Albemarle Corporation (ALB.NYSE)

Lithium is the primary component of lithium-ion batteries (LIB), which are rapidly gaining traction due to their wide applicability in energy storage solutions, in particular solar and wind energy projects, and the strong demand in the electric vehicle (EV) sector.

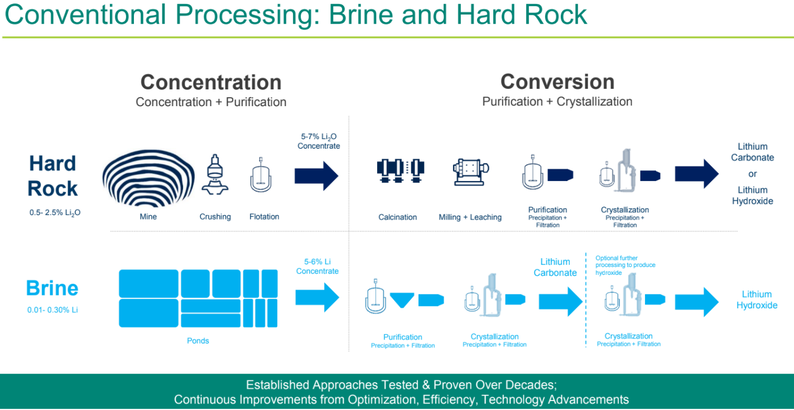

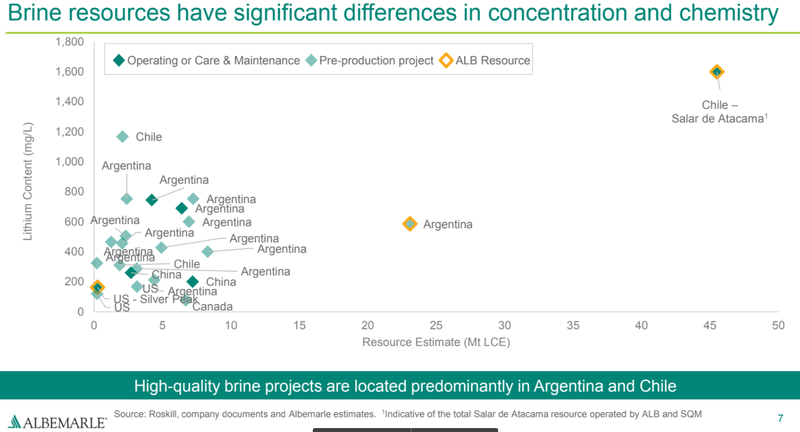

Lithium is very difficult to process and requires significant capex on necessary infrastructure to produce and manufacture it into specialty products. Data from Benchmark’s Lithium Forecast shows a projected annual lithium supply deficit of up to 225,000 tonnes in North America and 500,000 tonnes in Europe by 2030. To incentivise the right amount of investment in new mines there is going to have to be a sustained period of elevated prices. Bringing deposits into production is a time consuming process and can take years to undertake all the feasibility studies and actually construct a mine. Lithium deposits can either be produced from brine or spodumene rock production. Brine production is far cheaper and significantly more environmentally friendly.

Our outlook for robust lithium demand is primarily predicated upon increased demand for electric vehicle batteries. Albemarle produces lithium from both salt brine deposits in Chile and the US and hard rock joint venture mines in Australia.

Battery Innovation Center

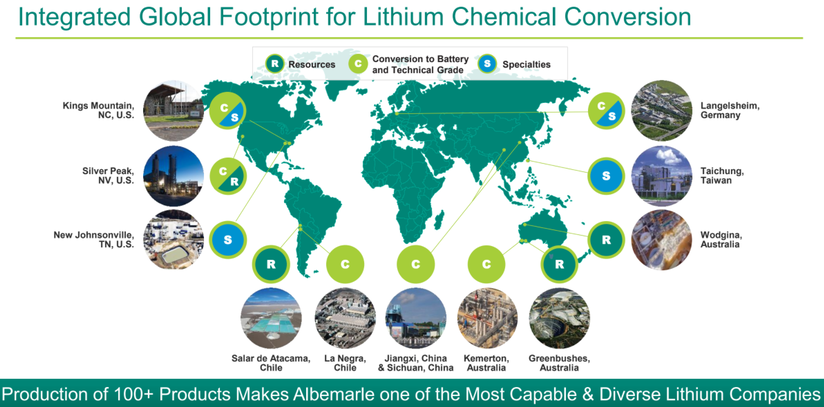

Recently ALB completed their Battery Innovation Center in North Carolina, the centre will enable ALB to research new materials and processes and incorporate them into battery cells for performance testing. With this new resource, ALB will be well equipped to optimize their lithium materials for a drop-in solution that helps them deliver high-performing cost-effective batteries for customers in the rapidly growing electric vehicle market. ALB isn’t like any other lithium company that produces the concentrate and sells it through off take agreements; they are a fully integrated company from the production of the metal to manufacturing of the battery and are innovating their end solution.

Bromine

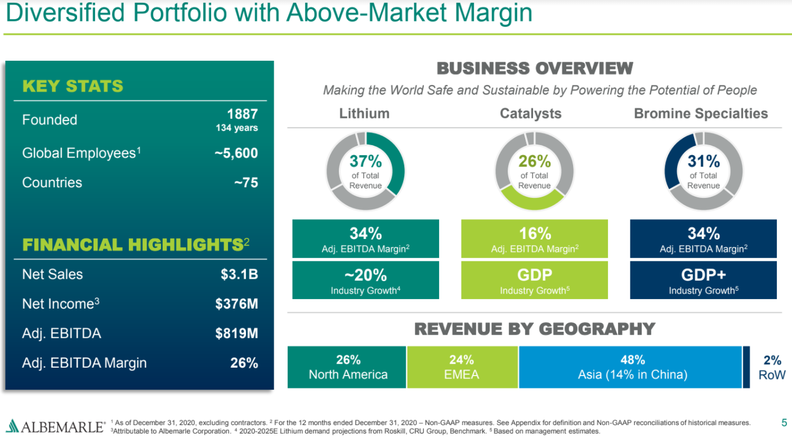

Albemarle is also one of the world’s largest producers of bromine. Bromine is used as a flame retardant that provides properties in order to keep our electronics safe. Bromine will be a winner from the transition to 5G, a thematic that we also have exposure to in the Global Mobility portfolio. The shift to 5G relies on printed circuit boards to transmit signals, all the materials involved will need fire retardants like bromine to keep consumers safe.

Why Albemarle?

Many people would look at ALB and conclude they are an overvalued stock. But! We believe their technical expertise and the runway for lithium more than justifies the premium. Unlike in other mineral industries, ALB has been able to establish a dominant position in the lithium market due to their technical expertise in processing, allowing them to achieve significant economies of scale across their operations. ALB has a lithium footprint spanning the globe covering key markets. They have multiple joint venture interests in producing lithium projects; both in South American brine projects as well as interests in rock projects in Australia and China, which is a low cost jurisdiction. They also have production plants in Germany, giving them a fully integrated supply chain and access to the car makers in the heavily environmentally mandated EU jurisdiction.

There are many companies one could invest in to gain exposure to lithium but how many of those companies can say that they have grown their dividend for 27 consecutive years and are delivering over $800m of EBITDA at a margin of 26%? ALB is the clear leader in lithium production and processing, they have low cost brine projects in South America and they have the balance sheet to pursue their lithium strategy and are innovating the lithium ion battery. There are no other lithium focused companies that have the technical expertise and access to the cash and credit necessary to scale their operations. ALB recently sold their fine chemistry business for $570m USD and this will enable them to focus on their core lithium strategy, pursue more M&A opportunities, acquire more interests in lithium projects and invest further in their development processes.

We see ALB as a company that has significant leverage to the lithium upside but at the same time has other profitable businesses in their Catalyst and Bromine divisions. This enables them to return cash to shareholders while also funding their lithium operations without diluting shareholders like many pre-production lithium companies are doing. As mentioned, it takes years to bring a lithium project into production and a lot can go wrong in that time. ALB is already one of the largest producers of lithium and has high quality, proven and large scale projects. They are achieving significant cost benefits as a result of their technical expertise and vertical integration. ALB offers full exposure to the lithium product cycle from the ground all the way to the battery in your electric vehicle.

Using ALB’s estimates of future production, their lithium segment could be contributing well over $1.5bn of EBITDA to the business. It is worth noting that this is assuming their margins don’t increase as a result of lithium price appreciation.

ALB is a profitable company that ticks all the boxes for the investment focus of our Global Mobility fund. They will benefit from the increased production of EVs through their lithium operations, this increased production is effectively being mandated by governments around the world via green initiatives and targets, tax breaks and rebates. Regardless of your personal opinion on electric cars, it’s happening. While not quite the opportunity afforded by lithium, ALB will also be a winner from the rollout of 5G and IoT through their Bromine division. Rather than buying companies in the exploration stage, we are looking to buy and hold established players in the industry that have the skillset and the funding to capitalise on the rise of EV production. We see ALB dominating the lithium production and processing market while also expanding their scale through near-production projects and potentially via M&A activity.