|

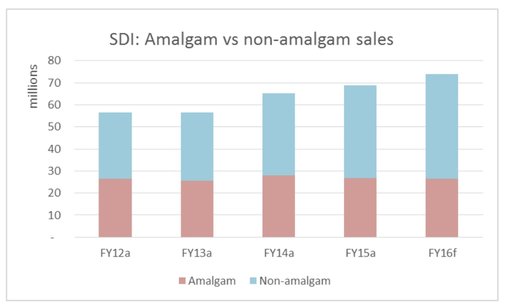

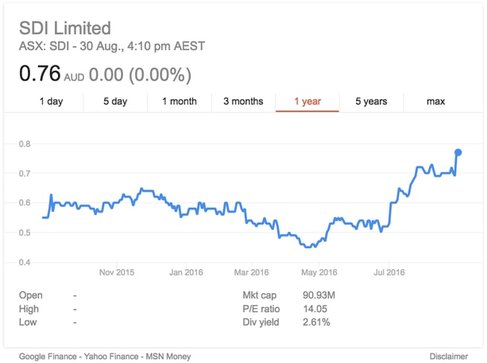

The Australian smaller companies universe is home to a number of companies which are building global leadership positions in their respective niche markets, and yet somewhat surprisingly remain largely unrecognised in the local investment community. Identifying these types of businesses is both the passion and the bread and butter of the manager of the TAMIM Australian Equity Small Cap IMA. We are pleased to provide a profile of our investment in SDI Limited (SDI.AX). The Australian smaller companies universe is home to a number of companies which are building global leadership positions in their respective niche markets, and yet somewhat surprisingly remain largely unrecognised in the local investment community. Identifying these types of businesses is both the passion and the bread and butter of the manager of the TAMIM Australian Equity Small Cap IMA. We are pleased to provide a profile of our investment in SDI Limited (SDI.AX). Stock Picking - SDI Limited (SDI.AX) SDI Limited (SDI.AX), a Melbourne based manufacturer and exporter of dental products. Established in 1972 by Jeffrey Cheetham, a trained metallurgist, SDI operates in the global dental equipment and consumables market, which is estimated to be in excess of $25 billion. SDI exports around 90% of its products to over 120 countries. SDI commenced operations in Jeffrey Cheetham’s garage, producing amalgam fillings and selling the products direct to dentists. By 1975, the company had operations in New Zealand, United States and Greece. Following a decade of national and international success, the company listed on the ASX in 1985. A strong focus on research and development has seen SDI develop an extensive portfolio of innovative restorative and cosmetic dental products including fillings, cements, tooth whitening products and associated dental equipment, with market leading positions in various geographies. SDI has offices and warehouses in Chicago, USA; Cologne, Germany; Dublin, Ireland and a recently commissioned packing facility in Sao Paulo, Brazil, and turns over in excess of $70m annually. WHY IS SDI TRADING UNDER THE RADAR? SDI is a relatively small family-controlled and family-run Australian company which competes against some large multinationals. The company has had an operationally challenging past few years with its performance subject to foreign exchange and commodity price fluctuations, and as a result, trades very much under the radar. SDI has built its reputation as a supplier of high quality amalgam (silver and mercury based) dental products. However, as consumer preferences have shifted towards more visually appealing dental products, there has been a move away from SDI’s original core amalgam products. As a result, SDI has struggled to generate significant sales growth momentum in recent years. Fortunately SDI’s more recent research and development initiatives have been focused on non-amalgam products, which is where the industry growth is. The company has been developing a more complex glass ionomer product range, as well as composite and whitening products. Given SDI’s historic reliance on amalgam products, the transition from amalgam to non-amalgam product sales has taken some time. However, with amalgam sales now representing only 36% of total sales, SDI has successfully managed this product mix transition. All of SDI’s sales growth in recent years has come from non-amalgam products as shown below: While amalgam sales have essentially been flat since 2012, non-amalgam sales have increased by over 30%, and have shown consistently strong year on year growth. The more complex non-amalgam products attract a higher gross margin, which, together with the company’s increased scale, has helped to drive SDI’s net profit from $2m in FY12 to around $7.5m in FY16. COMPELLING VALUATION Based on its recent guidance, SDI is trading on a FY16 p/e of around 11x, and on an Enterprise value / EBITDA multiple of 7x. It should be noted that SDI capitalise, rather than expense the majority of their research and development costs, which potentially overstates their reported net profit. However, these valuation metrics suggest to us that SDI is under-valued for a business with a strong global sales reach and solid growth prospects. OUR VIEW

SDI is a great example of a small Australian company developing unique intellectual property and achieving global success in its chosen niche market. We believe the stock deserves its position in our emerging global leaders list. A sell-down by one of SDI’s larger, long term institutional investors has recently provided some liquidity in this somewhat illiquid stock, and has enabled new institutions and shareholders to enter the register. Whilst SDI is very much perceived as being a family run company, there is the opportunity for a stronger non-family aligned shareholder base to now help change this perception. For many years the company has demonstrated its ability to consistently bring innovative new products to market. With a strong culture of research and development SDI has excellent potential to continue to grow its sales by expanding its product portfolio and its customer reach, and to become a more robust and larger company. We are happy long term shareholders. Comments are closed.

|

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed