|

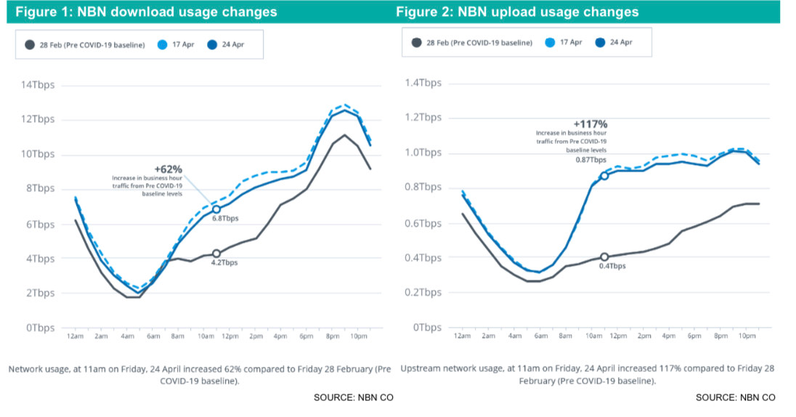

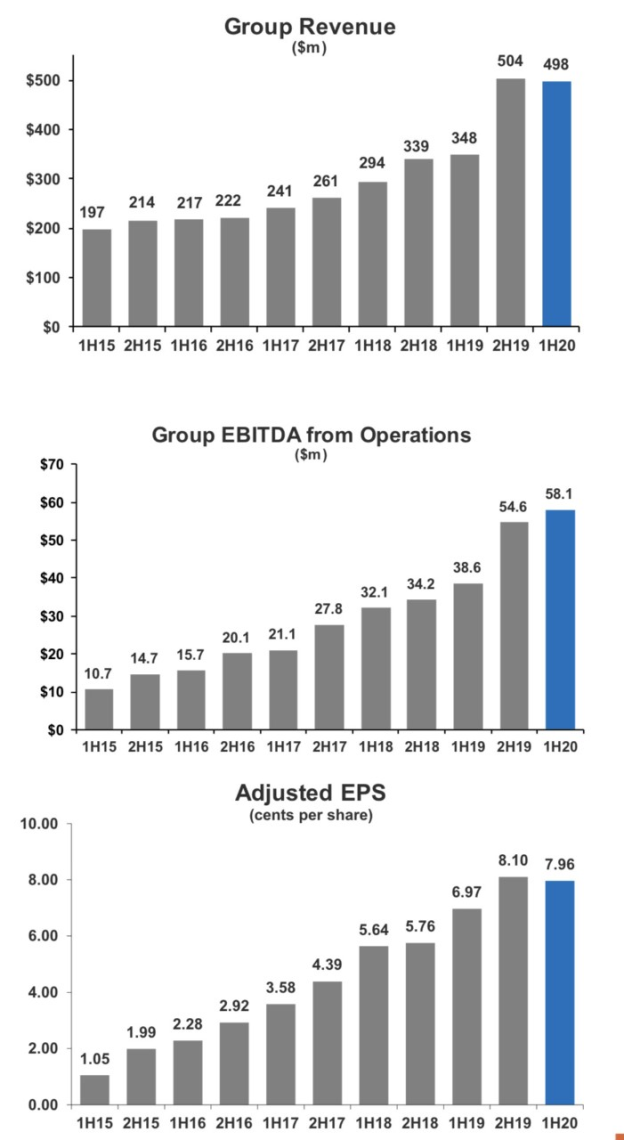

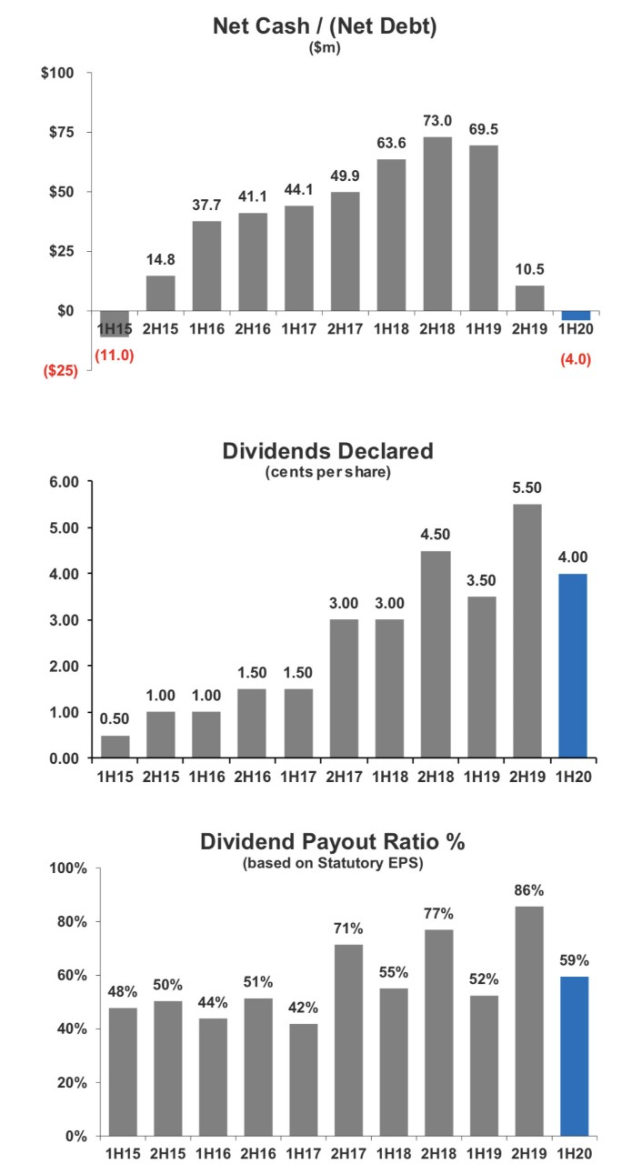

There’s an old saying that in a mining boom, investors should buy the companies supplying the picks and shovels. This week we present part 2 of our examination of the telco sector; we take a look at a services provider to the sector and see how it is benefiting from the surge in demand for connectivity that has been accelerated by the WFH trend. Service Stream (SSM.ASX) provides services for Australia’s telecommunications, gas, electricity and water utilities, with large blue-chip clients including the likes of NBN Co, Telstra and a number of network owners and operators in the Australian water and energy sectors. Services provided include network design & construction, utility meter reading, replacement & installation, and the design & repair of utility assets, such as water pipelines, through the recent acquisition of Comdain. We estimate that about 50% of SSM’s revenue is represented by NBN Co and Telstra. In FY19, NBN Co represented $463m of group revenue, while Telstra delivered $97m in revenue. Although in many cases the concentration of two large customers presents a risk, we believe strong demand for network connections and 5G mobile upgrades will see continued work for SSM for the next few years. Recently NBN has recorded significant increases in the amount of traffic across its network (download traffic on 24 April at 11am was 62% above pre-COVID19 levels, upstream usage was up 117%). This is a result of individuals being forced to work from home and thus the increased use of technology like video conferencing and streaming. While this particular spike in demand is short-term, it is an acceleration of a longer term trend of increasing demand in the connectivity space as more and more aspects of our lives move online.  NBN has also revealed that activations rose 32% in March from their February levels. The 176k new premises activated in March was the highest monthly number since August 2019. In addition, SSM may also see a tailwind from further NBN maintenance & assurance activities, due to increased connections and data demand. This should materialise in increased capital and remediation activities to ensure that the network can manage the ever increasing workload. SSM should also benefit from Telstra announcing recently that they will bring forward $500m of additional capex in the 2020 calendar year. This expenditure will be deployed to increase capacity as well as accelerate the roll out of their 5G network. We anticipate that Optus and Vodafone are likely to invest aggressively in their networks so as to stay competitive against Telstra. SSM customers in the utilities sector are deemed essential services providers. As such, we do not foresee any issues when it comes to SSM completing their work orders. In fact, unlike many ASX listed companies that have provided trading updates, withdrawn guidance and cancelled their dividends, SSM has been very quiet since February and has paid their dividend - a very good sign in our mind. Source: SSM company filings We are attracted to the business not only because of industry tailwinds but also a robust balance sheet in a net cash position, $1bn in revenue forecast for FY20 and an estimated $115m in EBITDA. The company has a long history of generating significant free cash flow. In FY20, this should translate to about 16c EPS and a 10 cents fully franked (ff) dividend, which is very attractive on the last trading price of $2.10. This places the stock on a PE multiple of 13x and a dividend yield of 4.8% ff. We value SSM at $2.80. Note: After this piece was published (20 May 2020) SSM provided a market update at 2.27pm on 21 May 2020. SSM updated the market of EBITDA guidance of $108m and strong cashflow. The company has experienced some delays on work with certain customers due to the lockdowns but nothing material that changes our medium- to long-term thesis. Disclaimer: SSM is held in the TAMIM Australia All Cap and Small Cap Income portfolios.

2 Comments

leon

22/5/2020 08:22:58 pm

nice work - thanks

Reply

19/6/2020 04:24:02 pm

I agree and have increased my holding on recent weakness and will do so again when I catch my 'breath'.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed