Advantest (6857.TYO)

Advantest is a Japan-based ancillary semiconductor company; they are an essential part of the ecosystem to develop semiconductors. Advantest provides a one-stop shop for the test systems, test handlers, and device interfaces which are essential to semiconductor package testing. From locations around the world, they provide equipment to support globally distributed semiconductor supply chains. Simply put, they ensure that the production lines are working and production yields for chip makers remain as high as possible. They are most well known for their automated test equipment which tests chips after the wafer is diced.

Advantest continue to be the only tester provider that can provide solutions for all producers and all test processes in both DRAM (a type of semiconductor memory that is typically used for the data or program code needed by a computer processor to function) and NVM (a semiconductor technology that does not require a continuous power supply to retain the data or program code stored in a computing device).

A Look into the Semiconductor Industry

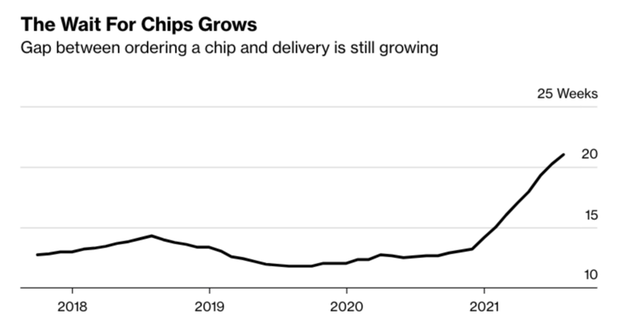

If you were to go to a car dealership tomorrow and try to buy a new vehicle, there is a decent chance that you won’t be able to take that car home for the next six months. The pandemic has caused a multitude of supply chain issues that have ultimately led to a shortage of semiconductors which are an essential component of just about every electronic device. They are so instrumental to our daily lives that the governments of Japan and South Korea compare them to rice.

We are currently in a generational shift to a more sustainable future filled with electric vehicles that require significantly more semiconductors than a traditional internal combustion engine (ICE). At the same time, we are in the middle of a massive supply deficit for semiconductors; many believe it will last for years to come. While some disagree on the timeframe, just about anyone can tell you that electric vehicles are going to be a pivotal pillar of the future. What fewer people are talking about is the lack of supply of all the critical inputs needed to manufacture them at large scale; this includes cobalt, nickel, copper, tin, manganese and, importantly here, semiconductors!

A couple of decades ago not having a mobile phone was no big deal. In today’s world however, not having a smartphone almost puts you at a disadvantage; you simply won’t have access to things. The ongoing digitisation of our economy, which includes smartphones, IoT, 5G etc., requires an enormous volume of semiconductors just to power the things we rely on in our everyday lives.

What many people don’t realise is that semiconductors are also a key piece to the puzzle when it comes to some of the complex geopolitical situations we are seeing unfold right now. China lags behind in terms of their semiconductor capability which means they simply don’t have the best technology. Their neighbour Taiwan though, is home to the most advanced semiconductor manufacturing company in the world, Taiwan Semiconductor Manufacturing Corporation. China isn’t looking to potentially invade Taiwan for their famous street food, they want to get hold of their ground-breaking semiconductor capabilities.

Already under immense pressure due to covid-related supply chain issues, the current Ukraine/Russia conflict will further exacerbate the chip shortage. Ukraine produced over 50% of the world’s semiconductor-grade neon, a crucial input to produce chips. As a result of the conflict, suppliers in Ukraine have halted operations.

Source: IC Insights

There is a growing need to ensure the reliability of semiconductors due to their increasing complexity. The expansion of semiconductor demand has also continuously boosted the demand for testers. The challenges of semiconductor miniaturisation, advancing complexity, and power consumption reduction have continually raised the bar for improving test efficiency.

Due to higher costs associated with larger wafer fabrication factories (fabs), manufacturers are mostly inclined toward outsourcing semiconductor assembly and testing services to third party providers. Leading fabless companies will continue to outsource everything, including testing, assembly, and packaging. This is a huge driver for testing companies like Advantest.

We are also seeing governments across the world giving huge grants for semiconductor companies and investing in bringing production onshore. They know what is at stake and the pandemic was a huge wakeup call for the US, who are starting to bring industrial production back onshore as a geopolitical and national security imperative so they are less reliant on overseas supply chains, China in particular. As part of Biden’s $2tn infrastructure plan, $50bn will be invested in boosting semiconductor competitiveness. China, who are about 5 years behind TSMC, are spending hundreds of billions to try and catch up.

In order to meet the surge in demand and close the supply gap, semiconductor manufacturers are set to spend $190bn on capex in 2022, a 25% increase on 2021 levels. TSMC are in the process of building a new fabrication plant the size of 22 football fields in southern Taiwan. This new plant will produce three nanometre chips which will be the latest generation and are expected to be up to 15% faster. The increased investment from manufacturers will understandably benefit equipment providers like Adventest.

Advantest are expected to grow their revenues by 32% in FY22 and a further 15% in FY23. They continue to invest significantly in R&D (around 13% of sales) and have become one of the leading SATS companies in the world. Their EBITDA margins are strong at 35% and will be a big beneficiary from the shift towards digitisation as well as the widespread shortage of semiconductors.

Advantest are currently trading below the average multiples for semiconductor testing companies. Not only do they look cheaper than their peers but we believe they have a better outlook than most of their competitors. Their main competitor, Teradyne (TER.NASDAQ), is heavily reliant on Apple (APPL.NASDAQ). Apple are developing a three nanometre chip for their next line of iPhone and Mac products. Apple are looking to launch this next line of products after 2023 which impacts Teradyne’s FY22 forecasts significantly, leading most brokers to downgrade their outlooks. One of the reasons why Advantest will fare better this year.

While most people would look to the well-known chip makers to gain exposure to the space – i.e. Intel (INTC.NASDAQ), TSMC, Samsung (005930.KRX), Nvidia (NVDA.NASDAQ) etc. – but we are always looking for companies that don’t see the same coverage yet have a strong foothold in the thematic we are targeting and therefore are leveraged to the tailwinds but trade at a cheaper price. Advantest trades at a cheaper price and will absolutely benefit from semiconductor tailwinds.

Advantest will continue to ramp up their investment in R&D and M&A. At the back end of last year Advantest completed the acquisition of Altanova, a testing equipment manufacturer in New Jersey. The acquisition will expand their test and measurement solutions across the continuously evolving semiconductor value chain. Altanova’s engineering and manufacturing capabilities, excellent customer base, and first-rate technical team will complement their semiconductor test equipment business as well as give them a bigger presence in the US. We expect more deals like this in future.

Like most listed Japanese companies, Advantest is in a strong net cash position with little debt. Their strong balance sheet affords them the opportunity to potentially lever up their balance sheet to increase returns for investors. Their ROE is currently over 30%, imagine what leverage could do to that figure. Advantest are on track to reach their goal of ¥400bn in sales and continue to grow their dividend payments each year.