|

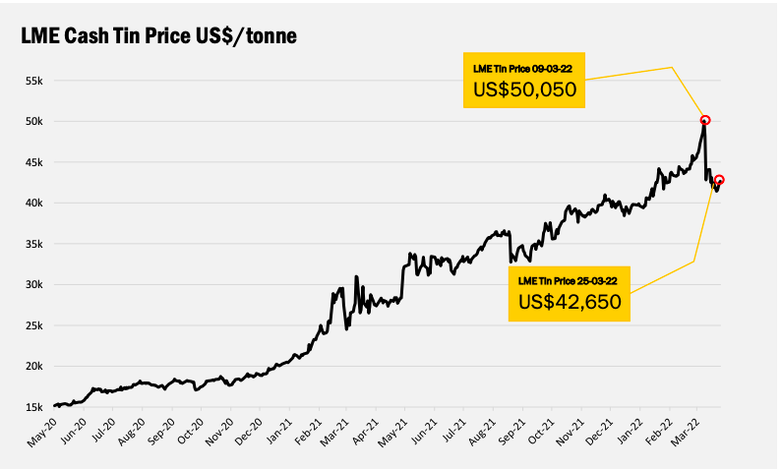

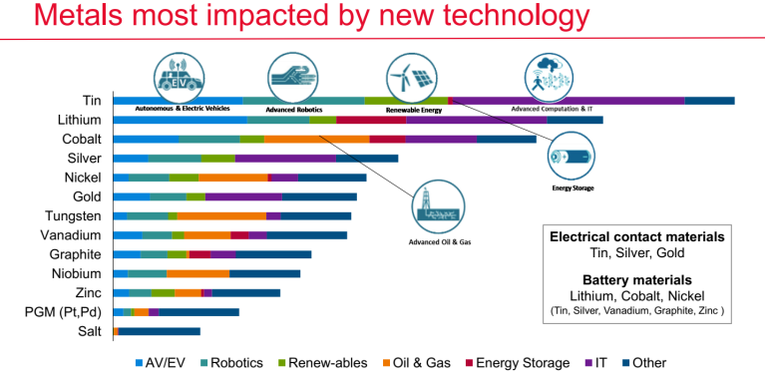

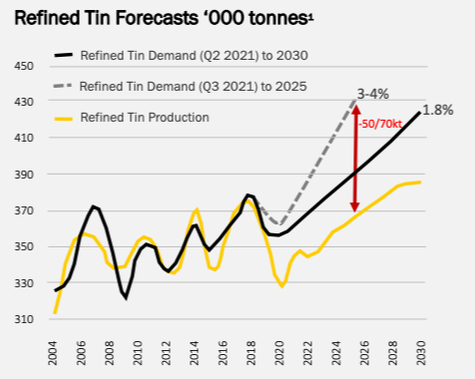

This week we will be writing about an underappreciated metal that is crucial to the energy revolution and shift to electrification. Regardless of your position on the timeframe, just about anyone could tell you that electric vehicles are the way of the future. The real question is do we currently have enough supply of the crucial commodities needed to develop and produce these vehicles on a mass scale? The metal we are focusing on here is tin, an often forgotten commodity in the hype surrounding the incoming proliferation of electric vehicles. We will be covering two listed tin producers, the only two producers listed on “first world” exchanges. Tin and Electric Vehicles When a lot of people think of tin the first thing to come to mind is the tin can. However, tin is a key electrical contact in electronic circuits (solder), printed circuit boards and semiconductors, accounting for 50% of tin demand today. It is the electric glue connecting key components. Tin plays a role in battery chemicals, battery anodes, alloys and, obviously, the humble tin can (i.e. tin plate). We are currently in the midst of a global semiconductor shortage like never before which has seen billions of dollars enter the sector in an attempt to rapidly close the gap. Yet, it seems that no one cares about investing in additional tin supply to meet this demand. Tin is commonly known as the ‘spice metal’ because a little tin is in virtually everything. The main focus for tin is in the positive anode electrode of lithium-ion batteries, usually made from graphite on a copper foil today. Tin will also play a big role in renewable energy with solder ribbon being used to join solar panels. Current global consumption of tin is around 360,000 tonnes p.a. but the International Tin Association is forecasting a 60,000 tonne increase in demand by 2030 for lithium-ion batteries, a whopping 16% increase in consumption. That’s just accounting for electric vehicles. Tin Supply As you can see, the demand for tin is seeing significant tailwinds. But what about the supply side? Tin deposits are few and far between, the pipeline of projects is underwhelming and the fact that there are only two listed Tin producers in the world says it all. There are two main sources of tIn: alluvial mines, usually found in places like Indonesia, and hard rock mines. Tin from alluvial mines is extracted from clays and is very low grade. Currently, half of our tin comes from these mines. Hard rock mines are much higher grade but most of the easy ore has been mined and finding new economically viable deposits isn’t easy given how hard it is to process. Mine disruptions due to the pandemic have cut supply from the 350,000t p.a. range to around 320,000t. With demand for tin forecast to skyrocket, we are staring down the barrel of a supply deficit for yet another EV metal. Right now there are four countries that produce ~85% of tin concentrate globally. This includes Myanmar and China, both of which are probably not sources the world can rely on. There are some that argue that these prices for EV metals are unsustainable as they will make electric vehicles unsellable due to higher prices. An EV battery typically uses around 1.5kg of tin, which would cost $64.5 per EV. The price could quadruple from here before making a material impact on prices. Metals X (MLX.ASX)MLX is one of few listed tin producers in the world. Metals X owns a 50% equity interest in the Renison Tin Operation through its 50% stake in the Bluestone Mines Tasmania Joint Venture (BMTJV). Renison is one of the world's largest and highest grade tin mines. It currently has about 120,000 tonnes of Proved & Probable Reserves of tin at a 1.4% grade. Renison is located on the west coast of Tasmania, approximately 15km north-east of Zeehan and has access to fully sealed roads to the Burnie port. Over the past twelve months the mine has produced 8,452 tonnes of tin at an All-In Sustaining Cost (AISC) of $22,248 p/t. The mine is expected to ramp up to producing 10,000t p.a. and, with tin prices today hovering around $43,000 p/t, MLX’s 50% stake will bring in around $175m of EBITDA to the business. MLX are also progressing the development of their significant growth opportunity in Rentails, a tailings stockpile accumulated from previous Renison processing, i.e. Ren(ison)tail(ing)s. Rentails is the second largest undeveloped tin deposit globally when measured by tin content in the mineral reserve. Nickel Spinoff MLX divested their nickel assets, including the Wingellina Nickel-Cobalt Project located in Western Australia and the Claude Hills Project located in South Australia. The assets were divested in the recent IPO Nico Resources (NC1.ASX) and MLX conducted an in-specie distribution of NC1 shares to shareholders. This divestment makes MLX a pure play tin producer, it is often a positive when mining companies sell off non-core projects, it usually means they have something really good they want to focus on pursuing.

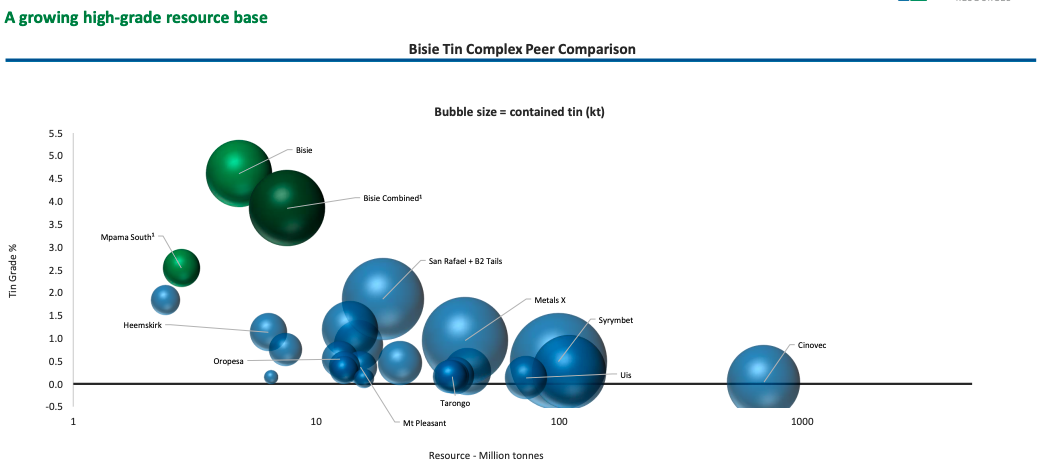

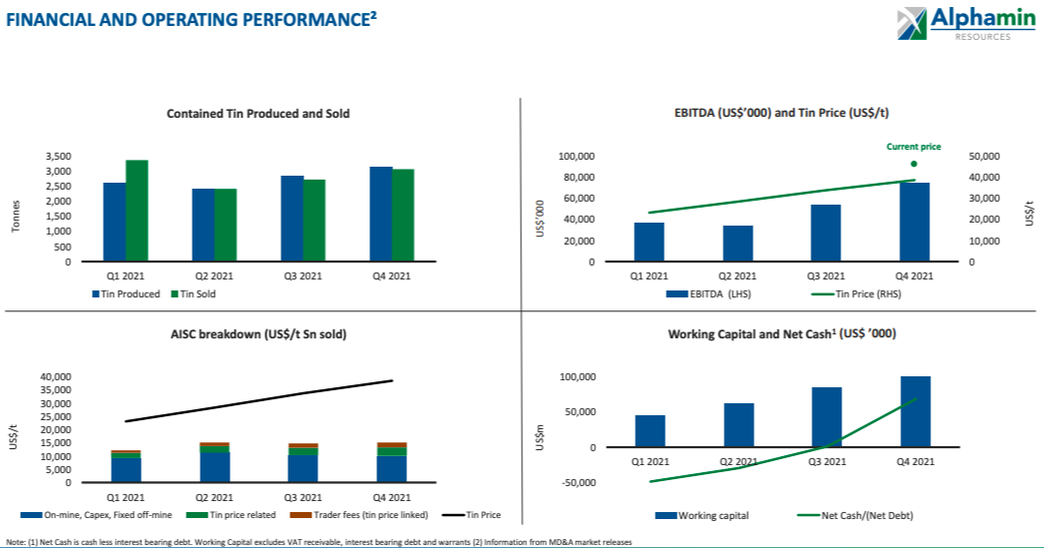

* assumption based on 10,000t p.a. production at current tin prices Alphamin Resources (AFM.TSXV)Alphamin Resources is a low cost tin concentrate producer from the Bisie Mine, a high grade deposit in Mpama North. This is on its mining license and it has an additional five exploration licenses covering a total of 1,270sqm in the North Kivu Province of the Democratic Republic of Congo (DRC). Alphamin is currently responsible for producing 4% of the world's mined tin. They are sitting on a world-class tin reserve of 3.33m tonnes at 4.01% grade for 133,000 tonnes of tin. DRC is home to some of the highest quality mineral deposits in the world, including the Matunda cobalt mine. The mining sector in Congo was ignited by Israeli businessman Dan Gertler and his partnerships with Glencore but Gertler’s deals were found to involve corrupt practices and saw him take advantage of the Congolese people. Congo has proven to be a tricky jurisdiction for many, however Alphamin have proven they can operate there with few issues. Alphamin’s current operations at the Bisie Mine are on a run rate of yielding 12,000 tonnes of tin for Alphamin at a AISC of circa US $15,000 p/t. At current tin prices this puts Alphamin on an EBITDA run rate of over US $300m. Mpama is home to multiple ore bodies that are currently being explored to add to Alphamin’s development pipeline. Their near-term prospect in Mpama South is currently being drilled out to upgrade its resources as part of further feasibility studies. The initial scoping study indicated that Mpama South could be producing over 7,000 tonnes of tin p.a., adding $180m of EBITDA p.a.

* assumption based on production at current tin prices Closing Remarks

Both MLX and Alphamin are trading at cheap multiples. Both are sitting on strong balance sheets (both in a net cash position). Tin deposits take time to bring to production and given that there are only two “first world” listed tin producers in the world, you would think that Alphamin and MLX might trade at higher multiples due to the sheer lack of quality listed tin companies. Tin prices have more than doubled over the past year and, with EV demand stepping up continuously, it's easy to see prices soaring higher. Both MLX and Alphamin are bringing in plenty of free cash flow at current prices and have practically paid off all their debt which means they can return capital to shareholders through dividends and/or continue to invest in their development pipelines.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed