|

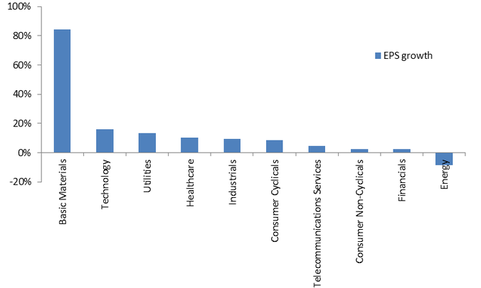

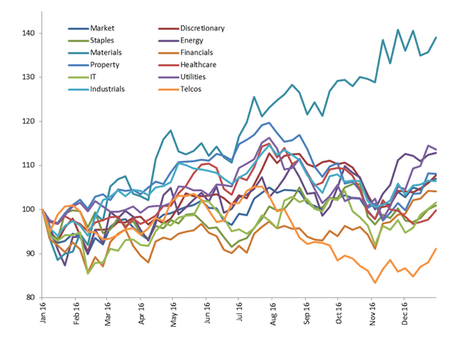

Reporting Season is well and truly underway in Australia. With this in mind we asked our Australian managers to provide a preview for the coming weeks. Here Guy Carson , manager of the TAMIM Australian Equity All Cap Value, reveals what he expects to see. TAEACV Reporting Season Preview Guy Carson Every six months reporting season comes around for the Australian Equity Market. It’s an important time for investors as we get detailed look into how a company has been performing and in some instances, an indication of how management see their outlook. The market typically will react to how the result and the outlook compare to the current market expectations. Hence, heading into reporting season it is important to understand what the market is expecting in order to understand the share price reactions that occur. The expectations at this stage are for a strong year in terms of earnings growth. Consensus earnings growth for the market is in double digit territory for the first time since FY11. In fact if expectations are achieved, it will be the first positive year for earnings growth since FY14. These positive expectations come despite what can only be described as a weak AGM season late last year and the number of downgrades seen through the recent “confession season”. The key driver offsetting the plethora of recent downgrades is the materials sector, where a rebound in commodity prices is set to drive earnings up over 80% following a 42% fall the previous year. Given the high expectations and the fact that commodity prices (in particular Iron Ore) remain above last year’s level, earnings for the commodity companies are largely locked in by this stage (for the first seven months at least). Hence, when they report this time around there is very little likelihood of surprise. Most of the focus will be on how much of the windfall in profit gets returned to shareholders. Further gains in the share prices this year will likely be dependent on commodity price moves. One aspect of the big miners’ reports that will be intriguing to us is how their capital expenditure expectations have changed over the last six months. With the rally in commodity prices, we have seen mining service companies follow suit. In recent years, these services companies have seen their order books shrink as mining work has been cut back. The expectation now is that with the higher commodity prices, capital expenditure budgets will increase and work will start to flow back to the contractors. This work won’t come from expansion of production but more likely through maintenance work that has been delayed in recent times in the name of boosting cashflow. The degree to which the likes BHP and RIO increase their capital expenditure budget for the coming years will help tell us to what degree the recent rally in mining services stocks is justified. Overall, the direction of the market over the early part of this year will most likely come down to the largest sector, Financials. Within financials, the key driver will be the banks. We have Commonwealth Bank set to report its half year result as well as quarterly updates from the other 3 of the big 4 and the consensus expectations for the sector this year are reasonably low at 2% growth. However given the recent rally in the share prices of the banks (the big 4 are up between 11 and 18% since the US election); we’d suggest that the market is running ahead of the sellside analysts in upgrading future earnings. We are sceptical that these upgrades will occur and we wrote in depth about the challenges facing the banks from the Western Australian and Queensland economies last week (see 2017 Outlook). Typically problems in the housing market take a while to play out however the increase in arrears from WA over the last 12 months suggests we may start to see an impact on the profit numbers soon. With only CBA set to give a detailed half year report in February, we may have to wait until the other three release their results in May to get a full view of how this is playing out. The other areas within the top 20 companies which are seeing earnings pressures are Consumer Non-Cyclicals and Telcos. The consumer side is dominated by the two large supermarket chains, Woolworths and Coles (owned by Wesfarmers). The supermarkets are facing increased competition from Aldi and Costco combined with the potential entry of Lidl. There seems to be no respite from these pressures in the near term, however Wesfarmers should see a boost to their result from Coal prices over the last six months. The Telco sectors is dominated Telstra, where earnings would be going backwards if not for the reimbursement from the government for the NBN. Telstra, by their own admission, have a $2-3bn earnings hole to fill over the coming year. So whilst investors may still be attracted by the significant yield on their shares, the uncertainty of their longer term earnings plus the increased competition in the sector makes us cautious on the outlook. When we look at the earnings expectations above, it’s no surprise that the materials sector was far and away the best performer last calendar year with a very strong rally off a low base. At the other end of the spectrum, Telecommunication stocks were the worst performing sector with concerns around the NBN pricing structure. The next worst performing sector was Healthcare after a significant sell off from August onwards. This selloff has us interested, particularly as the sector has been the most consistent in terms of earnings growth over recent years and this is expected to continue will expectations of over 10% this year. When share prices stagnate or fall whilst earnings rise, valuations become more attractive and hence we get interested. It’s a sector that we have increased our exposure to over the course of December (adding CSL to the portfolio as the price fell from above $120 to the mid $90s), and one we will watch closely over reporting season.

Along with Healthcare, Technology is a sector which has lagged in recent months whilst earnings expectations have been robust. The sector within the Australian market is small and is an eclectic one. A number of companies trade on high multiples with high expectations of future growth. These companies are susceptible to disappointing such as Aconex just last week. Elsewhere, you can find niche companies with strong products and a high degree of recurring earnings. Given their niche offerings, they are typically ignored by larger institutions and hence can offer attractive opportunities. So whilst the next three weeks will be interesting, there will still be a number of unanswered questions around the direction of the share market and the Australian economy. We will be busy foraging through reports, checking in with the companies we own and looking for potential new investments whilst always keeping in mind that when investing it is the long term that counts and not just the last six months. Happy Investing, The team at TAMIM Comments are closed.

|

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed