|

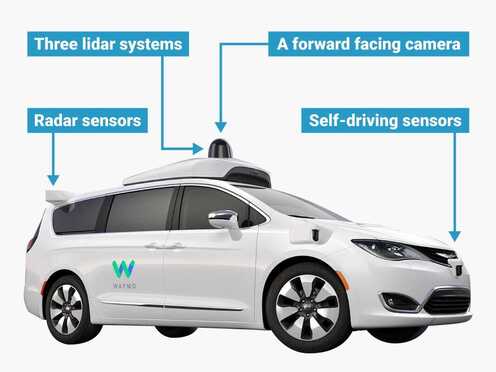

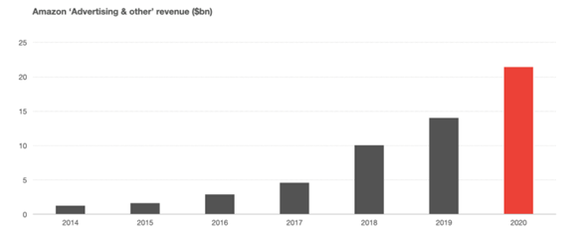

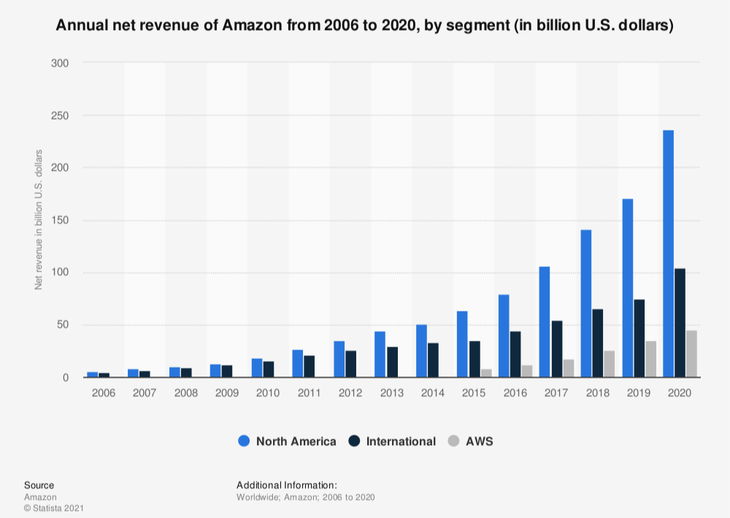

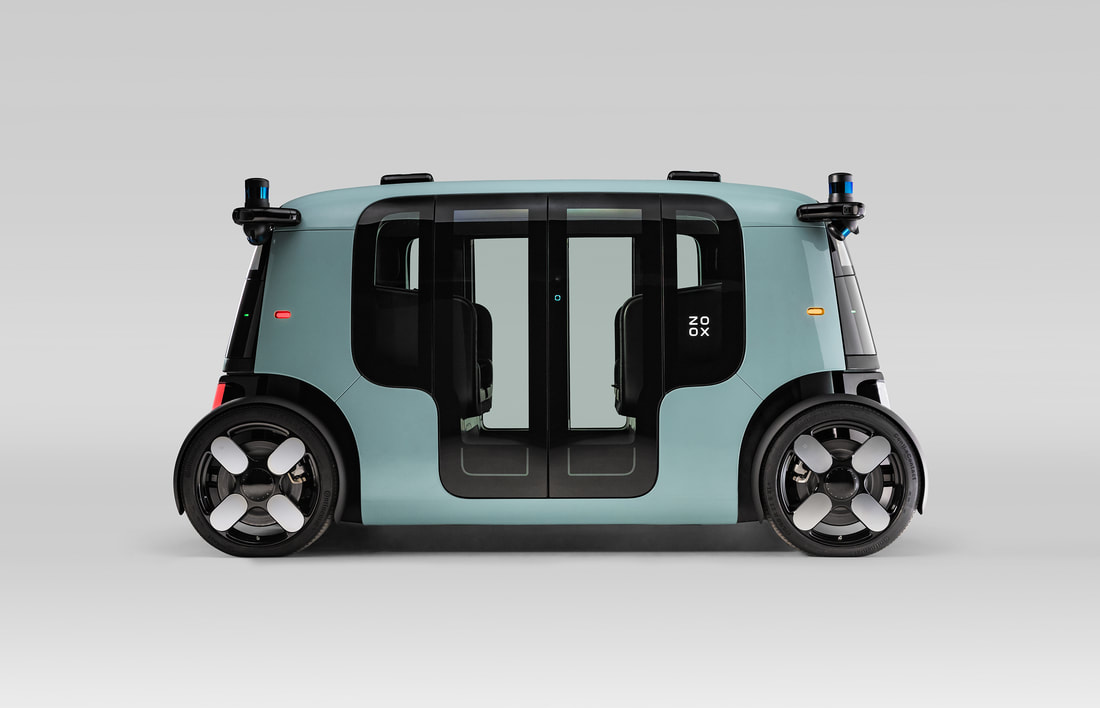

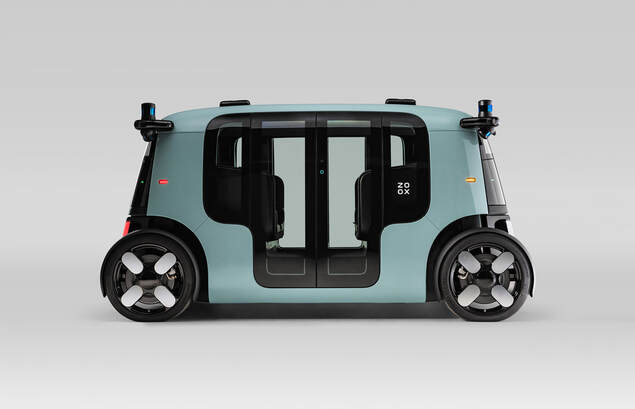

This week we will be writing about two of the heavyweights on the NASDAQ, Amazon (AMZN.NASDAQ) and Alphabet (GOOGL.NASDAQ). While these stocks are always in the headlines, we believe there are parts of these businesses that are stuck in the shadow of their parent company and aren’t getting the attention or credit they deserve and, as such, any value when it comes to the market. GOOGL and AMZN are best known for their search engines and marketplaces but what people may not see is that they are both making transformational advancements in the autonomous vehicle industry. Author: Adam Wolf Autonomous Vehicles Autonomy or automation has been pulled forward several years due to the pandemic and yet it remains an area the media largely ignores, similar to electrification about eighteen months ago. The technology is ready, has been developed and undergone plenty of trials (for those watching the Olympics, autonomous vehicles are being used to transport the athletes within the village). And now there are catalysts for change with, amongst others, labour shortages and efficiency improvements. Additionally, 94% of US car crashes are caused by human error so by removing these mistakes through fully autonomous vehicles, lives can be saved. There are still a lot of boxes to tick before autonomous vehicles are used at scale though. This includes things like road-side infrastructure connectivity (a space we are actively investing in) as well as some minor obstacles such as weather conditions but we believe autonomous vehicles will be a multi-trillion dollar industry and, just as people refused to see motor cars being widespread in the early days of the 1900s, we are seeing a similar situation with autonomous vehicles. Alphabet (GOOGL.NASDAQ)Google (we’ll use “Google” for familiarity’s sake) has been a strong performing stock recently (up 50+% YTD). The company makes most of its money from search and display ads and the like but other investments, such as YouTube and cloud tech which are growing at fast rates, are starting to drive profits too. While Google is one of the most covered stocks on the market, this is the same market that still isn’t giving them proper credit for subsidiaries like YouTube. Google at its core is starting to prioritise investments for long term value creation and they are accordingly starting to invest heavily in AI. The segment of Google that we believe is a real hidden gem, obscured by the shadow cast by the behemoth that is Google as a whole, is Waymo. YouTube Quickly touching on YouTube, Google bought the company in 2006 for $1.65bn USD. Since then, YouTube has become the second most popular website in the world. That $1.65bn is probably a small figure compared to what YouTube would attract if it were spun off today. YouTube is a unique asset in the sense that their business model is extremely tough to copy and anyone that tries to compete with YouTube can simply be copied or absorbed. Another feature of YouTube is that they can scale their service (add more users) and hardly increase their costs in doing so. The key revenue drivers for YouTube are its premium subscription service and Google Ads. YouTube-displayed ads currently account for around 10% of Google’s revenue. Waymo Waymo was first founded in 2009 as “Google’s self driving car project”. Waymo have developed the software that operates autonomous vehicles using, amongst other things, lidar systems and sensors. Since launch they have already achieved Level 4 autonomy. This means they can operate vehicles with full autonomy but with a few restrictions, such as weather and road conditions. Last year they launched Waymo One, a fully driverless ride-hailing service. This is an operation that means anyone in Phoenix with the Waymo app can hail a fully autonomous ride at the tap of a button. Competing with the Ubers and taxis of the world isn’t all Waymo is doing, they currently have a few segments to their business. They aren’t just looking to drive people, they are also looking to grab a piece of the commercial market through trucking, postal services and pizza delivery. Waymo was an early mover in the driverless car space and has made a lot of progress already having tested autonomous vehicles in 25 cities across the US. More recently, Waymo launched Waymo Via which is developing an autonomous trucking solution (directly addressing a pressing issue in the current environment given the US’ truck driver shortage). Waymo recently raised $2.5bn USD to further develop their technology and we think a lot of this will be used to progress Waymo Via. Waymo has also already established partnerships with Volvo, Nissan and Renault to name a few and these partnerships will be used to test how autonomous vehicles will be used in Japan and France. Context: Aurora There has recently been news of fellow autonomous tech company Aurora going public via a SPAC deal at a valuation of around $11bn. They are a fair way behind Waymo in terms of their capabilities (e.g. they haven't reached Level 4 autonomy yet) and they have no existing operations, having only been founded in 2017. These kinds of deals show that the sector is beginning to heat up while also highlighting what Waymo could be worth as a stand-alone company. Given how far behind Aurora is and the extent of Waymo’s existing operations, it is certainly well north of $11bn. Amazon (AMZN.NASDAQ)Jeff Bezos recently rocketed off into space but Amazon’s stock price has stayed grounded the past year while the S&P has climbed higher and, over that timeframe, Amazon has continued to grow and innovate. Amazon is essentially a bundle of lots of different businesses with different margins, their profits are being driven by Amazon Web Services (AWS), but they also have other segments that are emerging like their advertising business. Amazon’s ‘Advertising & other’ (see below) revenue segment contains a lot of the revenues generated from their subsidiaries and we believe portions of these investments are misunderstood and aren’t priced in. Automation Looking at Amazon, there is a huge opportunity to inject further automation (not entirely in the mobility sense either) into their business model, notably the e-commerce side. It will be a step function change in terms of their cost structure. Logistics is by far Amazon’s biggest expense. Any opportunity they get to automate anything, whether it’s picking within the warehouse, moving a package from warehouse to warehouse with autonomous systems, or anything along that front is going to be a step function change in their operating profit. We think that this development is something that the market is not paying attention to whatsoever. And that’s just one aspect of the business. AWS The other big aspect of the business is obviously AWS, their profit centre. AWS is providing on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered pay-as-you-go basis They’re not getting credit for this business whatsoever and, in terms of it fitting within our mobility theme, Cloud solutions/technology in general is something that fits perfectly within the first pillar of sharing and connectivity, we consider it the network layer. Cloud infrastructure is critical, particularly as we talk about edge computing, and having vehicle to vehicle, vehicle to infrastructure, basically just low latency connections. As Cloud scales, Amazon is obviously the leader there. All of the Cloud players - Amazon, Microsoft, and Google - have autonomous efforts. They know that autonomy is going to be huge and, simply put, having Cloud in house when you also have autonomy is a significant advantage. Zoox In 2020 Amazon acquired Zoox for approx. $1.3bn USD. Zoox is an autonomous vehicle company looking to reinvent personal transportation. Like Waymo, Zoox will provide mobility as a service in dense urban environments; they will handle the driving, charging, maintenance and upgrades for their fleet of vehicles. Riders will simply pay for the service. This is a key difference between these new autonomous solutions and the Ubers of the world. Amazon is a unique and growing company that uses its vast platform to disrupt any new business it enters; we saw what happened when Amazon bought Whole Foods, Walmart and Target took a big hit in market value. We can see them having the same impact in the autonomous driving industry. Zoox is something Amazon is getting negligible credit for. And that’s understandable. They’re a bit further behind in terms of the competition. But in terms of the opportunity set, it’s a massive one. And that’s not to mention anything else that Amazon has going on whether it’s pharmaceutical or Amazon Go, which is basically automation and something that we believe they’re going to probably license out over time and it will become a very high margin product. Regulation A risk that is commonly spoken about regarding the FAANG stocks is the perceived regulatory risk. There has been talk that regulators will step in and break up the Amazon’s into smaller entities, such as spinning off the AWS business, but so far it’s been a losing battle for lawmakers as they haven’t been able to force any of these changes yet. However, if Amazon or Google were to be broken up, we believe they would become more valuable as the market prices the spun off entities properly. It is relatively common for excellent companies with many different segments to be undervalued. Thesis Both Google and Amazon are pioneers in their respective fields but we believe these businesses are misunderstood and the market isn’t giving them enough value for their subsidiaries that would be worth a lot more as stand alone businesses. Both AMZN and GOOGL are investing in long term plays that create value for shareholders, e.g. AWS and YouTube, but we think their autonomous vehicle investments, Waymo and Zoox, may be their best ones yet. Rewinding back to the early 2000s, Amazon was spending hundreds of millions of dollars on capex to build out AWS for years. It was a massive expense, very capital intensive and a huge drag on free cash flow. All the corporates, their potential competitors, thought they were crazy. They didn’t understand it, so they ignored it. And so, for years, they allowed AWS to take a huge lead in a multi hundred billion dollar plus market with literally no competition. Fast forward to today and it’s a business probably worth about a trillion dollars and Amazon is the clear leader of the pack. That’s how we expect these autonomous units to be viewed, big cash drags that are given negative to no value. Today, Google is given no value for Waymo. One day the market will catch up and quickly recognise how transformational it is.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed