|

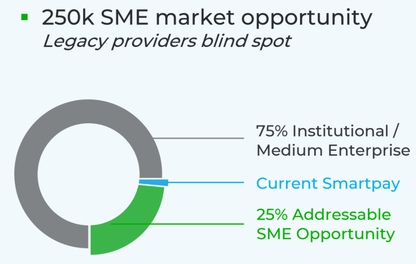

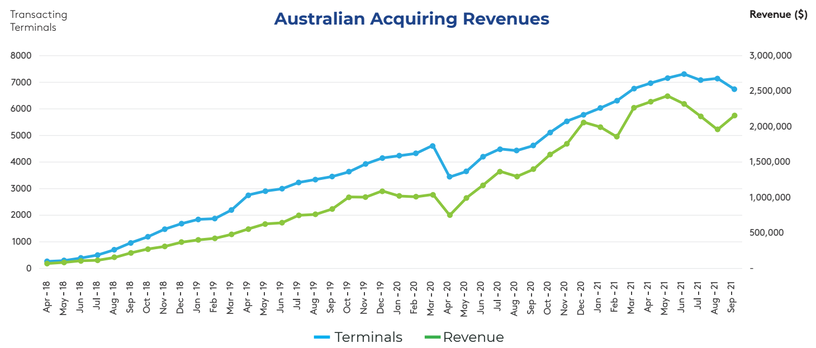

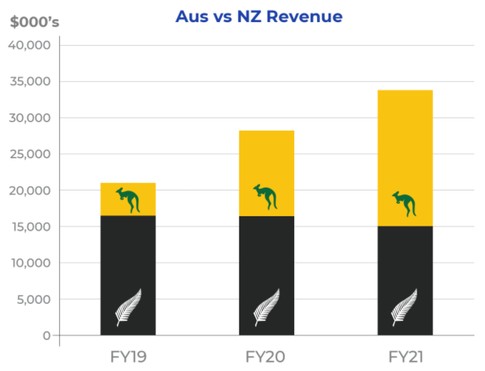

Over the past few weeks we have been covering stocks we believe are poised to benefit from the ongoing reopening of Australia and New Zealand. This week we will be writing about a small cap payments company that should be a huge beneficiary of this reopening thematic.  Author: Ron Shamgar & Adam Wolf Author: Ron Shamgar & Adam Wolf The stock in question today is Smartpay. While most stocks that have “pay” in their name have been pumped at some point in the last few years by investors desperate to find the next BNPL unicorn, SMP is not one of them. Smartpay is a profitable business operating in both New Zealand and Australia, trading at a significant discount to the value of its businesses and we will show you why. Smartpay (SMP.ASX) Smartpay Holdings Limited is a provider of technology products, services and software to merchants and retailers. The business designs, develops and implements payment solutions for customers in New Zealand and Australia. Smartpay is a merchant-facing, in-store EFTPOS payments provider; they have a significant position in the New Zealand payments market and a fast growing Australian business. SMP currently provides payment terminals for over 30,000 merchants. Smartpay has a huge presence in the New Zealand market but right now they are focusing on expanding into the Australian market which will provide a huge platform for growing the company. They currently have almost 7,000 operating terminals in Australia and are looking to add around 4,000 terminals per annum. Smartpay also has a huge SME market to attack in Australia. They currently have a tiny piece of the market but Smartpay’s reliability and competitive cost structure, through their zero cost eftpos solution, are seeing them winning market share in Australia, having grown Transactional (Acquiring) revenue almost 7x, from $2.5m in FY19 to $17.1m in FY21. Revenue Model Smartpay generates their sales through the transaction volume of terminals and processing those payments at a fee of about 1.6%. They earn a fixed fee per terminal and also receive income from software development, sales of terminals, short term rentals and other ancillary services. Their business model is mainly recurring and, once they acquire a customer, quite sticky; the churn rate is very low given the complexity involved in changing providers. Each terminal in Australia adds around $3,900 of recurring revenue per year. If Smartpay are able to achieve their goal of adding 4,000 terminals in Australia p.a., considering the operating leverage SMP have from scaling their merchant base this would add over $6m of EBITDA p.a.. The majority of Smartpay’s cost base is fixed and sits across compliance, IT, marketing and employee costs. If Smartpay executes on their growth in the Australian market they will see a huge lift in their bottom line earnings figures given the mostly fixed nature of their costs. Reopening Tailwind The past few years have seen significant changes occur in the payments industry, the pandemic further accelerated the use of electronic payments opposed to cash payments for hygienic reasons; however, lockdowns have had a stupendous impact on volumes. Heading out of lockdown and into the holiday season, retail and hospitality should receive a huge boost in activity and, given the length of the most recent lockdown, there is a lot of pent up demand. Revenues from transaction processing made up over 50% of Smartpay’s sales in FY21. In their recent trading update management said “The impact of COVID lockdowns, primarily in NSW and VIC, throughout Q2 FY22, resulted in approximately 1,400 terminals in their Australian fleet unable to transact in the month of September.” Direct competitor Tyro has seen their November transaction value (to the 12th) up over 40% compared to the same period last year. Smartpay will no doubt be experiencing a similar rise which will have a significant impact on their FY22 result. Valuation + Outlook

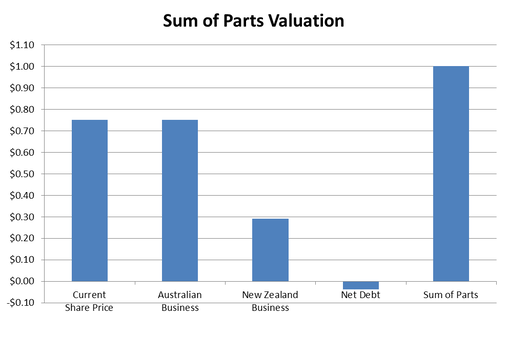

Note: all AUD When looking at the valuation of Smartpay we need to separate their Australian and New Zealand segments. Their New Zealand segment has 20% market share and is far more mature. The NZ business is a solid, mostly recurring stream of income and gets most of its income from a service fee for the terminals. The NZ business is not where SMP’s growth will come from. The real driver of the business going forward will be growth in the Australian market as opposed to the NZ. In 2019 Smartpay received an offer for their New Zealand business; the offer was a cash consideration of $70m NZD. At the current exchange rate (~96c as opposed to ~94c at the time), that values the NZ business at 29 cents per share. Looking to the Australian business, we are going to make comparisons with their peer Tyro Payments (TYR.ASX). Tyro has struggled to gain traction as a public company and earlier this year they had severe operating issues with their terminals. Short research firm Viceroy also launched an attack which, in all fairness, was a bit overstated. Tyro:

Note: FY21 figures Smartpay currently has 6,737 terminals operating in Australia. Using their average revenue per terminal of $3,900 this would give the group around $26m of revenue p.a. but if you account for their growth plans (adding 4,000 terminals a year) as well as the increased transaction volume heading out of lockdowns, this figure could be well north of that. To be conservative, we will say that their Australian segment will do $26m of revenue for FY22. If you apply the same EV/Sales ratio that the market affords Tyro, this would value their Australian business at $173m or around 75 cents per share. Accounting for SMP’s net debt (3.8 cps), now the maths becomes simple: 29 cps (NZ business) + 75 cps (Australian business) - 3.8 cps (net debt) = 100.2  Giving us a valuation of about $1, approximately 33% higher than it is currently trading (~$0.75). At current prices, we think SMP is significantly undervalued, there is a sizeable margin of safety here too as there are multiple ways to win on the upside. As mentioned, the reopening should see a big boost in transaction volumes across all payment terminals. This should see Smartpay’s revenue per terminal rise above what it has been the past couple of years thanks to on and off lockdowns around the country. Smartpay is a cheap way to get exposure to the digital payments thematic and, given their growth plans in Australia, Smartpay can expand their service offerings and offer new solutions such as business loans, bank accounts, data analytics, insurance while using their existing customer base to cross sell products. We believe SMP will do over $40m in sales in FY22 revenue and over $8m in EBITDA. SMP is growing much faster than Tyro yet it is trading at a discount, we see Smartpay having a significant multiple expansion re-rate. If SMP is able to execute their goal of adding 4,000 terminals p.a., they will be doing around $18m of EBITDA by FY23. This would put them at a forward EV/EBITDA of around 10x. Given the cheap valuation that SMP is trading at, they could also be an interesting potential takeover target having already fielded an offer for their New Zealand business. We value SMP at $1+ and it is a core holding for the TAMIM Fund: Australia All Cap portfolio heading out of lockdowns and into the holiday season. SMP’s recent trading update saw a 58% YoY increase in total transaction volume; SMP’s half year result is due this month. Disclaimer: SMP is currently held in the TAMIM Fund: Australia All Cap portfolio.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed