|

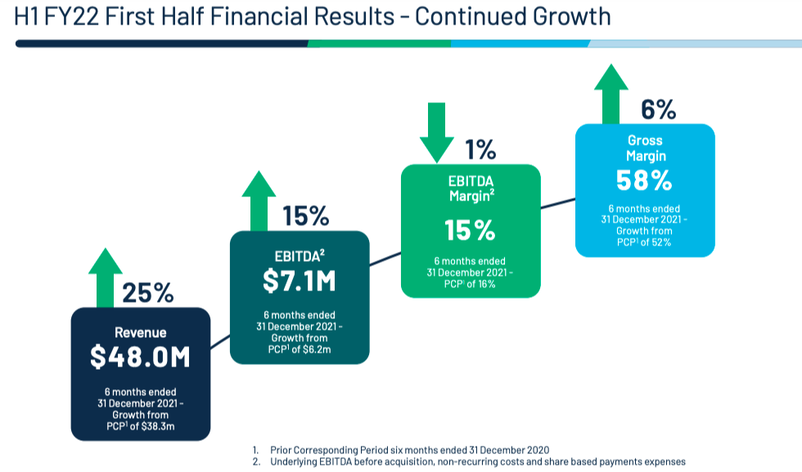

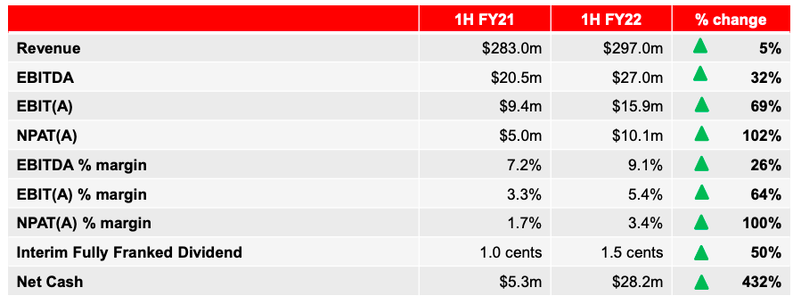

Continuing on with our reporting season notes, we will cover a few more of our key holdings across TAMIM’s Australian equity portfolios. There has been increased uncertainty across markets as geopolitical tensions in eastern Europe have come to a head alongside hawkish central bank commentary. Any company even remotely connected to the word ‘growth’ is apparently tainted and has been sold down accordingly.  Author: Ron Shamgar Author: Ron Shamgar Despite mostly good results across our portfolio the market is unwilling to rerate them; this is something we anticipated given the uncertainty currently at play. An opportunity for the enterprising investors perhaps? Webcentral (WCG.ASX) Webcentral, once Netregistry, is an Australian owned digital services company who empower more than 330,000 customers to grow and thrive in the online world. Their portfolio of digital services is extensive, with market leading offers across domain management, website development and hosting, office and productivity applications and online marketing. Webcentral currently owns and operates its own Nationwide highspeed Data Network with points of presence in all major Australian capital cities. 5GN Acquisition WCG completed the acquisition of 5GN, a telecommunications carrier providing datacentre and cloud solutions across Australia. Webcentral and 5GN operate in complementary businesses and the merger will result in a market leading, full-service online/digital solution provider that delivers strong value and growth opportunities to shareholders. This will come with synergies. During the half, 5GN saw strong customer growth and completed $12m in contract renewals. Results WCG saw their revenue climb to $48m, up +25% on the previous comparable period (pcp), with EBITDA of $7.1m, up +15%, for the half. They beat guidance on EBITDA while revenue came in at the top end of the range. WCG’s gross margin improved to 58% from a combination of organic growth and direct cost synergies. The company experienced a lack of hardware and software orders due to Covid-19 which disrupted installation. They also noted that this segment is skewed towards H2. It was stated on the earnings call that hardware sales are already recovering as we edge into H2. New data centre sales are currently tracking at $100,000 per month and they have seen improved customer retention. Looking to H2, WCG will be launching their domain business on March 24. They believe that it is a significant market and internal forecasts suggest that WCG will take approximately 30% of the market. WCG is also expecting 10-20% of their 330,000 strong SME customer base to take up their initial NBN launch in June. Outlook We were surprised to see WCG slide down after providing this result. Despite seeing weak hardware and software sales, they are still on track to meet their long terms goals. They are forecasting that they reach $29m in EBITDA in FY23 and are very confident on achieving a 20% EBITDA margin for FY22 There are also a lot of small M&A targets being looked at and they have seen an increased volume of inbound deals from brokers. In terms of their ~18% stake in Cirrus Networks (CNW.ASX), they are waiting to see their results and take action from there. They are also forecasting a gross cash position of $55m in FY23. Right now WCG are trading on an FY23 EV/EBITDA of 3x, a level that we believe is far too cheap given their growth initiatives. SRG Global Limited (SRG.ASX) SRG Global is an engineering-led specialist construction, maintenance and mining services group operating across the entire asset lifecycle. SRG operates three segments, namely Constructions, Asset Services and Mining Services. Results In what has been a tough operational environment for the sector due to Covid disruptions and labour shortages, SRG posted a strong result for the half year. SRG was able to weather the storm and grow revenue by +5% to $297m and EBITDA to $27m, +32%. SRG has seen a $40m swing from net debt to net cash since FY20; net cash now sitting at $28.2m. SRG’s strategic plan is to transition the business toward recurring revenues, providing better earnings visibility. Currently recurring revenue makes up 67% and they are hoping to boost this to 80%. SRG launched their Engineering Products segment which SRG are very excited about, believing it could grow to be their fourth operating arm. Alongside this, the revenue is recurring in nature. SRG have built a strong suite of clients, including the likes of Iluka (ILU.ASX), Fortescue (FMG.ASX), and Rio Tinto (RIO.ASX); 70% of these top tier clients weren’t there three years ago. SRG have also stressed the cross-selling opportunities of services as well as being able to get more work once they are on site with clients. Outlook SRG has a strong pipeline, Work in Hand coming in at $1bn with a broader pipeline of $6bn. Management noted that they believe the business will do significantly better in an easier operating environment; the WA border opening being a tailwind and increased access to labour on the horizon as Covid-19 restrictions ease. SRG have done well in their transition to more of a recurring revenue based strategy; we believe will earn them a higher multiple. We expect SRG to grow through a mixture of M&A and organic growth and they are well funded to do so, being in a strong net cash position. SRG upgraded guidance to $54-57m, putting them at an FY22 EV/EBITDA of around 4x and will be paying a fully franked dividend of around 6% at current prices. Disclaimer: WCG & SRG are both currently held in TAMIM portfolios.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed