|

In a previous article around the oil markets we contextualised the possibility of contango and a zero bound oil price. This week we revisit the topic but with a view to the longer-term, a topic particularly relevant given the recent price action in oil with the front month August contracts currently trading at 40.73 and 43.08 for WTI and Brent respectively, In particular, we make a long-term bullish case for the oil market in exploring two Australian companies that look reasonably attractive. But what about the electrification of vehicles and green energy? This is probably the most frustrating counterargument we hear when it comes to oil and gas. The quest for renewables and the likely long-term secular decline for oil demand is very much a valid point. But ask yourself the question of whether producers are aware of this problem? Or are they somehow in some sort of a vacuum/bubble that prevents them from seeing the likely outcomes for the industry. In fact, most of the big oil players have either diversified their asset base or looked to move into materials production, they all have renewables divisions now. As increasing hurdles are placed upon direct fuel consumption the most viable trend from a national perspective is the transformation of fossil fuels into materials. Most investors tend to forget that oil can not only be transformed into plastics and petrochemicals, such as naphtha and diesel, but also polymers as well as being a crucial element of the making of everything from steel to fibreglass. So while the cars might be electric, oil producing nations and producers of fossil fuels will likely lead a shifting of the focus towards ensuring that as much of the actual end product is a result of oil as an input. Wind turbines, for example, take a tremendous amount of oil product to produce, from the cargo that transports them to the steel and fibreglass they are made up of.

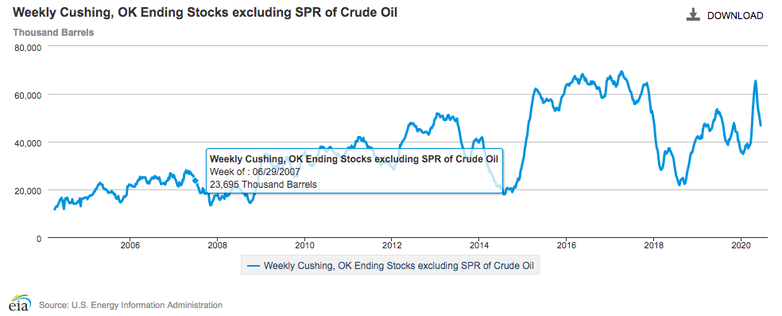

Source: US Geological Survey Even LNG, which makes up about 41% of the United States’ electricity generation, is predominantly associated gas or the natural gas that is a by-product of oil drilling. Even if there were to be further longer-term trends that damage the future use and sustainability of oil, this in itself is a question mark since it relies on policy makers keeping to their commitments (we all know how the Paris Accords have played out), there is still going to be marked demand for oil. Whether we see triple digit prices for oil is going to be contingent upon the magnitude of supply cuts across the Permian and the capacity for the OPEC countries to diversify their base and move towards fuel transformation not only into petrochemical related products but materials, this represents a rather bullish scenario over the long-run. Caveat: While we are bullish over the long-run, the short-run action is a dead-cat that bounced The recent price action has primarily been driven by traders who are ignoring or choosing to ignore the fundamentals. The below graph shows the inventories for Cushing, the rather sharp decline it seems has created some rather misguided optimism. We don’t have the data but we would be willing to bet that most of this inventory has been taken up in the SPR (Strategic Petroleum Reserve) and the tankers off the Gulf of Mexico sitting at port and charging a hefty fee. So, keeping in mind that our bullish case is over a much longer time horizon, we next move on to two companies on the ASX that we think make reasonable cases from an investment perspective. Woodside Petroleum (WPL.ASX) Woodside is a rather interesting company and, while many people probably have a sour taste as a result of the downward movements, we find the company attractive based on two aspects. Currently with a market cap just north of 20.5bn AUD, the first of these is the balance sheet (well capitalised with close to 8bn USD in liquidity) and the second is their low cash breakeven. It also has the added advantage of a diversified portfolio given its substantial LNG portfolio. Assuming that the WA gas market reverts back to somewhere near pre-covid levels over the next twelve months, we are likely to see a tightened demand scenario. The Scarbrough domestic supply was key to rebalancing an already tightened supply from a purely domestic perspective but over the long run we are likely to see an increased demand and monetisation of Woodside’s existing infrastructure assets (i.e. Pluto) which include the processing of LNG. Most recently Chevron has also indicated its sale of its stake in the NWS (North West Shelf Project, Australia’s largest LNG project), of which it currently owns a sixth. This brings up the prospect of either Woodside or Shell (the other shareholders) increasing their respective stakes. The potential synergies from this prospect, especially given their Pluto LNG infrastructure, could be stellar since it brings in the prospect of vertical integration (both upstream and downstream). Purely from an oil production perspective, although Q1 results were less than appealing given below guidance Enfield production (due to unplanned maintenance) and Cyclone Damien, management has continued to invest as usual while scaling back capex over the short run. Their Sangomar Field project (Senegal) continues to progress however, bringing in the prospect of additional production (they are targeting 2023). Their revenue is also well hedged while capturing the upside in H2 this year. Our valuation, assuming an oil price “rebound” to 50 USD a barrel over the next 24 months, is $36. Horizon Oil (HZN.ASX) For the more adventurous of our readership, Horizon is another company that looks attractive from a numbers perspective. Though we wouldn’t say the same if one were to consider its recent management shenanigans at first glance. They have got themselves into a bit of a pickle around their PNG operations of late. There were allegations of bribery made against the then CEO Michael Shridan because of payments to the tune of 10m AUD made into a shell company. A recent investigation by Deloitte concluded no signs of wrongdoing (wink! wink!...?) or, at the very least, no breaches of Australian anti-bribery laws. Horizon now has a new CEO. One would hope this one might do a better job of at least maintaining the optics. Unfortunately, the sad reality is that “gifts” are often just a cost of doing business in developing countries like this (typically these "gifts" pass through consulting firms and the like though), it would be naive to think otherwise. Nevertheless, from a balance sheet perspective, the company has continued to decrease its debt (by 89%!) from 64m to 7.4m AUD with close to 22m AUD cash on hand. What is rather interesting is the breakeven for Horizon is an attractive 20USD/pb. Its book was also previously hedged at close to 60USD/pb, a substantial premium from the market. In addition, there is much to be said for Horizon’s Asia-Pacific strategy with their Beibu Gulf fields producing 8000 barrels per day and likely to go up in the future. The cost of production in this particular region is below 15 USD/pb. As the company continues to maintain balance sheet discipline and a target revenue guidance of 90-100m USD and EBITDAX of 50-60m USD, we think it is a reasonable buy since it currently trades at a market capitalisation just shy of 60m USD (80m AUD). Our valuation, assuming an oil price “rebound” to 50 USD a barrel over the next 24 months, is 0.25 AUD.  Disclaimer: WPL is a holding in select TAMIM portfolios. HZN is not currently held.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed