|

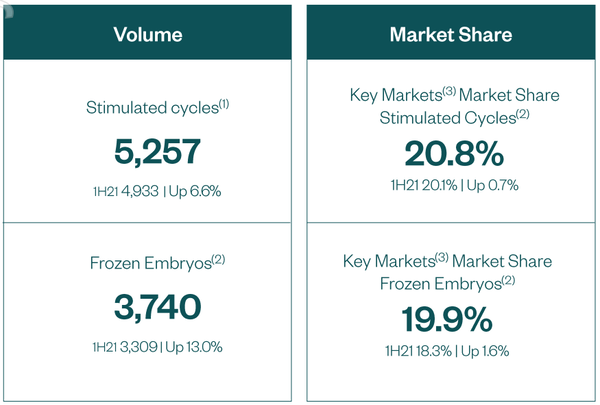

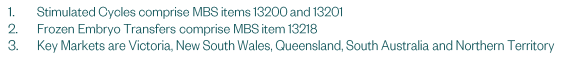

This week Ron Shamgar takes a look at an expanding healthcare services company that has traded well despite a tough operating period; a stock that could also potentially be interesting from an M&A perspective. Author: Ron Shamgar Monash IVF Group (MVF.ASX) MVF is a leader in the field of human fertility services and is one of the leading providers of Assisted Reproductive Services (ARS) which is the most significant component of fertility care in Australia and Malaysia. ARS encompasses a range of techniques used to assist patients experiencing fertility issues to achieve a clinical pregnancy. In addition, MVF is a significant provider of specialist women's imaging services MVF has clinics in Australia and is expanding internationally through their Southeast Asia strategy. MVF have approximately 20% of the market share in Australia. They have seen continued growth in their cycles, up +6.6% on previous comparable period (pcp). MVF’s first half results were solid given some of the impacts they would have experienced due to Covid-19. The biggest impacts were on their ultrasound businesses along with their clinic in Kuala Lumpur which was affected by movement control orders. It's also worth noting that MVF saw significant growth in H1FY21, maintaining those levels despite a tough operating period is what investors should be looking at. January would have been a slow month for MVF due to Omicron but we expect that cycles should stabilise from here as they operate in a normalising environment. These patients aren't going anywhere, it just boosts pent up demand. Malaysia saw a recovery in Q2 with +15% growth in revenue, we expect this recovery to continue into the second half. They have a great brand, are increasing pregnancies in a mature market, building their scientific capability and will continue to attract specialists. In the half, MVF attracted four new experienced domestic fertility specialists. It is important that MVF continue to invest in their scientific capabilities to continue attracting talent for expansion which will grow volumes in turn. MVF will be opening clinics in Penrith and Darwin this half while also launching clinics in Singapore and Bali, which should add 300 cycles p.a over the next few years. Their Kuala Lumpur clinic was doing 1,000 cycles pre-Covid so Southeast Asia should be doing over 1,400 cycles p.a. in FY23. Given that MVF did 5,257 cycles in the first half, their Asia operations will form a material piece of the business. MVF will continue to look for partnerships in Southeast Asia as well as explore M&A if the right opportunity presents itself. MVF are launching testing kits which will help people assess their fertility. They expect to be distributing 100 kits a month. The biggest benefit of this will be that the obvious choice for people that come up as at risk using the test kit will be to use MVF. They think that this could account for 10% of their volume in the next five years. Takeover Activity  Fellow listed peer Virtus Health (VRT.ASX) received its first takeover bid from BGH Capital at $7.10 a share in December last year. The latest offer, from CapVest, was $7.70 a share. VRT operates in Australia, UK, Denmark and Singapore. We believe that VRT’s stronger international presence is what saw them receive takeover bids over the likes of MVF. MVF is the smaller of the two and has half the market share in Australia, nonetheless, MVF is working on their international expansion and we think they could be heading down a similar path. The latest takeover bid for VRT values them at approximately 12.4x EV/EBITDA, making MVF look cheap given that they are currently trading around 8x EV/EBITDA. If MVF were to trade at the same multiple as VRT they would be sitting at a share price of $1.68 (based on FY22 EBITDA of $52.7m), a ~30% premium from the current share price. Outlook When looking at companies we also like to try to examine them through the lens of a potential acquirer. That is, what would someone else pay for this company? The recent bids for VRT show that there is interest in the IVF industry from private equity players. It also tells us that the multiple they are willing to pay is far above what MVF is trading at. MVF has a strong foothold in Australia (20% market share is nothing to sneeze at) and are building out their international presence so we wouldn’t be surprised to see MVF receive a takeover offer at some stage. Looking into the second half, MVF has seen an +11% increase in new patient sign ups domestically and has a strong pipeline of returning patients. The industry has also seen increased government support and they anticipate further government funding which improves affordability for patients, one of the biggest constraints of IVF treatment. Disclaimer: MVF is currently held in TAMIM portfolios.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Stock CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed