|

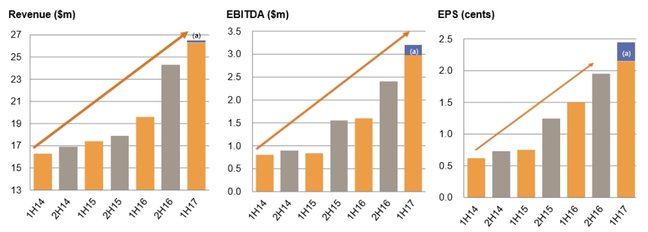

This week the small cap team takes a look at their investment in Konekt (KKT.ASX), a workplace health solution provider. Who is Konekt? Konekt provides workplace health solutions. Its service lines cover the employee lifecycle from injury prevention to redeployment, helping organisations prevent injury and minimise the impact of workplace injury costs by assisting injured employees return to work. KKT comprises over 400 permanent employees of which over 350 are qualified allied health professionals, operating from 44 offices in all capital cities and across major Australian regional centres. KKT is an Australian market leader (~11-12% market share) in a very fragmented market. The company currently has a market capitalisation of $44 million. Case study – Injury prevention:Boral is Australia’s largest building and construction materials supplier, with operations in all Australian states and territories. Injuries caused by manual handling are a major burden to society, and particularly in the construction sector. Following a review of internal incidents and injuries, Boral Timber identified the need to improve manual handling behaviour within their workplace to reduce the frequency and severity of lost time injuries. Boral had been a long term customer of KKT, and began working with KKT to develop a positive manual handling culture within Boral Timber. Konekt and Boral developed a targeted program to address safety culture, and foster safe manual handling procedures. The program become a key part of the culture at Boral and assisted with increasing employee awareness and cementing the core principles of safe working practices. Over a 12 month period following the program implementation, Boral Timber reported a reduction of more than 80% in manual handling injury claims. Employee understanding and recall of manual handling principles post-program increased 20%, while there was a significant increase in the level of employee accountability in relation to safe manual handling practices. Why we like Konekt:KKT, under the leadership of CEO Damian Banks, has delivered consistently strong revenue and earnings growth in recent years in a sector which has exhibited relatively low growth. As a national business with a meaningful fixed cost base, this revenue growth has resulted in a strong increase in operating margins (FY14: EBITDA margin of 5%; FY17 forecast EBITDA margin of ~11%). Growth has come organically from new and existing customers, complemented by some sensible acquisitions to expand national coverage and broaden the range of services offered (eg: last year KKT acquired a leading psychological health services firm, that offers services in mental health and wellbeing training, resilience training, psychosocial risk assessment and mental health advisory services). These acquisitions have been funded by KKT’s strong cash flows, which have also funded the re-payment of all corporate debt and enabled a modest dividend to be paid in FY16. KKT has a reasonably broad customer base split between corporate organisations, insurance companies and government departments. The numbers:Despite some challenging recent market conditions (eg: KKT had previously done a significant amount of work in the mining services, which began to reduce from 2013 as the mining sector contracted), KKT has delivered consistently strong revenue and earnings numbers. For FY17, Konekt has recently confirmed its guidance of revenue in the range of $51.0 – $53.5 million and EBITDA margin in the range of 10.5% to 11.5% of revenue. This would suggest earnings per share of just over 5 cents which places KKT on a price/earnings multiple of c. 11 to 12 times. We do not think that is demanding pricing for a market leading national business, with a strong track record of growth and with potential to take further market share in a fragmented market and/or expand its range of service offerings to become a diversified corporate health provider. Recent developments:We recently noted that KKT had advised the market that its largest customer, Medibank Health Solutions (MHS) had decided to change certain requirements relating to the rehabilitation services provided under the MHS Contract. Through this MHS contract, KKT provides rehabilitation services to the Department of Defense, and KKT oversees and provides sensitive services to approximately 3,000 (and increasing) defense personnel across a number of (often remote) geographic locations. During May 2017, KKT announced that it had executed a new contract with MHS for the provision of rehabilitation services until October 2018. The major change in this contract is that rehabilitation services will now be directly supplied on- base (inside defense property) rather than working out of a KKT office as was previously done.

On a separate note, each year KKT releases the Konekt Market Report in which KKT analyses rehabilitation services data from over 156,000 cases over the last 8 years. This comprehensive review includes referral patterns and return-to-work outcomes across jurisdictions, organisation size and industry sectors. The 2017 edition was released in May. Key findings from this latest research included:

We like KKT as it is a well-managed business with a market leading position, a strong balance sheet, is on an undemanding multiple and is making a genuinely positive contribution to the lives of many thousands of people across Australia each year.

2 Comments

frank

19/6/2017 05:19:08 pm

What will the increased costs of providing services on DEFENCE bases cause to the base line.

Reply

DMX - Simon Turner

20/6/2017 09:12:48 am

One of the major problems that Konekt faced in servicing the ADF contract, prior to the renegotiation, was the time and cost (which Konekt was not compensated for) of travelling between the base (where the services were carried out) and the nearest Konekt office (where all the administration was carried out, as Konekt were previously not able to use phones and emails on base). The savings and efficiencies gained from being located on base should mitigate any additional costs, and we do not expect the net cost impact of this change of resourcing model (from off base to base) to be material.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed