|

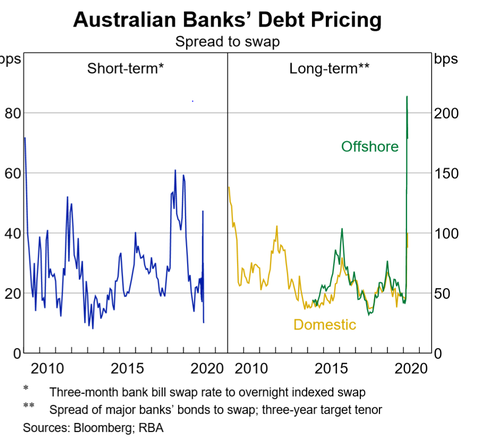

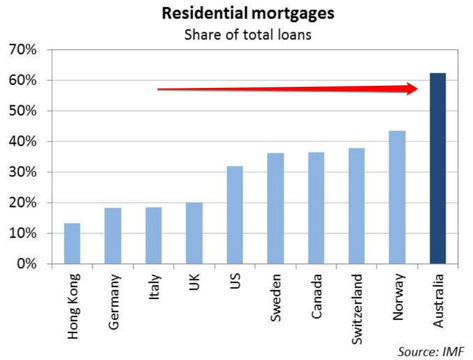

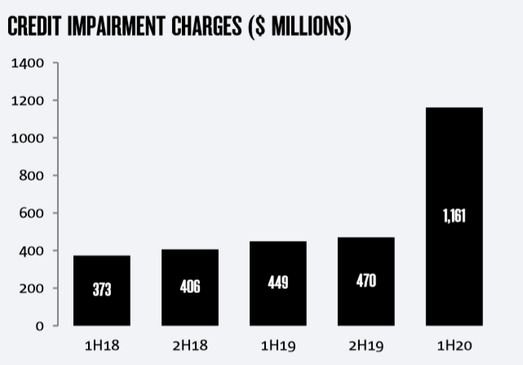

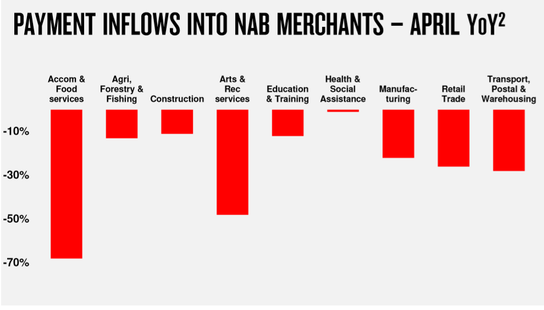

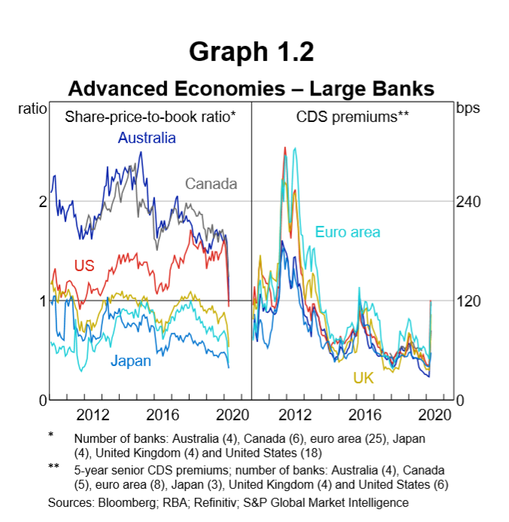

This week has seen an announcement by NAB of the anticipated dividend cut to 30c per share, and a capital raise, this pretty much makes it a certainty that the other three will follow suit. Given the centrality of the Big 4 to Australian equity investors and the broader economy we thought it pertinent to revisit the topic. In particular, with a view to see what the other banks might do and their risk profile going forward. This is all to say, is it time to buy yet? Note: Since writing this piece ANZ has deferred its interim dividend with no capital raise announced. 1.0 A Bit of Background | What has the RBA been up to? One cannot begin to look at the banks without taking into consideration the actions of the central bank. Not only because of its direct impact upon underlying profitability but also risk profiles. Perhaps the most important non-conventional action in recent months with regards to the banks has been the introduction of the TFF or Term Funding Facility. This gives authorised deposit-taking institutions (ADI’s) access to a centralised funding mechanism of at least $90bn AUD for a term of three years at an interest rate of 25bps or 0.25%. The goal being to not only buffer the balance sheet and increase liquidity but more importantly to increase credit growth, especially when it comes to SME lending. The second has been the introduction of remuneration on the ESA’s (Exchange Settlement Accounts) balances to the tune of 10bps or 0.1%. For those of you unaware, ESA’s are essentially corridor arrangements whereby the system is used to settle obligations from the clearing process (i.e. think about bank transfers as an example, the wholesale clearing will now turn into a further profit mechanism whereas before this would’ve incurred zero interest for the banks). The third development has been the injection of liquidity through the purchase of sovereigns across the yield curve and the debt of state/territory governments in a bid to keep the yield below 0.25%. For those of you who are a little more active, this might be a potential opportunity to buy every time the yield falls outside this range and turn around some quick profits. Furthermore, the average maturity of REPO’s (or Repurchase Agreements), which determine the short-term funding mechanisms for banks, have been extended from thirty (30) days maturity to seventy (70) days. This was in addition to $50bn AUD injections through daily open market operations. To briefly explain how the third mechanism impacts the banks, let's describe what Repurchase Agreements actually are. It is simply an agreement to sell securities in order to buy them back at a slightly higher price (this is what is called the repo rate). Typically, for capital adequacy requirements, in the case of the banks, this is usually treasuries. Why would the banks need to do this? The treasuries are usually used as collateral in return for liquid cash, so for short-term funding needs you might park some treasuries with the RBA in return for cash and buy back the treasuries at a slightly higher rate. The whole point is to keep the system functioning, typically the repurchase agreements mature within thirty days, but by extending the maturity this increases the amount of short-term liquidity on hand. 1.1 Have the Policies Been Effective? Simply put, yes. The measures have been putting downward pressure on funding costs and have adequately offset the higher spreads across funding markets. Increasing short-term profitability through remuneration within the context of ESA is likely to put some money onto the bottomline. The TFF should, for the foreseeable future, let the banks expand their balance sheet despite the increased credit and default risk, since the 0.25% rate is substantially lower than market rates. To complement this, there has been a spate of policy measures, such as an implicit guarantee of 50% on new loans for SME working capital by the government. The AOFM (Australian Office of Financial Management) has begun the purchasing of ABS (Asset Backed Securities) as a way to expand support to even non-ADI’s. 2.0 State of the Banks So Far | (And what to watch for in the announcements) With the RBA context that essentially seeks to reduce tail-risk within the financial sectors we now look at the state of the banking industry overall. In doing so, we borrow heavily from the FSR (Financial Stability Review). Firstly, it is important to give credit where it is due, the financial and liquidity positions of the banks since the GFC have increased substantially. Metrics such as leverage ratios (Tier 1 Capital to non-risk weighted assets) place Australian banks at the forefront within the global context, they’ve also maintained high ROE (return on equity) before the pandemic. Liquidity coverage is also significantly helped along by recent policy interventions like the TFF mentioned above. That being said, one must also remember that we have also had uninterrupted growth for close to three decades, especially within the property sector which remains the bread and butter of the Big 4. In fact, Australia remains the outlier within the OECD with over 62% of the overall book allocated towards residential mortgages. In terms of the rankings, Westpac has the largest exposure, closely followed by CBA and NAB, with ANZ being the least exposed. The big thing to watch therefore beyond all else, and over and above the SME and corporate book, will be what happens in the default rates for the residential segment. In ANZ’s case this might be the other way around with SME lending playing a greater role. We think that the TFF will be more applicable to ANZ than the other three, while the interest holidays on the residential book will impact Westpac and CBA disproportionately compared to NAB and ANZ. What to Watch 1: Residential Mortgage Defaults & SME Loan Book Earnings Credit Impairment Charges are up 156% for NAB (as per their half-year results above). One thing is for sure, the situation is likely to get messier. While historically (given the perceived “safety” of the Australian banking sector) they have traded on a relative premium to their global counterparts, after the Royal Commission and the latest Covid situation their share prices have been sunk to a level where this premium has now been all but erased. Take, for example, the share price-to-book ratios of the banks as illustrated in the graph below. Another metric to watch is the CDS (or Credit Default Swap) premiums for large banks. As the graph shows, while historically the premiums for Australian banks have been relatively lower, this is no longer the case and they are in line with their global counterparts. Note: A Credit Default Swap is a contract that helps an investor (in this case the bank) offset the credit risk with that of another investor. Think of it like an insurance premium you pay for a rainy day. What to Watch 2: CDS Premia & Cost of Wholesale Funding The other thing to understand is that, given the interest rate environment and the unlikely prospect of a change to this anytime soon, there will also certainly be an impact upon their NIMs (Net Interest Margins). This is despite the fact that they can overcome some of these hurdles by going overseas for wholesale funding which are unconstrained by the 0-bound (meaning that they can source capital at a considerably lower rate). We also see the increased use of USD-Swap lines established by the Fed, though this hasn’t been the case so far in Australia. 2.1 Where to Next? One historical advantage for the banks is that they pay interest on deposits that are indexed to the cash rate (as opposed to fixed) which means that they have been able to fall with the cash rate. This brings us to another issue to watch for when deciphering the announcements, the amount of loans that are variable vs. fixed. Your best bet would be a player that has a large amount of fixed rate mortgages as opposed to a variable. This point is pretty basic so we won’t labour it, it simply means they have more security in their revenue and that, we think we can all agree, is something we like. What to Watch 3: Percentage of Fixed vs. Variable Loans  3.0 Is it Time to Buy? Overall, we do not see a silver lining here if their global counterparts are anything to go by. Yes, they have always been and will remain relatively safe bets for overall portfolios. But there will be increasing stress and reliance upon monetary policy to cushion their balance sheets. This is likely to be just the beginning of a rather drawn out process. The thing to watch will be inflation (given that banks tend to behave rather well in these environments) and credit distress. With unemployment figures likely to go into the double digits we will likely see stress in both the property and residential mortgage sector. Not necessarily increasing their risk of bankruptcy but more their ability to pay dividends and keep the same level of credit growth that they have been used to for close to three decades now. There will come a time to buy for the long-term. Though holding on a short-term basis for the purposes of getting access to capital raises might be a rational strategy to play the exposure. We think that this is the beginning of more to come, diluting existing shareholders. They are good businesses but we expect more downside for share prices as more cap raises are in the pipeline and with dividends likely to go lower for the foreseeable future. So no, not quite time to buy, but as the news flow regarding dividends and capital raising finalises this will bring about opportunity.

2 Comments

john Hanson

1/5/2020 07:34:58 am

Given the overall importance of the banks to our society, I do not think that they should abandon their shareholders and reduce dividends to zero.

Reply

Sid Ruttala

1/5/2020 11:39:05 am

Hi John, we would agree with you with the caveat that optics is important, especially if they require further assistance from the RBA and government.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed