|

This week we continue to look at investing in needs and not wants, highlighting two stocks in our portfolios. Following the volatility in markets this year we have been extensively reviewing our portfolios and looking for companies that have steady earnings, inflationary protection and a service/product that is a necessity and is immune to the central banks attack on consumer spending.

0 Comments

This week we continue looking at needs not wants; companies that provide critical services that people need rather than want. We are using this theme to highlight companies that are best positioned for inflation with some even set to benefit from higher interest rates. We will be diving into the insurance industry and highlighting one company in particular.

Over the past few years investors that owned the much-coveted “FAANG” stocks would have been amongst the most popular people in the room. Fast forward to today and the NASDAQ is down -26% YTD; Facebook, now known as Meta Platforms (FB.NASDAQ), alone is down over -40% YTD. Growth stocks went on a tremendous rise to the top post-Covid however in the current environment, where fear is winning the arm wrestle against greed, those same growth stocks are being sold off heavily. So, where to allocate?

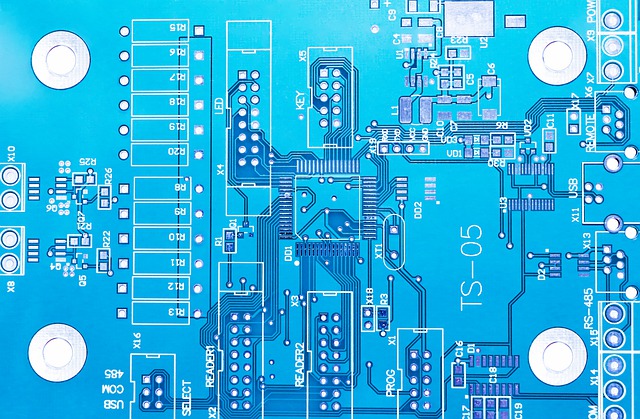

This week we will be visiting the world of semiconductors and looking at why the equipment providers may be a compelling way to gain exposure to the sector. We are currently in the midst of a massive global shortage of semiconductors at a time when demand is skyrocketing as a result of aggressive digitisation and the rise of tech like electric vehicles. The stock in question is a SATS (Semiconductor Assembly and Testing Services) company.

This week we look at a contracting company that provides infrastructure services to the energy industry. The company should also be well positioned to benefit from the shift toward clean energy. Contracting companies typically trade at low multiples due to their low margins and cyclicality, the stock we are covering is growing revenues at 25% and is seeing their renewables division doubling YoY.

This week we begin a new series centred around the global pharmaceutical sector with a particular eye to ascertaining where the opportunities and risks may be. Going back to our broader macro views, in particular around inflation, this sectoral allocation is one that we feel may have legs.

Infrastructure companies are essential providers of facilities and structures for the effective operation of a business, state, or economy. They are indispensable to sustainable growth and enjoy stable demand, growing profitability and provide above average yields to equity investors. Robert Swift explores one such stock.

Robert Swift takes a look at why Advantest's share price jumped 50% in July and what aspect in particular provides a blueprint for future investments. This article was prompted by the announcement that Verizon was selling Tumblr for a few million dollars. Tumblr is/was a social networking site that allowed users to blog personal stuff to each other. A couple of years ago Tumblr was reckoned to be worth $1bn.

Robert Swift takes a look at the ongoing frenzied search for yield and highlights one sector, infrastructure, and stock that has benefited accordingly. The search for income is becoming more frenzied. Very low cash rates and yield curves that have been massaged downwards by central banks’ policy has left the yield on the safest assets below the official rate of inflation, and well below the actual rate of service sector inflation, that typical buyers of safe assets (retirees and aging superannuants) experience.

Karl Hunt, of the Global High Conviction strategy, examines one of their more interesting investments. A stock that could be end up being taken out by a bigger fish or, if not, could end up being a compelling media play in its own right.

Robert Swift, manager of the Global High Conviction strategy, highlights the almost farcical nature of some of the hottest IPOs in the world recently and presents a stock that he finds much more palatable.

If 50 is the new 40, then is negative the new positive? We ask this in the light of 2 recent Initial Public Offerings (IPOs) where neither company has made a profit, is not about to make a profit, and is quite possibly never going to make a profit. We are of course referring to Lyft and Uber – the ride companies with other bits added. Robert Swift highlights one of his favourite stocks at the moment, one that he thinks might just be better than Facebook. We prefer to pay less for future earnings and dividends. If we can find a stock whose future prospects are even only a little better than the market expects, we make good money. Human biases and desires to be in crowds often produce unloved stocks which are merely misunderstood and yet very likely to be re-rated.

The TAMIM Global Equity High Conviction team at Delft Partners highlight a recent addition to the High Conviction portfolio. Why has this household name only now been deemed worthy of inclusion?

Robert Swift further presents his case for stocks that straddle multiple sectors in looking at one particular "tech" stock that has recently had some positive newsflow.

This week Kevin Smith of the TAMIM Global Equity High Conviction IMA takes a look at technology stocks. He takes a quick look at the idea that many tech stocks are not in fact tech stocks while many stocks, like the two supposed consumer discretionary stocks he highlights, perhaps should be considered so.

With the chatter questioning whether it is time to trim the FAANG stocks growing, Karl Hunt of the TAMIM Global Equity High Conviction IMA takes a look at portfolio holding Apple (AAPL.NASDAQ) through this lens.

Robert Swift takes a look at the electric vehicle phenomenon and takes a look at how his TAMIM individually managed account strategy is looking to take advantage of this increasingly potent thematic.

Everyone has been obsessed with the FAANGs, FAAMGs or "Sexy Six" for a while now but Robert Swift, manager of the Global High Conviction strategy here at TAMIM, only holds one. Robert takes a look a one of his better performing stocks of late to help explain why this is while examining the fallacy that stocks can be defined by a singular sector.

This week Robert Swift examines one of the more costly mistakes of the TAMIM Global Equity High Conviction portfolio so far this year. We still believe the investment thesis for Macy's to hold but this experience underlines the significance of timing on short-term returns in investing.

Karl Hunt & Roger McIntosh, of the TAMIM Global Equity High Conviction Individually Managed Account (IMA), take a look at portfolio holding Randstad Holding HV.

Reporting Season is well and truly underway in Australia. With this in mind we asked our Australian managers to provide a preview for the coming weeks. Here the managers of the TAMIM Australian Equity Small Cap IMA reveal what they expect to see.

While Macy's looks like a failing or declining department store business, we don't believe it is a department store at all but rather a real estate company with significant potential as an online retail business.

In the wake of the US Election result yesterday, we at TAMIM have asked a couple of the managers we partner with to give us a few quick reactions and thoughts on where they see opportunity now that President Donald J Trump is a reality.

In the lead up to Brexit Robert Swift, head of the TAMIM Global Equity High Conviction Individually Managed Account (IMA), took the view that one could effectively immunise a portfolio from the effects of potentially massive global economic events like Brexit or the upcoming US Election. Having successfully taken precautions to hold stocks that rode out Brexit admirably he now turns his attention to the US in an attempt to immunise the global equity portfolio against any shocks following the US election. The themes presented here should present strong investment opportunities whatever the outcome of the election may be. Robert also provides us with a list of stocks he is watching with this in mind.

This week Robert Swift, head of the TAMIM Global Equity High Conviction Individually Managed Account (IMA), examines the need for an increase in US infrastructure spending and the opportunities this presents. In this video, Robert takes a quick look at Vinci - a stock that should benefit from the coming spend.

|

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed