|

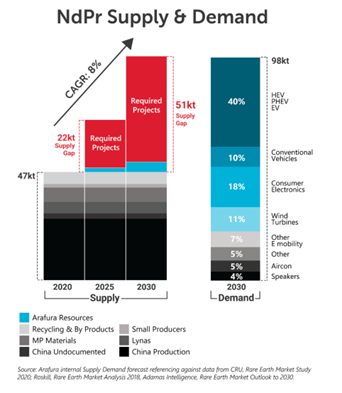

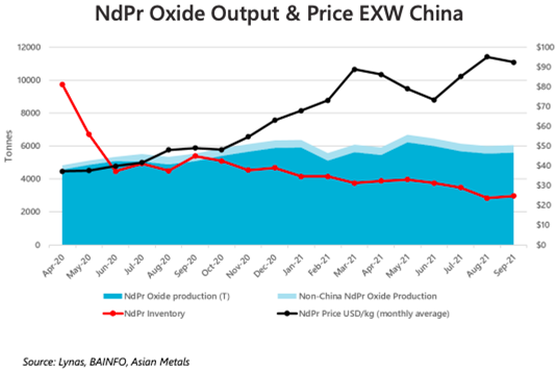

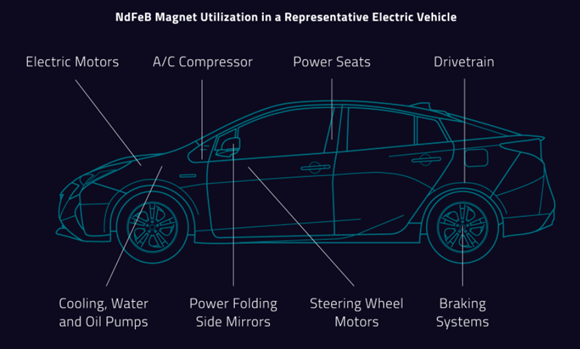

This week we are tackling the subject of rare earths, their applications for electric vehicles and how TAMIM’s Global Mobility strategy aims to benefit. The rare earth elements are composed of a group of seventeen metals that are each just as hard to pronounce as the next. They are becoming increasingly vital to a carbon free economy with applications for both electric vehicles and electrical efficiencies. Author: Adam Wolf Right now, China is producing over 80% of the world’s rare earth supply. As a result of this, the US is pushing towards domestic production of these elements. Our holding, MP Materials, stands to benefit. MP Materials (MP.NYSE) MP Materials owns and operates Mountain Pass, the only integrated rare earth mining and processing site in North America. The Mountain Pass mine is in Nevada, a top tier mining jurisdiction. Mountain Pass is blessed with one of the world’s highest quality deposits of rare earths, allowing MP to be a global low-cost producer The Mountain Pass mine contains more than 800k tons of recoverable rare earth oxides with an average 8% ore grade, one of the highest quality (known) deposits in the world. Mountain Pass is designed as a zero-discharge facility, featuring a dry tailings process that allows recycling of ~95% of the water used in the milling and flotation circuit. The sustainable features of the mine are very favourable given the current ESG-driven environment when it comes to valuation. The Rare Earth Elements: Scandium, Yttrium, Lanthanum, Cerium, Praseodymium, Neodymium, Promethium, Samarium, Europium, Gadolinium, Terbium, Dysprosium, Holmium, Erbium, Thulium, Ytterbium, Lutetium MP currently produces ~15% of the global supply of rare earths, currently in the form of an intermediate product — rare earth concentrate — that requires further processing in Asia. It currently sells its output to China-based, and 8% shareholder, Shenghe Resources for further processing but this is subject to change once MP implements their upcoming expansion strategies at the Mountain Pass mine. The company plans to reinvest the free cash flow generated from operations into expanding MP’s US capabilities, including restoration of domestic refining capability at Mountain Pass by next year. MP Materials will relaunch its onsite processing facilities, setting the foundation for a renewed, self-sufficient US rare earth industry. MP Materials shares have more than trebled since listing on the New York Stock Exchange in November 2020. Rare Earth Elements Rare earth elements are far more abundant than their name suggests but extracting, processing and refining the metals poses a range of technical, political and environmental issues. Most of the rare earth deposits are found along with radioactive materials that contribute to ecosystem disruption and release hazardous byproducts into the atmosphere. As a result, it is often difficult to receive the necessary environmental approvals to develop a rare earths mine. Environmental regulations are often more stringent than inside China which is why the country dominates the rare earth industry, producing over 80% of global supply as mentioned. Having a single country, particularly one like China, dominating the supply of such critical elements poses a number of issues for the US. This is especially the case given the current geopolitical environment and the supply chain issues that are not only threatening inflation but also causing shortages in electronics and other industrial goods. President Biden signed an executive order requiring the US Government to review supply chains for critical minerals and other identified strategic materials, including rare earth elements, in an effort to ensure that the US is not reliant on other countries, i.e. China. Electric Vehicles With electric vehicles being one of the three pillars of our Global Mobility fund (along with autonomy and sharing/connectivity), we look for companies that will benefit from the imminent growth in electric vehicle production by participating in the ecosystem that is being built around the industry. While the US intends to shift away from China to source their rare earth supply, without domestic production this would have a significant effect on American consumers as domestic demand for batteries and electric vehicles ramps up. The pace of demand growth is expected to rise rapidly over the next few years as sales of electric vehicles are slated to reach 12.2m in 2025, according to data from IHS Markit. Rare earths are going to be a vital component in humanity’s shift towards cleaner energy. Not only will they be integral for electric vehicles but they are also used for things like wind turbines. Neodymium and dysprosium are the key components of the magnets used in modern wind turbines " The wind turbine market is anticipated to account for ~30% of the global growth in the use of rare earth magnets from 2015-2025. Using rare earth metals prevents the use of gearbox. Rare earth magnets make the turbines lighter, cheaper, more reliable, easier to maintain and capable of generating electricity at lower wind speeds." - UBS Research, 23 July 2018 Stage II + III Strategy As it currently stands, all of MP’s rare earth production requires further processing in Asia, something that the US is clearly anxious about. Following the acquisition of the Mountain Pass mine in 2017, the mine’s production is approximately 3.2x greater than the highest ever production in a twelve-month period by the former operator using the same capital equipment. That was the first stage of MP’s strategy. The second stage of MP’s Mountain Pass strategy will see MP Materials relaunch its onsite processing facilities, setting the foundation for a renewed and self-sufficient US rare earth industry. This would mean that MP Materials no longer has to send their product for further processing in Asia, they will now be able to sell their concentrate to end users which will have a huge cost-benefit. MP is aiming to finish their second stage in 2022. Stage III would be downstream integration, to be completed via either building a captive integrated magnet supply chain or investing in this capability via an acquisition, partnership or joint venture. The integration of magnet production would establish MP as the first and only fully-integrated source of supply for rare earth magnets in the Western Hemisphere. In addition to offering end-market magnet customers a complete Western supply chain solution, MP believe downstream integration would also create a material incremental value creation opportunity. Outlook & Thesis We see MP Materials as a company with multiple tailwinds moving forward. The shift toward a self-sustained supply chain in the US will obviously have a favourable outcome for US rare earths miners and provide further support for future projects. The demand side for rare earths is looking strong with electric vehicle production ramping up as well as other applications in things like electronics and wind turbines. Looking over at the supply side, due to the radioactive material that is usually found with rare earths, these mines are hard to bring into production so our outlook for the price of these elements is very strong. The completion of MP’s Stage II plans will be a major catalyst for the company, it will make them the only US company that can provide a rare earth end product to consumers. This will not only be cost-effective but will give them sizable leverage when negotiating off take agreements with US consumers. MP are currently sitting on over US$1.1bn in cash, enabling them to execute their strategy at the Mountain Pass mine while also allowing them the opportunity to make further acquisitions or JV agreements, further increasing their production and presence in the future. In their last quarterly announcement, MP had an underlying EBITDA of 64%. Considering the cost benefits of their Stage II implementation and their increased bargaining power in terms of off take agreements, MP is sitting on a highly profitable mine. MP Materials is another company in TAMIM’s Global Mobility portfolio that will benefit from the shift towards decarbonisation through electric vehicles and clean energy applications. We see MP Materials dominating the rare earths industry in America and they will be the only US based company that has the ability to provide an end product to consumers without relying on Asia. Disclaimer: MP Materials is currently held as a long position in TAMIM's Global Mobility portfolio. The TAMIM Global Mobility strategy seeks to to capitalise on the ongoing $7 trillion autonomous and electric vehicle revolution.

3 Comments

Doug

7/10/2021 07:57:49 pm

Adam,

Reply

Roger Armitage

8/10/2021 09:39:04 am

You didn't mention Lynas which has two US DOD contracts for heavy and light Rare Earth separation facilities on US soil

Reply

Adam Wolf

8/10/2021 10:37:42 am

Hi Roger,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed