|

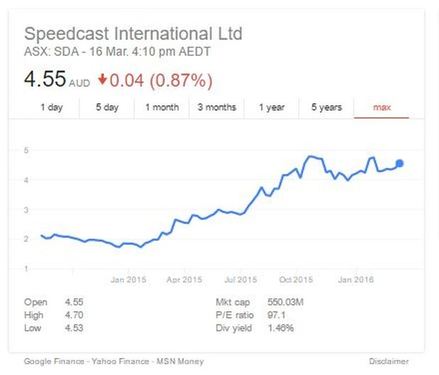

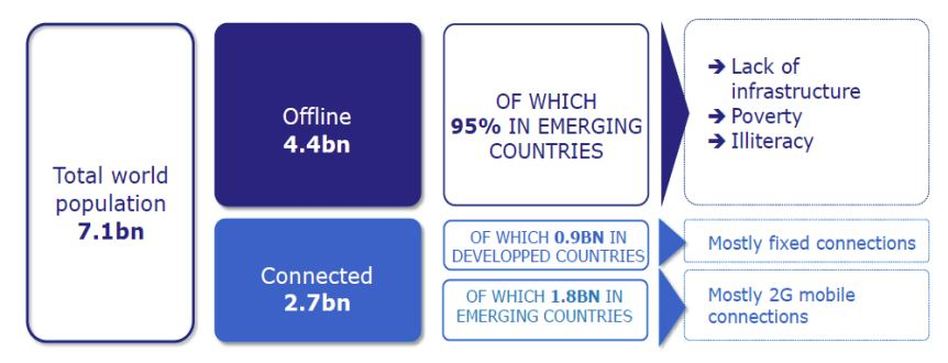

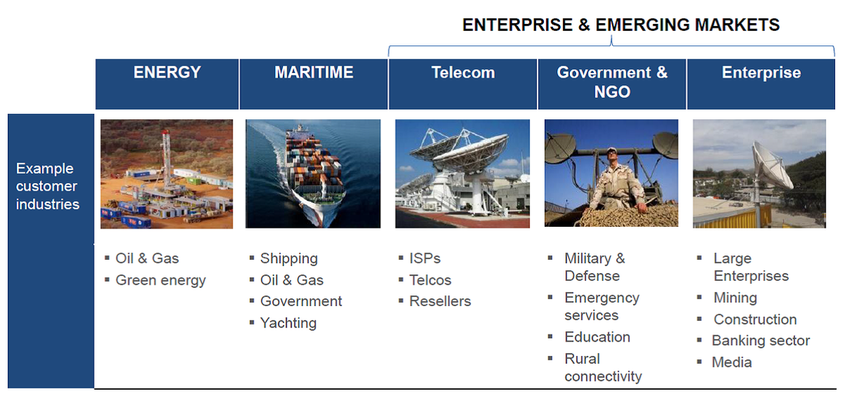

At TAMIM we invest in stocks - not markets. The recent volatility in markets has highlighted to investors the need to own high quality growth stocks in their portfolios. Our partners at CBG utilise their growth focused investment style to highlight an interesting Australian investment, SpeedCast. This week Michael Newbold from the manager of the TAMIM Australian Equity Growth IMA takes time out to discuss SpeedCast. While the Australian stock market seems to have taken a hiatus from its downward movements, it is extremely important to remember that this is not a set and forget market. You constantly need to be reviewing your portfolio and much like we do in our portfolio committee's, constantly re-evaluate your investment thesis for holding a particular position. It is also extremely important to review the various asset classes and investment styles of your investments. We know that your asset allocation decisions will be as important as your stock picking decisions. For a further discussion on asset allocation and stock picking please call us to arrange a time for one of our directors to meet with you. SpeedCast is a high growth telecommunications business with leverage to increased satellite services demand and VSAT (two-way satellite ground station with a dish antenna that is smaller than 3 meters) penetration to deliver these services. Through organic growth and acquisitions, SpeedCast has strengthened its competitive position in high growth industry verticals & emerging geographies across APAC. At the FY15 result in February, SpeedCast delivered 38% revenue and 42% EBITDA growth despite FX headwinds (20-25% of revenue is in AUS/EUR vs reporting currency being USD). Management is targeting double digit organic revenue and EBITDA growth pa over the medium term while progressing with its acquisition strategy in order to build out its verticals e.g. energy or martime. The industry is highly fragmented with the majority of competitors being localised with lower quality-of service, inferior expertise/technical capabilities, and diseconomies of scale. This provides synergy opportunities for SpeedCast. SpeedCast is currently trading on 33x FY16F EPS with a modest 2.7% yield. It offers strong double digit organic revenue and EBITDA growth plus upside from acquisitions. Please note that EPS is impacted by amortisation of customer contracts. SpeedCast is trading at a more modest 19x adjusted for this impact. Company background SpeedCast is a leading provider of satellite-based communication networks and services in the Asia Pacific region and to the global maritime industry. It designs, implements, integrates, operates and maintains communications networks combining satellite capacity and network infrastructure. SpeedCast also provides a range of value-added products and services, including user applications (voice, video conferencing and video surveillance), network optimisation (firewalls, filtering and data compression) and network monitoring and management (including reporting tools and remote access for IT technicians). SpeedCast serves over 1,000 customers across over 3,000 terrestrial sites, predominantly in Asia Pacific (though its global presence was enhanced over CY15), and 1,700 offshore rigs and vessels with satellite services. SpeedCast is headquartered in Hong Kong but has a local (Australian) management presence. What do satellite service providers do? Satellite-based communications networks enable real-time broadband communications in areas where traditional terrestrial infrastructure is either unavailable or unreliable (eg due to war, natural disaster etc). It provides remote users with digital communication capabilities similar to those available at the corporate office. This includes making telephone calls, providing internet access and running applications to facilitate everyday operations. SpeedCast’s communications network has a global reach that uses 60+ different satellites, 15 different satellite operators and 30+ teleports. SpeedCast’s two largest customer groups are maritime and energy, which accounted for 31% and 18% of CY15 revenue respectively. So how does SpeedCast make money? SpeedCast generates five main types of revenue that can be classified into three buckets: service revenue (fixed monthly fees), equipment revenue (sale of equipment on which they earn a margin) and wholesale VoIP revenue. Key industries for SpeedCast are set out below along with example customer industries. How big is the addressable opportunity?

The global satellite services market is estimated by management to be worth US$5-6bn with SpeedCast’s biggest competitor having a c6% share (vs SpeedCast at c3%). The industry is therefore highly fragmented and a strong candidate for consolidation. Key earnings drivers

Catalysts for share price movement

Happy investing, The team at TAMIM. Comments are closed.

|

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed