|

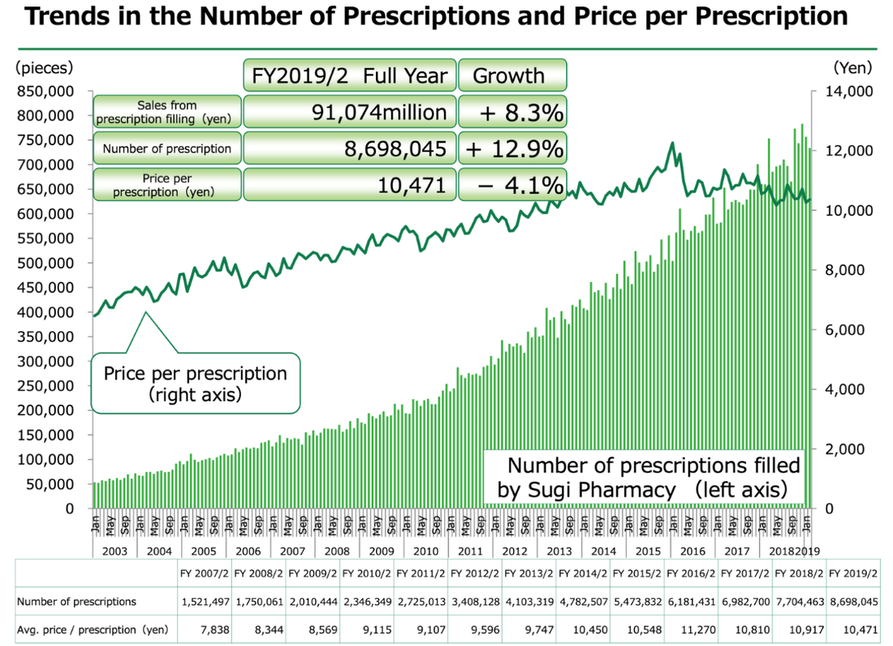

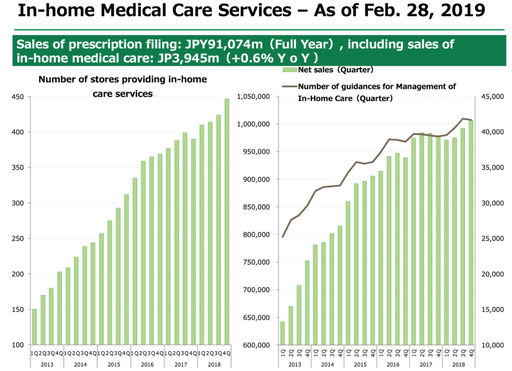

Kevin Smith, of Delft Partners and portfolio manager of the TAMIM Asia Small Companies Fund, highlights one of the stocks in the Asia Small Companies portfolio. SUGI HOLDINGS CO. LTD. (Sugi) is a Japan-based holding company mainly engaged in the management of retail pharmacy stores. Sugi is engaged in the sale of medicines, health foods, cosmetics, daily necessities and prescription preparations. Sugi also operates visiting nursing stations that closely cooperate with regional medical institutions and social welfare operators, through the provision of visiting nursing services and in-home nursing care support services. In November 2019 Sugi operated a total of 1,271 stores (including nursing stations) and employed 6,237 full-time in addition to 10,456 part-time staff. Accounting, Strategy and Governance Comments Accounting

Strategy

Governance

Value, Momentum and Quality Comments

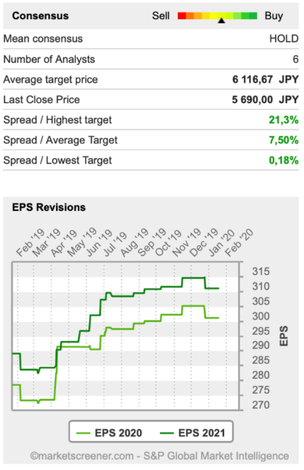

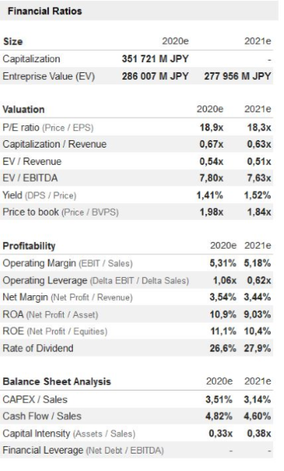

Source: Market Screener

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed