|

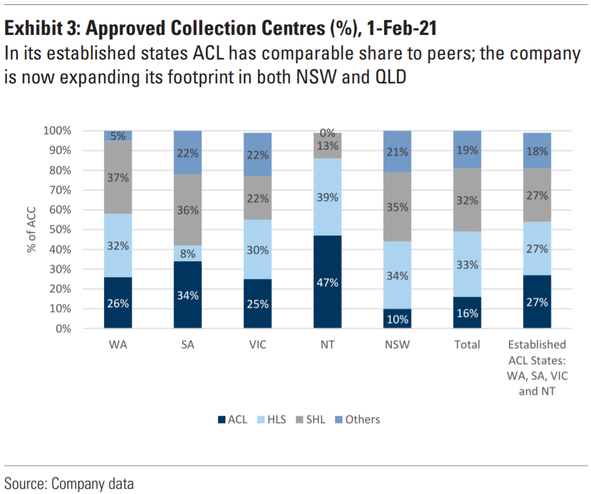

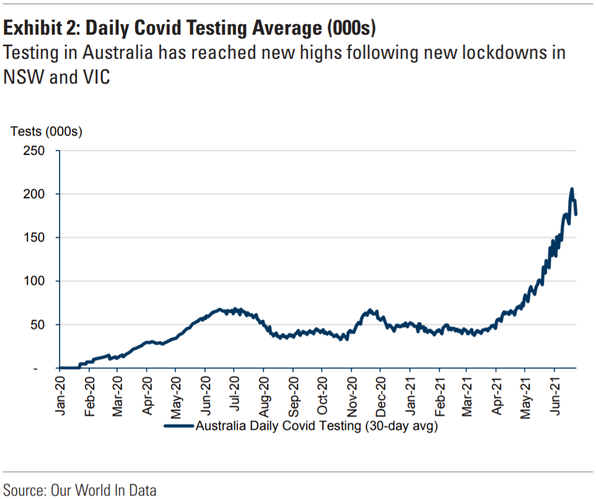

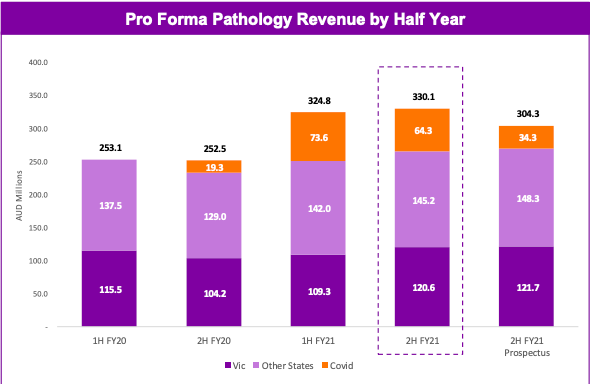

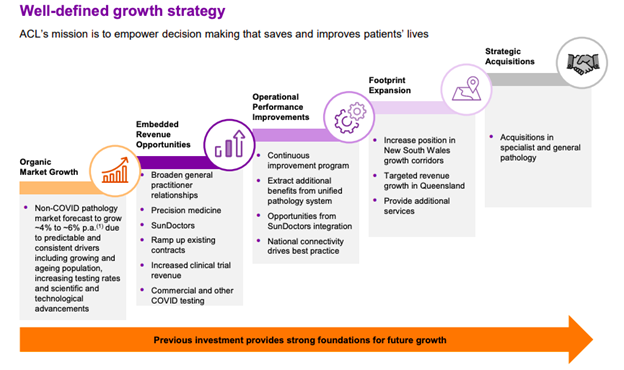

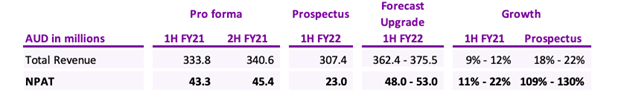

This week we discuss a hidden gem on the ASX and one which we believe has the ultimate investment exposure in a Covid world. With the company only listing three months ago it is yet to receive much attention from fund managers and brokers, yet it is highly profitable and on an upgrade cycle. Find out which stock below.  Author: Ron Shamgar Author: Ron Shamgar Australian Clinical Labs (ACL.ASX) is the third largest pathology provider in Australia. The pathology market is worth over $6bn annually and 80% of revenues are dominated by three main players: Sonic Healthcare (SHL.ASX), Healius (HLS.ASX) and ACL - with 16% market share. The industry is growing at approximately 5.4% per annum but Covid PCR based testing has added another layer of substantial and lucrative revenues. Now whether Australia reaches 80% or 100% vaccination rates, or whether we are in and out of lockdowns or completely open our borders - we don’t believe it matters for testing requirements. Whatever your stance on the situation, Australia’s Covid strategies and responses are fixated on case numbers. This means that, for better or worse, testing volumes should continue to stay elevated for a couple of years to come.  What gives us confidence in this statement is the high levels of Covid cases overseas, especially in countries where vaccination rates are high. Ongoing testing will be required for travel purposes, work related requirements, healthcare and staying on top of different strains of the virus that will undoubtedly evolve over time. More importantly, alternative antibody (antigen) testing methods so far appear to be unreliable in replacing PCR based methods. ACL are currently serving over ninety hospitals and are also running thirty specialist skin cancer clinics across Australia which are responsible for diagnosing over 15% of all reported melanomas. Hence ACL profits are sustainable for now. The company has significant momentum and is in the midst of a strong upgrade cycle that we believe the market is currently overlooking. FY21 prospectus forecasts were beaten by 5% on revenues (to $674m) and were over 20% ahead in the NPAT line (to $89m). Free cash flows are strong and the balance sheet ended the period with low levels of net debt ($65m). All this should allow ACL to continue to make acquisitions, especially in NSW and QLD where ACL’s market share is still quite low. Unlike their larger peers, ACL should be able to make smaller acquisitions that make a meaningful impact on their bottom line. ACL’s past acquisitions have increased their presence throughout Australia and have provided significant synergies for the company by reducing operating costs and improving EBITDA margins. Watch this space. The momentum behind the business was evident with 1H22 guidance upgraded significantly from prospectus forecasts. Revenues are now 22% ahead of the previous forecast and NPAT is a whopping 130% ahead at $53m. To put this in perspective, analysts previously had ACL earning $53m for the whole of FY22. Dividends are expected to be paid at 60%+ of profits, placing the stock on a 6%+ fully franked yield. ACL has also invested significantly in their in-house tech and operates a national unified pathology system that allows the majority of tests, clinicians and laboratories to operate as one laboratory across the country. ACL’s unified pathology system enables operational benefits which include improved turnaround times and ability to handle demand peaks, national benchmarking to drive performance improvement and efficiencies and share innovations. Their system is a competitive advantage and has been a key factor in their ongoing and pivotal role in Australia’s Covid response. This system and the advantages it brings will serve them well if and when there is a decline in Covid testing. Last year we successfully (and rather profitably) rode the wave of Covid winners in e-commerce and BNPL stocks. We see ACL as a similar beneficiary but on a more long term and sustainable level. Any slowdown in Covid testing should be replaced by increase in non-Covid business/testing resuming. With SHL and HLS trading on 14-19x PE multiples, we see ACL - currently at 9x PE - as significantly undervalued. We believe that management’s FY22 guidance is conservative as was their FY21 guidance. They are assuming a sharp deceleration in test volumes and, as we said above, we don’t believe it will be quite so sudden. On the back of the conservative forecasts, we expect further upgrades through the year and further acquisitions to drive a rerate. An ASX300 index inclusion is also potentially on the cards. Our valuation is $6.00+ and ACL is currently one of our top holdings in both the Australia All Cap and Australia Small Cap Income portfolios. Disclaimer: ACL is currently held in TAMIM Australian equity portfolios.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed