|

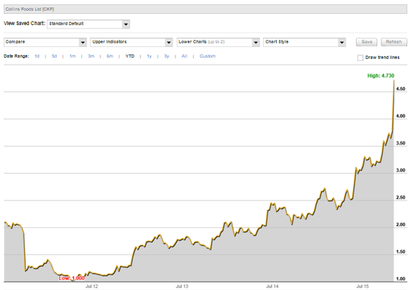

James Williamson of Wentworth Williamson and manager of the TAMIM Australian Equity Value IMA looks at Collins Food and how it is possible to beat private equity at it's own game.  Source: Commsec Source: Commsec With the very public dumping of Dick Smith by the equity market over the last month, TAMIM thought it timely to remind investors how to play private equity listings profitably. We have been holders of Collins Foods Ltd (ASX:CKF) since 2013 and have recently seen the stock rerated by the market. Here is the story of Collins Food and how and why we held it for our clients. KFC landed in Australia in 1968 when the first store was opened in Guildford, Sydney. Today, KFC serves 2 million customers every week through over 600 stores and is one of the most recognised food brands in the country. Collins Foods Limited is the largest franchisee of KFC restaurants in Australia, operating 171 outlets in Queensland, northern New South Wales, Western Australia and the Northern Territory. Collins Foods also has investments in Sizzler (Australia), Sizzler (South East Asia) and Snag Stand, but the collective profit contribution of these businesses is not meaningful to the Group. Collins Foods listed on the ASX in late 2011 at $2.50 per share, proceeds were used to pay back the vendor, private equity firm Pacific Equity Partners, and reduce gearing levels. Collins Foods is a good defensive business, but it is normally not a good idea buying from a private equity firm in an initial public offering widely promoted by large investment banks! Three months after listing, the company issued a profit warning citing fragile consumer confidence. Disillusioned investors sold the stock down to an intra-day low point of $1.00 on the 9th of May 2012, 60% below the initial listing price. Only now in 2015 has the NPAT (pre-exceptional items) come into the range of the 2012 earnings forecast in the prospectus. Generally the best time to invest is when uncertainty or an element of fear dominates the thinking of investors and market commentators towards a stock; the sell down of Collins Foods in late 2011 and 2012 was totally out of proportion to the earnings downgrade. We acquired Collins Foods in 2013 when our trust started operating at prices from $1.60 to $1.80. Our investment thesis for Collins Food cited:

The acquisition of 44 KFC restaurants from Jack Cowin in late 2013 on an undemanding multiple (probably partly due to his long standing disagreement with KFC brand owner, Yum! Brands) was a natural fit to the existing business, boosting the growth trajectory of the Group. As it turns out, not only have the original core KFC franchises performed better than expectations, the Group stands to benefit from bolting on other KFC operators in Australia, leading to further scale economies over time. At the most recent reporting period for the half year October 2015, revenue rose 5.1% to $269.7 million as same store sales at its KFC fast-food restaurants lifted 5.2%. Sizzler’s fell 12% as it continues to remain an orphan asset. Earnings before interest, tax, depreciation and amortisation was also up 19.8% to $35.3 million, reflecting strong growth earnings and profit growth. CEO Graham Maxwell said the KFC businesses continued to perform in Queensland, Western Australia and the Northern Territory. The company opened three new KFC restaurants during the half year, two of them were in Western Australia. Sixteen store revamps were completed during the half. The Sizzler Australia business is now managed as a non-core business segment with no further growth capital been allocated. Three stores were closed during the period and the company said earnings before interest, tax, depreciation and amortisation remains positive. The group lifted its fully franked interim dividend by one cent (20%) to six cents a share. Collins Foods is no longer trading at bargain prices of 2012 and 2013. Net operating cash flow is up 43.4% to $23.8m. In addition, it was pleasing to see the Group report a lower net leverage ratio of 1.62. Assuming no further corporate activity, the trajectory for net debt remains on a declining trend (whilst still paying out a healthy dividend stream). With the Friday close at $4.72 TAMIM has shown its managers will not be caught out like other investment professionals by the games of private equity investors.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed