|

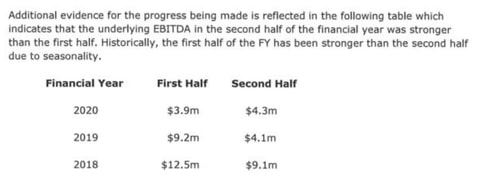

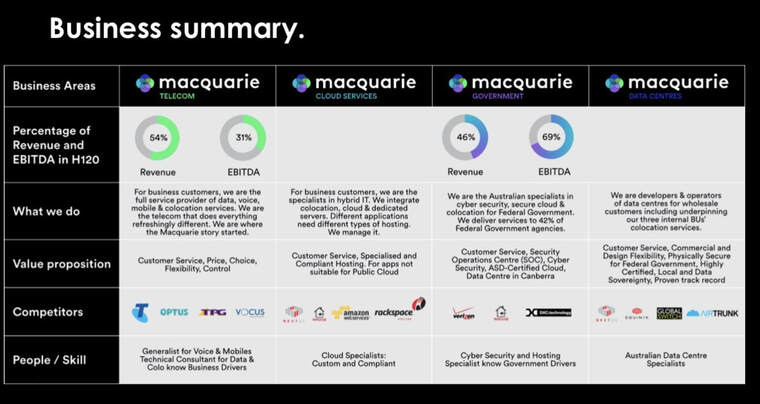

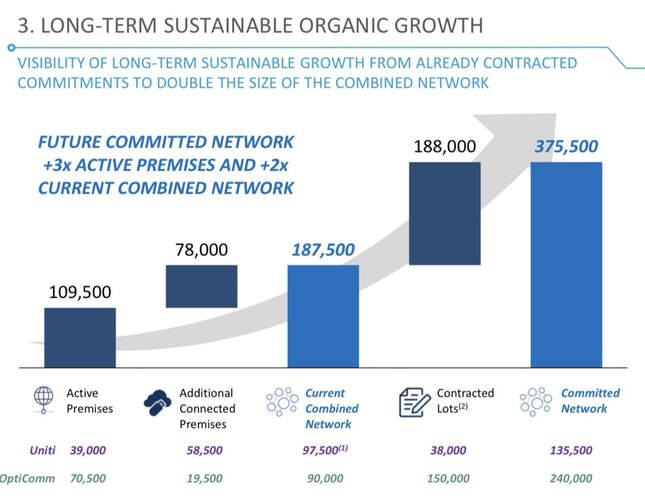

Ron Shamgar provides an update on a number of the companies held in TAMIM's Australian equities portfolios.  Author: Ron Shamgar Author: Ron Shamgar Macquarie Telecom (MAQ.ASX) is a leading data centre and telco company. Their data centres specialise in providing specialist cloud security colocation services, mainly to government agencies. The Telco division offers businesses data, voice and mobile services. Combined, the company has grown steadily over the years with a management team led by the two Tudehope brothers, cofounders of the business. For FY20, MAQ is forecasting EBITDA of $63-$66m. Data centres and cloud services makes up 70% of group earnings and we believe this is being considerably undervalued by the market when compared to their closest peer, NEXTDC (NXT.ASX), who trade on about 25x EBITDA. MAQ is now on 15x. We see the stock continuing to rerate as the company will begin separating the data centre division earnings so the market can value it appropriately. We first bought into MAQ at $22.00 and our valuation is $55.00.  Source: FXL company filings Source: FXL company filings Flexigroup (FXL.ASX) is a consumer lender that has gradually evolved into a BNPL firm, finally appealing to the younger demographic customer base. The company has been the “ugly duckling” of its sector from a share price performance perspective, but the business is finally "humming" along. During June, the company updated that it has exceeded 2.1m customers and has processed over $2bn of transactions. Their BNPL brand, Humm, has grown online sales volumes by 282% in 2H2020. The issue for FXL, being left behind in the midst of a booming BNPL sector, is the fact that the company is still churning through its legacy traditional credit card business together with the fact that their only exposure to Australia and NZ is not appealing enough to the growth centric investors. We see FXL as a value play in the BNPL sector and believe the company will look to enter the US and/or UK markets at some point. At that point we could see the stock potentially double or triple on such news. As of today, we value FXL at $1.80. McMillan Shakespeare (MMS.ASX) is a salary packaging and novated lease provider in Australia along with asset finance in the UK. The company is highly profitable and diversified and has been a consistent dividend payer for many years. We took a position at $6.50 as investors grew concerned about the impact on car sales and new business growth due to Covid-19. This month, MMS provided a solid update. The business has been partially impacted by the difficult economic conditions but is still on track to generate $71m in underlying NPATA. This places the stock on about 10x PE and a 10% grossed up dividend yield. Historically, MMS has generated strong cash flows and has a reasonably geared balance sheet. We believe further sector consolidation will take place and MMS is well placed to lead it. We value MMS at $12.00.  Source: EVO company filings Source: EVO company filings Evolve Education (EVO.ASX) is a new position we initiated recently. EVO is a large, established and profitable child care operator in NZ with a small but growing operation in Australia. EVO is both a turnaround story and a growth story. The NZ operation consists of 123 centres generating $130m of revenue and the majority of the group’s $8.2m EBITDA for FY20. The Australian operation consists of 10 centres, generating $10m of revenue. Last year the company was recapitalised and a new management team, who founded G8 Education (GEM.ASX), took over. GEM was a market darling for many years under their leadership and we think they will replicate some of that early success with EVO. Just two years ago the NZ operations were generating over $20m of EBITDA and, with better cost management, we believe they can achieve that again. The growth opportunity is in Australia as the sector has been through a difficult period due to the impact of Covid-19 lockdowns and a glut of new centres over the last few years, driving centre occupancy lower. The positives are that finance constraints have driven new centre supply out of the market and government financial support for the sector has helped retain demand. We see the company, with negligible debt on its balance sheet and ample funding capacity, to opportunistically acquire centres in Australia over the next few years. We estimate EVO will earn $20m EBITDA in CY2021 and approximately 1 cent EPS. We think dividend payment is a highly likely next year. We value EVO at 16 cents. Isentia Group (ISD.ASX) is the leading media intelligence group in the APAC region. We wrote extensively about our turnaround thesis for the business. Unfortunately, this has not played out to our satisfaction so far. To some degree we underestimated the time it has taken to remove costs and, at the same time, bring the software set and new functionalities up to date. During this time, ISD has seen its main Australian competitor, Streem, snipe away at some of its more lucrative government contracts. Although ISD has continued to retain the majority of its government clients, this has in some instances seen pricing pressure. We got some good news this month in the form of EBITDA guidance of $20-$21m. This includes a $1.3m loss from the North Asian operations which the group is finally exiting. With an underlying EBITDA of $22m and healthy cash generation, ISD is trading on an EV multiple of about 3x. In further good news, the South East Asian division continues to show good growth prospects, (albeit not enough to offset the price pressure at home). We will stick with the turnaround as we firmly believe corporate activity will eventually emerge. Uniti Group (UWL.ASX) conducted its largest and most strategic acquisition to date with the purchase of its largest rival, Opticomm (OPC) for $532M. The deal included $270M equity raise and $150M of debt with the remainder in script for the OPC shareholders. The deal will see significant synergies of $10M and will create a growing, large national private fibre challenger to the NBN and other large telcos. Combined, the group will generate close to $141M revenue and $87M of EBITDA run rate post synergies. At the completion of the deal we see the enlarged company as being more relevant for larger investors to own and a high likelihood of an ASX200 inclusion. The business going forward will have 375k contracted lots to be connected and a large runway of organic growth. We believe once OPC is integrated and delivers its first half year result next year, the group will continue on its M&A strategy. We are pleasantly reassured to see directors continue to invest millions of dollars of their own money into the stock. We value UWL at $2.00 and see significant share price upside ahead. Disclaimer: All six companies are current TAMIM holdings.

5 Comments

RAY AYLMORE

30/7/2020 10:02:54 pm

Is the new management team that founded GEM still involved with GEM?

Reply

Ron

2/8/2020 12:37:35 pm

The GEM founders are no longer involved and are now running EVO.

Reply

Alyn

30/7/2020 11:48:51 pm

It would be a brave man or woman to buy MMS. Good long term returns but a roller coaster ride.

Reply

Ron

2/8/2020 12:35:41 pm

We felt very brave and very comfortable when we bought MMS in the $6s

Reply

David buckwalter

20/8/2020 08:50:03 pm

Thats the advantage, plenty of opportunities to buy and sell

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed