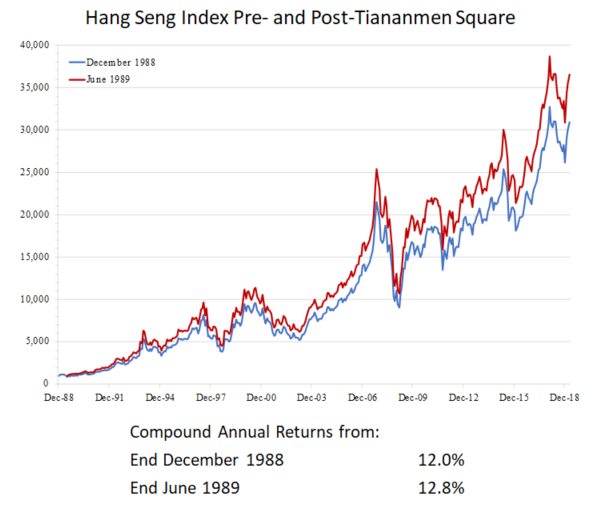

We return to the ever important topic of portfolio management and take a look at three extremely important things to keep in mind when managing an investment portfolio. This week we revisit the topic of portfolio management and elucidate further thoughts around this all-important skill (see our previous article Risk, Uncertainty & Just Maybe Survival). Risk has been top of mind recently given the RBA’s decision to lower interest rates, giving further momentum to risk assets as cash continues to search for that ever elusive yield. A couple of stories in the financial press also illustrate this global phenomenon, the first is Berkshire’s potential debt issuance in the European markets and the second is a story recently published in the AFR around Central Banks Globally holding around 1.4 trillion dollars in Equities. The first story was interesting to us not for the fact that Berkshire was shopping around in Europe for a potential buy but that the debt was likely to be issued at a 2% yield (50 bps above the UK sovereign). Just take a moment to process that. The very fact that a corporate (granted it is Berkshire Hathaway) can issue at that rate is rather telling. Apparently, we continue to believe that the greatest worry in the world is debt and therefore the cure to it should be more of it. The second story was also interesting in that even central banks around the world are being forced to take on risk assets in order to diversify their reserves away from low yielding bonds. Take a moment to grapple with how far we’ve come from a mandate that started with inflation targeting to a point where monetary authorities are essentially controlling asset prices. What this does to the price discovery mechanism of markets and the longer-term efficiency of capital markets we shall leave to the readers to think about. What we are implying here is that, if the cost of capital is increasingly zero bound then it becomes increasingly difficult to maintain balance sheet discipline or for companies to even go bankrupt (for those of you that think this is not possible, take a look at Japanese markets pre-GFC or indeed post). This essentially leaves very little room for rational investment decisions or for value to make much sense at all. Constantly stress test: So what does all this mean for us as investors? Well, quite simply, as long as the status quo is maintained there is very little reason for us not to stay invested or be very discerning about what we’re holding in our portfolios for that matter. We are by no means suggesting that we’ve thrown up our arms and surrendered as we at TAMIM continue to believe that, over a long-term time horizon, investing based on valuations does have significant merit. But it will only make sense if and when there is a reversion to the mean and, secondly, it pays to have the ability to work across both Value and Growth. Quality seemingly doesn’t matter at present, however, let us posit a scenario for you. What would happen to our portfolios if there was a big macro-shock or monetary surprise? We would posit that very few portfolios would be able to withstand such an event and herein is the first point we seek to make about portfolio structure: Stress test it. Very few people can say that they do macro well and, to be perfectly honest, we agree with that. It is complicated and difficult. We live in a truly dynamic world and we have to learn to see markets as a complex system. Diversification for the sake of diversification does not work, but we can reasonably continue to look at portfolios and run through various scenarios such as a 50 basis point movement in interest rates or currency appreciation/depreciations. Think about what is in the portfolio and what cumulatively is on the balance sheet as a whole. The easiest way to visualize this, for example, is simply to take a factor like debt-to-book ratio averaged across the portfolio and test for a rise or fall in interest. Extreme events are buying opportunities: Being prepared for a macro-event is important but this is not all it is about. One of the most frustrating things we talk to people about on a day-to-day basis is the old, ‘I think there is a big macro-event coming and therefore I am going to cash.’ Unfortunately, timing the market is probably one of the biggest mistakes that allocators both retail (and professional) make. So here is our next point, accumulate cash because you’re not able to spot good opportunities that fit within your parameters BUT don’t do it because you think the market is overheated. The markets have a fantastic history of faking people out, the easiest way to contextualize this is to think about how long we’ve had recession and downturn predictions, the bull market should’ve ended in 2015, 2016, then 2017 and so on and so forth. Suffice it to say eventually it will come right if we keep chanting the mantra long enough. After all, a broken clock is right twice a day. One of the most interesting charts to illustrate this point is one some of you may recognise from a recent presentation we did around global equities: This shows the cumulative impact of timing the market almost to perfection in perhaps one of the most volatile indices in the world. Basically, this is trying to show that, on a compounded annual basis, you would’ve sustained a 12.8% p.a. return if you’d invested at the bottom of the market in 1989 compared to 12% p.a. if you invested at a cyclical peak just pre-Tiananmen Square. That said, if you had the wherewithal and conviction in your holdings, the post-Tiananmen market environment would have created double-down opportunities. After all, if there were no flow on effects to the individual securities and no new news-flow on a micro or company level you would have got securities at discounts. This is the second caveat, market sell-offs create buying opportunities but a run up isn’t necessarily in and of itself a selling opportunity again. We do not, as individuals, have the capacity to consistently predict macro-events with any degree of certainty. In any case, if you think a company is overvalued and has run too hard, you should not be holding it.

Buy and Sell: That brings us to our final point. With regards to the whole notion of buy, hold and sell, our view is that there is only buy and sell. If you would not buy a security at a given price, than I don’t see why anyone should run the risk of actually holding it in the first place. For us, it seems to imply that ‘I wouldn’t buy this asset or stock but I shall continue to hold it in the hopes that others with less intelligence than I will buy it at a better price than now anyway (the premise, of course, is that I as an investor want to see the value continue to grow). The point here is, if you wouldn’t buy something at the current price level, then perhaps you should not hold it. At the very least, there is a certain value in having the ability to sleep better at night. This all comes with the caveat that this must fit in with what you have decided are appropriate position sizes. So with that, we would like to end this weeks article by adding a few more rules of thumb on how to manage your investment portfolios:

2 Comments

Nigel Groome

13/6/2019 09:21:44 pm

A great article. Only the most experienced should try and manage their own portfolios I think

Reply

13/6/2019 11:25:11 pm

Interesting sugestions on portfolio management

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed