|

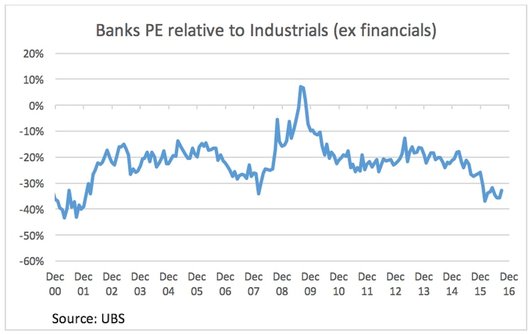

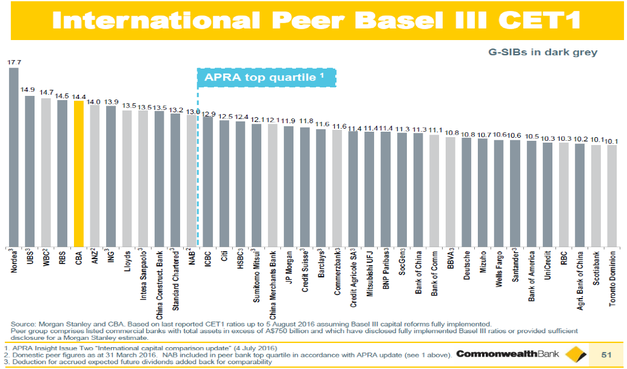

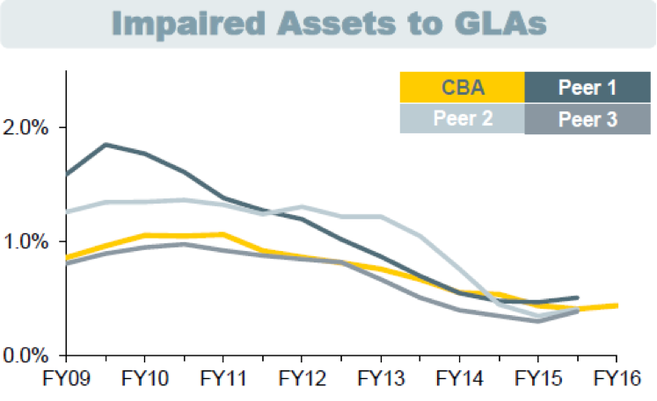

This week Vincent Cook, senior analyst with the fund underlying the TAMIM Australian Equity Growth & Income Individually Managed Accounts (IMA), takes time out to discuss the Australian Banks. There is a significant amount of negativity in the Australian press regarding the outlook for our banks however we see some positive signs with indications of consolidation appearing in the sector. Given the worry about Deutsche Bank and banks in general, it is timely to discuss our thoughts on the sector. This week Vincent Cook, senior analyst with the fund underlying the TAMIM Australian Equity Growth & Income Individually Managed Accounts (IMA), takes time out to discuss the Australian Banks. There is a significant amount of negativity in the Australian press regarding the outlook for our banks however we see some positive signs with indications of consolidation appearing in the sector. Given the worry about Deutsche Bank and banks in general, it is timely to discuss our thoughts on the sector. Read on to find out more. Time to Buy the Banks? The major banks are currently trading at the largest PE discount relative to the All Industrials ex Financials since 2001, at 35%, which compares to a 10 year average of 20% (figures from UBS), reflecting fears including capital requirements and bad debts. A case can be made that some of these concerns may be overplayed and we believe the sector is now discounting the fall in margins and ROE, a tightening in lending requirements to the property sector and Basel III changes. While it is too early to suggest we are back into an uptrend especially given the concerns around the European banking sector, it is certainly worth highlighting some positives on the Australian Banks. Capital Adequacy: In terms of capital, the Financial System Inquiry recommended that our banks be unquestionably strong, with the benchmark being top quartile capital ratios relative to international peers. The banks have already achieved this, as illustrated by the below chart from CBA’s FY16 result presentation. Revisions to the Basel III capital measurement framework are expected from the Basel Committee towards the end of this calendar year, which may push this benchmark somewhat higher. However, governments and central banks, particularly in Europe and the UK, have begun to push back against ever increasing capital requirements, which may mean that the new requirements are not too onerous. The oversight body of the Basel Committee said in a statement in September 2016 that they had “discussed the Basel Committee’s ongoing cumulative impact assessment and reaffirmed that, as a result of this assessment, the committee should focus on not significantly increasing overall capital requirements”. APRA’s Wayne Bayres also said in January 2016 that the changes in the pipeline will likely be “well within the capacity of the banking sector to absorb in an orderly fashion over the next few years”. A key difference between the prospective changes and the situation in 2015 is that APRA is talking about a multi-year time frame, whereas the 2015 raisings were driven by a change to mortgage risk weights on only a 1 year horizon. A multi-year time frame gives banks the opportunity to accrete the additional capital organically, from retained earnings. A worst case scenario is probably capital raisings of a similar magnitude to those in 2015, which diluted shares on issue by around 5%, while organic capital generation combined with dividend reinvestment plan dilution of 1-2% may be a more likely outcome. Bad Debts: In terms of bad debt risk, the back drop to the current situation is that interest rates are at record lows and business and personal credit growth, historically the key drivers of impairments, have averaged 2.0% and 1.0% respectively since the GFC i.e. we have not had a systemic buildup of credit risks. There are pockets of weakness, such as the mining sector and a potential oversupply of residential apartment developments, however these represent a relatively small share of bank lending, at sub 2% each, with residential development lending also generally well secured. The banks were burnt by commercial property lending in the GFC and subsequently tightened up their risk standards. Hence the fallout from an oversupply of apartments may hurt the profits of some developers of lower quality stock, but have only a limited impact on the banks. Sector impaired assets as a percentage of loans have declined materially in recent years and remain at low levels, as shown in the chart below from CBA’s FY16 result presentation. EPS and DPS growth is expected to be non-existent (or slightly negative) for the banks sector in FY16, driven by the capital raisings undertaken in 2015 and a modest increase in bad debt charges from record lows. However, system credit growth is continuing at a reasonable clip of 6.2% for the year to June 2016 and the banks are targeting costs. For example, WBC is aiming for cost growth of 2-3%. Assuming the banks concede 1-2% per annum of the revenue growth from increased loans to competitive pressure on margins, these drivers could deliver reasonable, mid-single digit EPS and DPS growth over the medium to long term.

Conclusion: We are now less then 45 days out from the ex dividend dates of the major banks. Traditionally bank share prices will run into the dividends as income conscious investors buy the banks to comply with the 45 day rule. Assuming the European banks do not melt down this could be an opportune time to pick up some Australian bank exposure yielding 8 to 9%. Happy Investing, The team at TAMIM Comments are closed.

|

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed