|

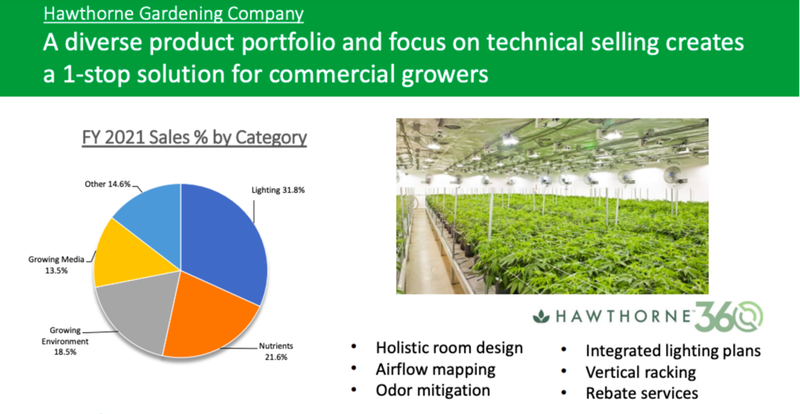

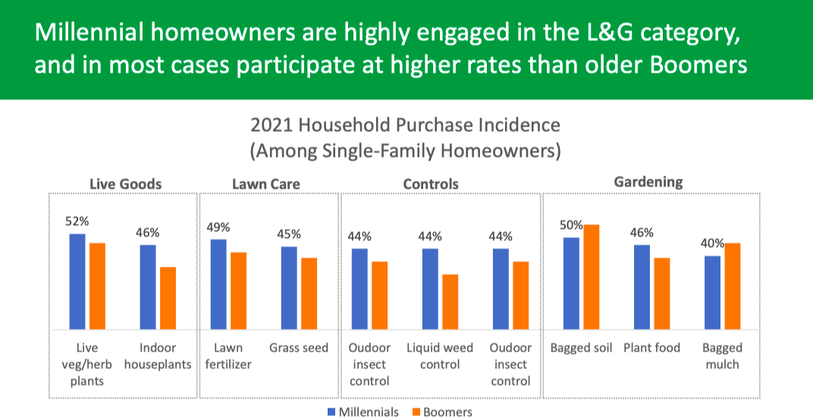

This week we will be looking at the US cannabis industry and talking about a stock in the ‘picks and shovels’ side of the industry, a real blue jeans to miners story. US cannabis stocks have been in a relentless bear market, hovering near all-time lows despite the industry showing huge growth. Before we continue, this is not an industry that TAMIM currently invests in and it may never be. That being said, we do acknowledge the potential in the industry and, given its current changes in legalisation, it currently presents as a perfect example of the benefits of identifying 'picks and shovels' or 'blue jeans to miners' companies. Cannabis operators face enormous constraints as a result of cannabis not yet being legal at a federal level. These constraints include higher taxes, no access to capital and an inability to list on the primary exchanges. The ancillary companies that provide services to the industry get the benefits of the industry growth without suffering the constraints. Ancillary Companies An alternative way to gain exposure to the growth in cannabis is to invest in ancillary companies; the companies that provide goods and services to the cultivators. They are the ecosystem that facilitates the growth of the cultivators. As the cannabis industry grows, it’s not only the operators that grow and sell cannabis that will benefit. The companies providing finance, equipment, and other goods and services will also be winners. Farming businesses have never been overly attractive; they tend to be cyclical, reliant on external factors like weather and so much can go wrong. On top of this, the risk of crop contamination is always present. As many of these cannabis companies are essentially just farmers, investors may prefer to allocate to the companies that provide equipment or even software to optimise crop growth. These companies typically come with less risk and, since they don’t grow or sell cannabis, they usually can trade on the primary exchanges. Scotts Miracle-Gro (SMG.NYSE)SMG manufactures and sells products to the consumer lawn and garden market, the company was founded in 1951 by Horace Hagedorn and is now run by his son Jim Hagedorn. SMG is a family-run business with the Hagedorn’s owning around 27.1% of the business still. While SMG has been a steady business that benefited from Covid, what we are interested in is their ancillary cannabis segment, Hawthorne. Hawthorne has built a portfolio of leading hydroponics companies (i.e. the systems used to cultivate cannabis in a greenhouse). Hawthorne supplies the nutrients, lighting equipment, and other essentials to cultivate the crop. As the industry grows, so does Hawthorne. With the rapidly expanding footprint of cannabis legalisation across the east coast, where cannabis needs to be cultivated indoors, Hawthorne will further benefit from increased demand for their products SMG is a safer way to gain exposure to the cannabis sector and it’s listed on the primary exchanges. It has an Apple-like presence in the lawn and garden industry. SMG also has first-mover advantage when it come to the picks and shovels in the cannabis space, their Hawthorne segment has quickly grown to a billion-dollar business. SMG’s business will also benefit from changing demographics; millennials have been proven to spend more on their home as opposed to boomers. Pandemic-related stay-at-home orders resulted in a lot of consumers developing new hobbies, igniting the huge shift towards DIY driven by millennials. These trends will support SMG as well as boost their ecommerce activity. Scotts Miracle-Gro’s recent Super Bowl ad was leaning into this growing demographic: the millennial gardener. SMG saw its share price come down from US $250 on 1 April 2021 to around US $117 today. Their core business was a huge beneficiary from Covid with the shift to DIY but their Hawthorne segment has struggled with the oversupply of cannabis and fractured supply chains, leading to a 38% decline in sales for the first quarter. SMG provided a $150m convertible loan to Canadian cannabis investment company RIV Capital (RIV.CNSX) who have taken stakes in a portfolio of different Cannabis-related companies. This convertible note gives SMG shareholders further exposure to the broader cannabis theme. SMG is currently trading at about 12x NTM EBITDA. When you compare this to other hydroponics companies like Hydrofarm (HYFM.NASDAQ), who are trading at 17.2x EV/EBITDA, you can see that there is some value here with the Hawthorne business. At current prices, the market isn’t ascribing any value to the Hawthorne business; investors are essentially paying for a steady gardening business with the potential upside of cannabis exposure. Potential Catalysts:

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed