TAMIM Fund: Global High Conviction

Process

Investment Philosophy

Equity Markets are inefficient and good active managers can add value.

Investing in a disciplined and systematic way, with the use of quantitative models, helps us to identify both risks, and opportunities.

Equity Markets are inefficient and good active managers can add value.

- What we mean by inefficient is that information on companies in these markets is misinterpreted and that other investors, against which we compete for our returns, make mistakes which are both predictable and persistent.

Investing in a disciplined and systematic way, with the use of quantitative models, helps us to identify both risks, and opportunities.

- All investing is the result of decisions made by humans – it’s all judgment. However the use of quantitative models (designed by humans) can reduce the tendency to extrapolate the recent past and to ignore signals which run counter to our own beliefs.

- Combining forward looking ‘fundamental’ research work with the historic based ‘quantitative’ modelling approach mitigates the errors that each discipline alone tends to make.

A value biased approach is not the only way to invest of course but we have found that the most cost effective way to make money is by using a value approach.

A commitment to research, and to incorporate discoveries in the investment process, is vital to maintain any competitive advantage

Management of the return volatility is critical “Winning by not losing”

Communication between team members is crucial in detecting investment opportunities and focusing on the correct management of the portfolio.

- The value approach tends to reward investors with higher cash payments in the form of dividends, strong asset backing relative to the price paid in the market, and lower transaction costs in that we are typically buying when others are selling and vice versa. We like this.

- We know that a value process tends to have limitations in that we may be drawn to invest in companies whose asset values and earnings power are in terminal decline. We work hard to identify a catalyst which convinces other investors that returns on capital have potential for improvement or that the company’s profit stream is less risky than believed

A commitment to research, and to incorporate discoveries in the investment process, is vital to maintain any competitive advantage

- It is our contention that an investment process, or team, which doesn’t change and/or adapt is likely to be superseded and lose any competitive advantage it held.

- Most clients would like no change to an investment process but we believe that other investors are smart and motivated, and are also looking for the inefficiencies we are trying to spot.

- Therefore, within the confines of our “Value” approach and our commitment to a systematic process, we continue to look for new ways to beat the competition and expect to add new tools to our process once we are happy that they are persistent and have a connection to the real world. We are, for example, unlikely to use planetary alignments to pick stocks even though we can create high correlations with astronomy and relative stock returns.

Management of the return volatility is critical “Winning by not losing”

- We don’t use a macro economic framework to pick countries but prefer to identify cheap stocks with the prospects for change and assemble a portfolio where the predicted total volatility is less than that of the index.

- We aim to be patient and expect lower levels of stock turnover – this benefits investors by reducing transaction costs

- No single stock position should jeopardise fund performance - a diversified portfolio means prudence

Communication between team members is crucial in detecting investment opportunities and focusing on the correct management of the portfolio.

- Portfolio management is not best done by consensus.

- However we do like the portfolio managers’ thesis to be tested since they are unlikely to have a monopoly on good ideas, nor able to keep abreast of every relevant development for the portfolio

- We have found over many years that a team approach is the best way to avoid errors that an individual can make

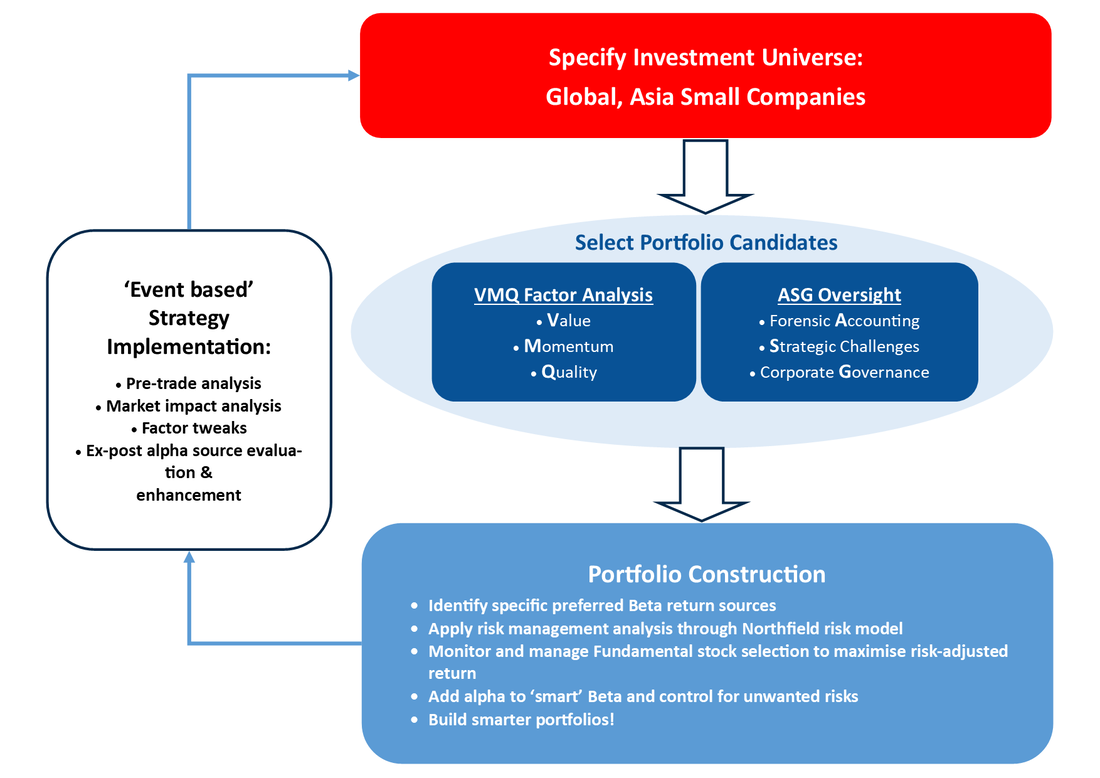

Investment Process

Our investment process uses internally developed quantitative models combined with experienced judgement (‘fundamental’ research). We believe that quantitative models (VMQ) and fundamental research (ASG) are complementary and not competing philosophies. Since each tends to reduce the errors of the other, a combination makes for a more robust process. Our team has extensive experience, global relationships, and knowledge, of global equity portfolio management, asset allocation and risk management.

Our investment process uses internally developed quantitative models combined with experienced judgement (‘fundamental’ research). We believe that quantitative models (VMQ) and fundamental research (ASG) are complementary and not competing philosophies. Since each tends to reduce the errors of the other, a combination makes for a more robust process. Our team has extensive experience, global relationships, and knowledge, of global equity portfolio management, asset allocation and risk management.

|

Idea Generation: VMQ

Value, Momentum and Quality assessment on every stock in the investable universe. Value

Momentum

Quality

We run the VMQ numbers on regular and frequent basis - event rebalancing not calendar based - and the top two quintiles (40%) of VMQ ranking provide a source of company ideas. |

Idea Verification: ASG

Our fundamental research ‘ASG’ further refines the list of candidates removing all companies that fail to meet our standards. What do we know that the numbers aren’t telling us? Is the company’s strategy valid? Is company’s governance structure consistent with interests of shareholders? Accounting

Strategic

Governance

|

Our quantitative research ‘VMQ’ eliminates thousands of companies, our risk control model suggests the best. Our fundamental research ‘ASG’ further refines the list of candidates, removing all companies that fail to meet our standards.

|

Portfolio Construction

|