|

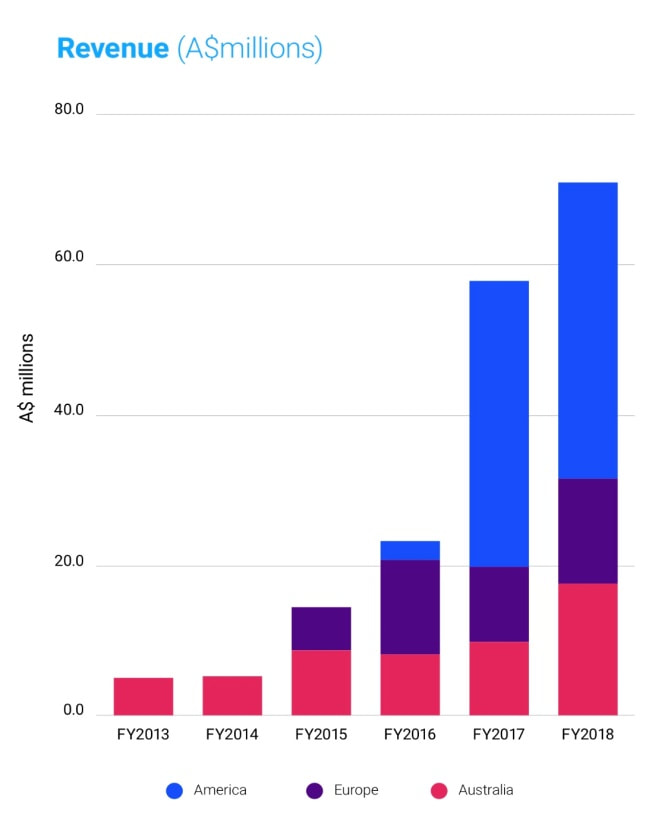

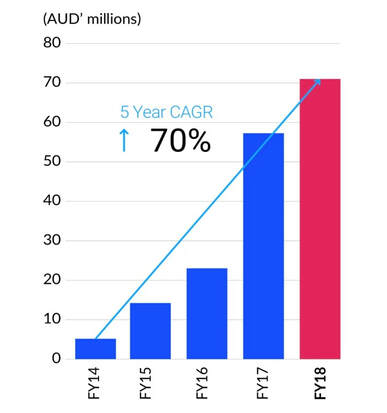

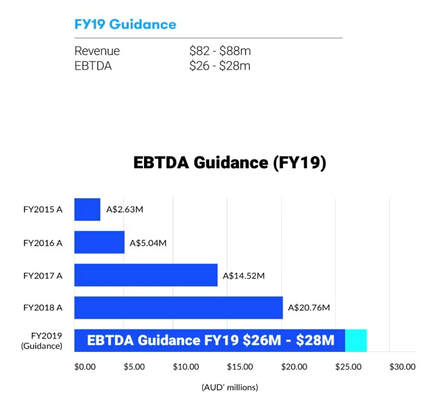

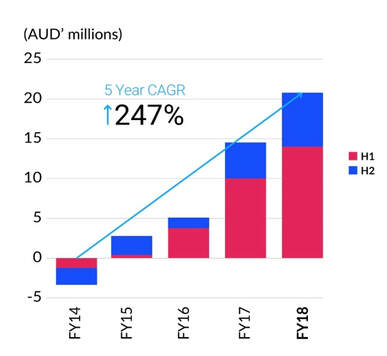

Ron Shamgar, Head of Australian Equities and Portfolio Manager of the Australian All Cap portfolio, examines one of his core holdings. A stock which we believe the market has to this point underestimated from both a growth potential and innovation perspective.  In this report we turn the spotlight onto one of our conviction holdings in the TAMIM All Cap portfolio, EML Payments (EML). With a $375M market cap, EML is a global payments processing platform operating across Europe, North America and Australia. EML meets many of our investment criteria and we think the market is underestimating the growth potential and innovation EML can deliver over the next few years. Find out why below. What does EML do? EML is an innovative payments platform that is an issuer, processor and manager of electronic payment programs around the world. EML’s core function is providing a payment solution to its clients, which in turn offers their customers the ability to make or receive payments through debit cards, mobile pay or virtual card accounts. EML is a beneficiary of the global trend away from cash, cheques and credit cards into electronic payments and debit cards. EML operates under 3 distinct segments: Non-reloadable Programs - mostly gift card programs, retail rebate schemes and corporate incentives. Examples of clients here are shopping malls in Europe (EML is the largest player), and North America. In Australia, EML works with the Leading Edge group to deliver digital gift and retail incentive programs. Reloadable Programs - this division is the primary driver of future growth. Example of clients here are online gaming operators allowing their customers to access cash winnings instantaneously through EML’s debit cards. Salary packaging is another industry vertical with McMillan Shakespeare using EML for its meal & entertainment cards to employees. Other industry verticals include Neo Banks, Crypto exchanges, Loyalty rewards and fuel rebate programs. Virtual Accounts - this division is US centric and allows companies to replace the use of paying suppliers by Cheques with a virtual credit card payment. In the US there are over $10 trillion a year of payments between companies and their suppliers. In FY18 EML processed $3B in Virtual Payments. EML business model: EML earns revenue by taking a percentage of each dollar that is processed on the platform. In FY18 EML processed over $6.7B in Gross Debit Volume (GDV) and earned 1.05% revenue margin. With over 1,200 programs, EML earns anywhere between 5bps to 600bps on GDV processed (FY18 blended average was 105bps). As EML processes payments it also holds these funds in various bank accounts globally and earns interest on the stored value in these programs. In FY18 stored value increased to $410M. Rising interest rates globally will benefit EML in future years. EML gross margins sit at about 75% but over time will increase to 80% as the company processes more payments under its own recently obtained issuing license. EML’s cost base is fairly fixed meaning growth in revenue drops proportionally more to the bottom line. EBITDA margins have grown to over 30% in FY18 and we expect these to exceed 40% within three years. EML balance sheet is forecast to have approximately $50M in net cash in FY19 (no debt) and we expect acquisitions to form part of the growth strategy in the near future. Why we like EML? Over the last five years under the leadership of Managing Director and largest shareholder, Tom Cregan, EML has grown impressively: We expect growth to continue over the foreseeable future. EML contracts customers on 5+ year agreements and becomes a critical component of their businesses. As long as EML continues to deliver and innovate for its clients in meeting their business requirements, we see loss of clients as very low and unlikely. The high cost of switching providers means EML has in excess of 90% of revenue as sticky and recurring.

In our view the primary growth driver in the near term is the European and US gaming verticals. In Europe, EML has recently signed the largest gaming operators to its cash out winnings card solution and will launch in market across Europe in 2H2019. We see the European market as $2B GDV (>$20M revenue) opportunity compared to $500M currently processed in Australia. Over in the US, the ban on online sports betting was overturned by the Supreme court in July last year and each State is now allowed to legislate its own online sports betting laws. So far, eight states have legalized online betting and it’s estimated a further twenty states will do the same in the next couple of years. The US online sports betting market is estimated to be worth >$100B and, due to the nature of its individual state based laws, not all federal bank issued credit cards allow gaming clients to load funds with their gaming provider. This has created a huge opportunity for EML to offer its payment solution in the market. As EML’s existing gaming partners in Europe and Australia enter into the US market and so it is reasonable to expect new agreements to be signed and launched during CY2019. If EML succeeds in capturing a share of this huge market opportunity we expect GDV in the US gaming vertical to exceed $3B (>$30M revenue) in the coming years. Based on our analysis and management incentives we forecast EML to deliver $28M EBTDA in FY19, $35M in FY20 and $44M in FY21. By then the cash balance will have ballooned to over $100M and so we expect acquisitions to add further growth. With 80% of revenue generated offshore, a weak AUD is a further tailwind in the short term. We value EML at $2.10 based on FY20 estimates. Looking out five years from now, we see a possible scenario where EML is processing $15B of GDV, generating $150M in revenues with EBTDA margins over 40%. At that stage we think EML could be a ‘’multi bagger” from current prices today . EML is a core holding across the TAMIM All Cap portfolios.

3 Comments

Curtis Taylor

25/1/2019 06:33:32 am

Who are EML's major competitors and what is EML's competitive advantage?

Reply

Ron Shamgar

25/1/2019 09:28:59 am

Hi Curtis,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed