|

Kevin Smith, of Delft Partners and portfolio manager of the TAMIM Asia Small Companies Fund, highlights one of the stocks in the Asia Small Companies portfolio. A world-class technology company, Advantest is a leading producer of automatic test equipment for the semiconductor industry and a premier manufacturer of measuring instruments used in the design and production of electronic instruments and systems. Its leading-edge systems and products are integrated into the most advanced semiconductor production lines in the world. The company also focuses on R&D for emerging markets that benefit from advancements in nanotech and terahertz technologies and has introduced multi-vision metrology scanning electron microscopes essential to photomask manufacturing, as well as a ground-breaking 3D imaging and analysis tool. Founded in Tokyo in 1954, Advantest established its first subsidiary in 1982, in the USA, and now has subsidiaries worldwide. Accounting, Strategy and Governance Comments Accounting

Strategy Advantest has built a business that ranks seventh in the top ten of global integrated circuit (IC) manufacturing equipment makers. This business has high barriers to entry and splits into three broad areas:

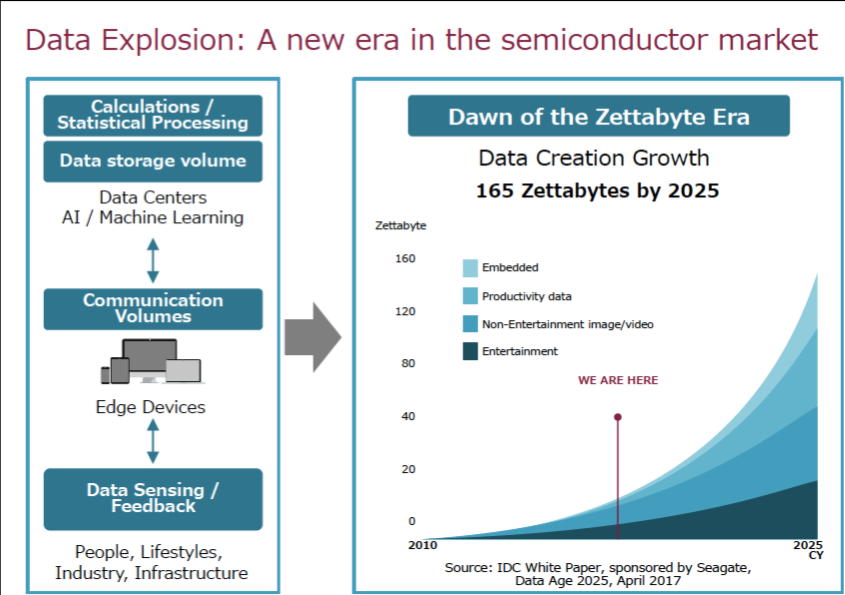

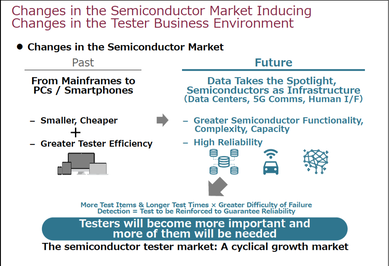

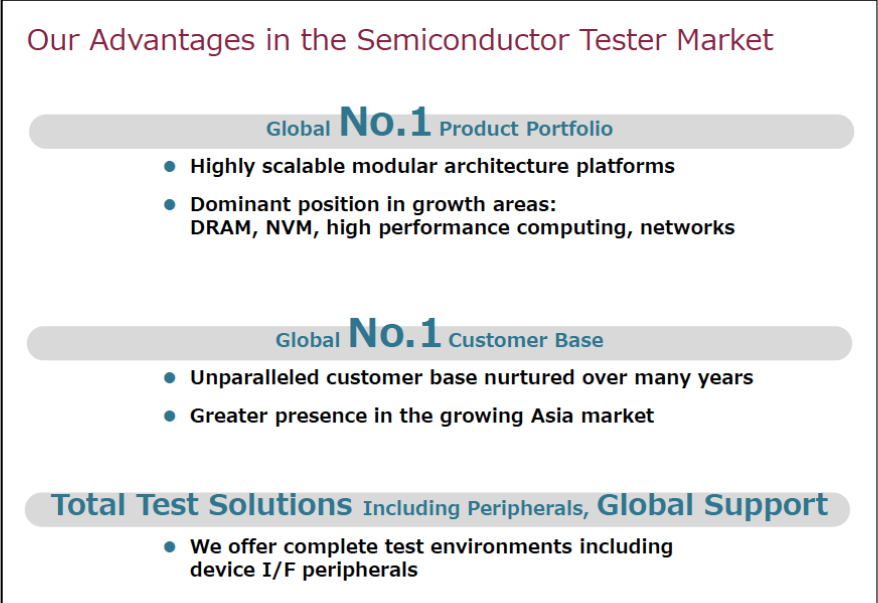

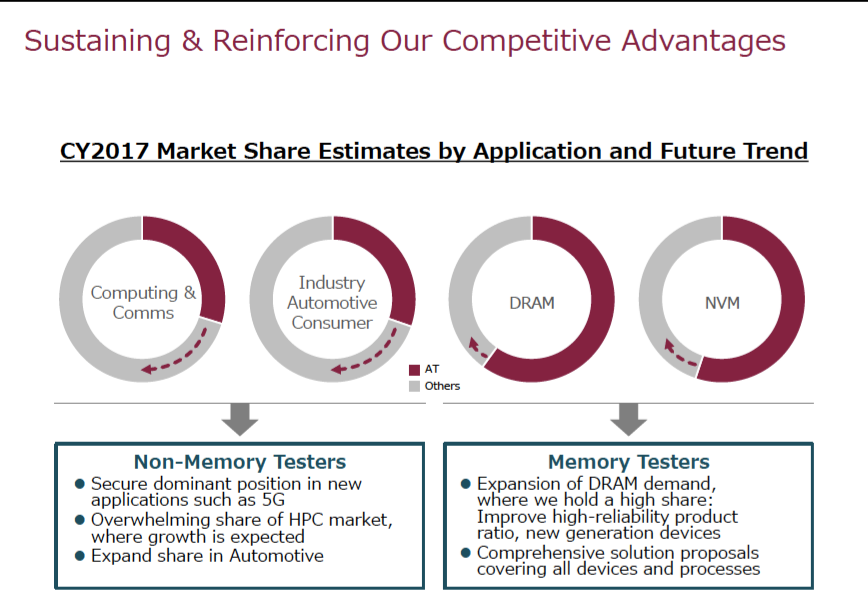

Advantest has a business that adapts to developments in the market, in 2018 the key driver for testing was for smartphone chips while demand for memory chip testing declined. The Company is prepared for slow market conditions in 2019 and then expecting the next wave in technology development to drive higher demand especially in the arena of 5G and Artificial Intelligence. We are happy with Advantest’s strategy of completing incremental acquisitions, especially where that provides a complement to the existing book of business. In February 2019, Advantest completed the acquisition of Semiconductor System Level Test Business from Astronics Corporation for USD 100 million plus an earn-out payment of up to $35 million. This business adds expertise in the field of system level testing and we were pleased to see that the eventual price paid was adjusted down from the originally announced level of $185 million plus $30 million earn-out. The graphics below demonstrate Advantest’s view of the market growth opportunity, increased capacity and improved reliability standards will increase resources devoted to testing within the industry. The tables below give an illustration of Advantest’s positioning in the market place, in particular their competitive advantages in terms of product portfolio and client geography. The Company’s medium term plan shows their expectation of substantial increases in market shares in the computing and consumer segments together with the automotive market. Governance

Conclusion Advantest is a world class semiconductor test equipment business that has demonstrated an ability to adapt their offering in a changing market for technology products. The business has a strong management structure, communicates well with investors and has the capacity to deliver strong investment returns based around a strategy that should see increasing market share in a growing overall market for testing equipment and support. Value, Momentum and Quality Comments

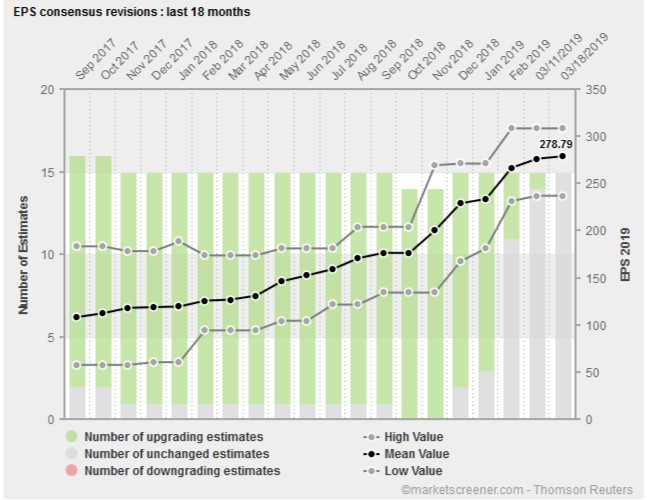

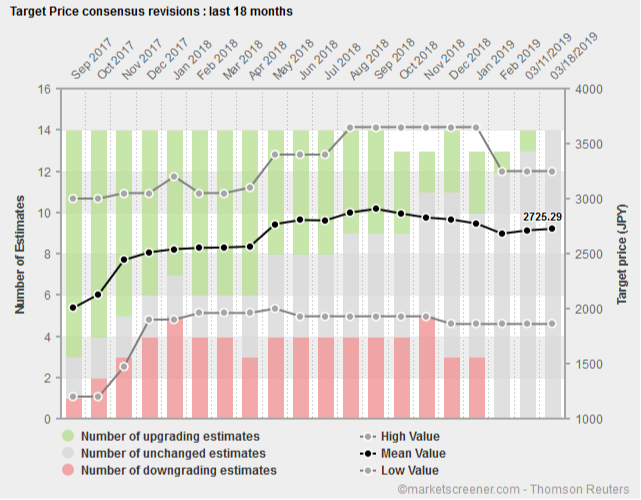

The Company has maintained very strong momentum and quality scores throughout the period, the key behind a sharp improvement in the overall VMQ score shown below is a consistent improvement to the value scores during 2018. The table of earnings revisions below shows that forecasts for 2019 earnings have been upgraded throughout the past year. The other table below shows the progression of target share price by analysts covering Advantest, the consensus target is Ұ2725, versus a current share price of Ұ2440. We expect that target price to be the subject of further upgrades during 2019.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed