|

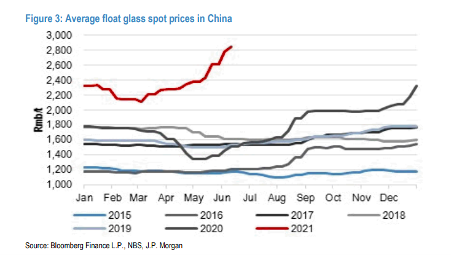

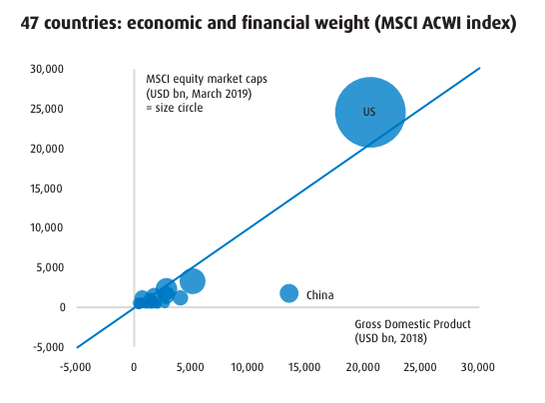

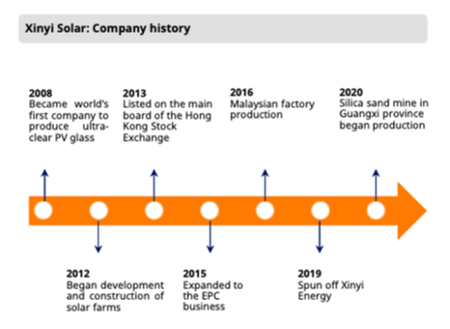

This week we will be talking about two stocks in our Asia Small Companies portfolio. This portfolio focuses on investing in small companies (up to $10bn market cap) predominantly in north Asia due to the increased levels of governance. Asian markets are typically unloved, especially China and Japan, and this opens up a large opportunity to gain exposure to misunderstood companies that have big growth potential. More recently, there have been improving levels of governance across Asia with a greater emphasis on delivering shareholder value. Author: Adam Wolf The Opportunity in Chinese Equities China has been rapidly growing their domestic economy through ongoing urbanisation, which is projected to rise to 70%. As most are probably aware, there have been increased political tensions surrounding China, causing an isolation of China’s economy and increased concerns about political risk when it comes to investing in Chinese companies. Our Asia Small Companies portfolio only invests in Chinese companies that are listed on the Hong Kong Stock Exchange to somewhat mitigate these risks. The negative attention surrounding China has led to cheaper valuations of Chinese companies which is creating a huge opportunity for investors to capitalise. To give some perspective, the US accounts for 25% of the world economy and has a 65% world cap weight compared to China who account for 15% of the world economy but only have a 1% world cap weight. Xinyi Glass (0868.HKG) Xinyi Glass is a glass manufacturing company headquartered in Hong Kong providing high-quality float glass, automobile glass and energy-saving architectural glass. Xinyi has a sales network covering over 130 countries and regions around the world. Float glass currently represents 67.5% of Xinyi’s revenue with automobile and architectural glass making up the remainder. Xinyi’s share price is up 224% in the past year and expects their net profit to increase by 260-290% due to current glass supply dynamics. Tightening Global Glass Supply  Source: Bloomberg Finance L.P., NBS, JP Morgan Source: Bloomberg Finance L.P., NBS, JP Morgan Driven by a strong rebound in construction demand and limited production growth, the glass industry’s prices and profitability are approaching historic highs with float glass prices up 75% YoY. New capacity addition could be low in 2021 and the glass industry’s margin should remain at close to these historic highs, driving strong earnings growth. The supply of float glass has and will be constrained in 2021 and 2022 because of stronger environmental protection measures. Some production line repairs are unlikely to continue to operate despite the favourable market environment. Xinyi Glass will continue to expand their capacity to capitalise from the higher prices. Xinyi plans to increase its float glass capacity by 26.0% by the end of 2021. They will also look for more acquisition targets in the Chinese market alongside opportunities in overseas markets. Given their capacity expansion, Xinyi Glass is expected to outperform the industry in terms of shipment growth. The EV Tailwind Automobile production is starting to gain some traction due to the increased production of electric vehicles. Emissions mandates are putting more pressure on car companies to shift away from combustion engines while the general sentiment towards clean energy has also shifted and this is enticing a race for practical and scalable electrification for auto manufacturers. This is a tailwind for Xinyi’s automobile glass business given their key customers include Volkswagen, Ford and General Motors, all of whom are investing significant capital towards developing electric vehicles. New Plant in Malaysia As mentioned before, with the increased isolation of China’s economy, many Chinese companies have chosen to list in Hong Kong as opposed to Beijing as well as establish overseas production plants to maintain and expand their exporting capabilities. Xinyi established a plant in Malacca, Malaysia which spans over 444 000 square metres. This plant is essential for Xinyi increasing both their domestic and international market share. The Malacca plant will feed product into international markets, allowing more of the domestic production in China to stay in the home market. Xinyi Solar Xinyi Solar Holdings (0968.HKG) is the world's largest solar glass manufacturer, trading on the HK stock exchange with Xinyi Glass owning 23% of the company. Xinyi Solar has been benefitting from the roaring solar panel industry, projected to reach $223bn by 2026 growing at a CAGR of over 20%. Xinyi Solar recently announced guidance of a 100-120% increase in net profit for the half year ended June 2021, they have significantly expanded their production capacity and are benefiting from the incentive programs in place to reduce emissions thus increasing demand for their solar glass. Xinyi Solar is currently trading at about 10x EV/EBITDA and are paying a 1.64% dividend yield. Thesis Simple, Xinyi Glass has been the biggest benefactor of tightened glass supply and they are ramping up production to fully capitalise. Their half year guidance puts them at an EV/EBITDA ratio of approximately 12.3x (a conservative estimate given that their holdings in Xinyi Solar and Xinyi Energy combined are worth over $33bn HKD), a compelling metric with their 200%+ increase in NPAT. Xinyi also stands to benefit from the shift towards cleaner energy through their automobile glass segment which will see increased demand on the back of electric vehicle production and through their holdings in Xinyi Solar. Management have announced share buy back programs and have already bought 1% of the total shares outstanding since March, showing great confidence in the company and something which has been reflected in the share price. Lien HWA (1229.TPE)Our next stock is Lien HWA Industrial Corporation, a Taiwan-based company mainly engaged in the processing and distribution of wheaten food products. These wheaten food products include flour, wheat bran and pasta, amongst others. The company operates a number of business operations, including a leasing segment which operates real estate leasing and a development business. While they started off as a flour producer they are now a holding company and the hidden gem is their 73% stake in MiTac, an innovative electronics business that is driving Lien’s profits. A feature we like of the Taiwan stock exchange is that companies must report their sales figures monthly, providing greater transparency to shareholders and giving us more timely information to make investment decisions. The Hidden Gem: Subsidiary MiTAC MiTAC is a provider of smart technologies, electronics and cloud services. MiTAC is looking to capitalise on the emerging thematics of IoT, smart cities and autonomous vehicles, something we touched upon in a previous article. To capture these markers MiTAC also provides integrated hardware and software solutions including dashcams, smart cameras and navigation systems to the automotive industry. These products also tie in with their connected car and smart city solutions. MiTAC currently accounts for around 50% of Lien’s earnings, recording $11b TWD of revenue for the first quarter. Property Development Lien HWA Property Development is a subsidiary company, established in 2019 from the real estate & leasing division of Lien HWA Industrial Corp, with management and development of company-owned real estate across Taiwan as its core business. A special unit has been established in conjunction to provide professional services to meet customer demands including real estate leasing, assets enablement and value-added developments. The property development segment further diversifies Lien’s revenue mix and currently accounts for 4% of their revenue. Lien holds around $4bn TWD worth of property. Thesis RIght now there are very few analysts covering Lien. Lien HWA is a misunderstood company and, just like some of the Asian markets in general, it has hidden gems that aren’t being appreciated to the extent they should. Lien HWA may look like a simple flour business but it is actually a flour business with a key stake in an innovative electronics business as well as an established real estate business. Lien HWA presents an extreme value proposition with the growth upside of a tech company targeting emerging thematics. We see MiTAC continuing to drive Lien’s earnings, benefiting from autonomous vehicles and smart cities given their IoT and connectivity offerings. Lien is currently sitting on a 5.8% dividend yield and distributes both a cash and stock dividend.

Note: Figures calculated from the 2020 Annual Report, all denominated in TWD. Disclaimer: Both stocks are currently held in TAMIM's Asia Small Companies portfolio.

1 Comment

Jake Wein

15/7/2021 04:13:26 pm

Excellent summary. Appreciate the insight and thoroughness of the analysis.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed