Author: Robert Swift

Confirmation bias is a common problem for portfolio managers. You have a thesis and then look only for news flow and data that confirms that thesis.

Since there always lots of news and data available, this bias is commonplace. However sometimes, you’re right and the news flow is supportive because it is meaningful.

One such example now is a subtle shift in language coming from central bankers and finance ministers, representative of a shift in macro policy from monetary to fiscal. For a number of reasons they will never say the last twenty + years of continued monetary incontinence has a) been a mistake and b) a mistake that has gone on too long in the face of evidence that illustrated its shortcomings, but at least we are seeing a shift? We think so at least and have positioned the portfolios accordingly. This has implications for the kind of risks that should be in your portfolios.

Here’s where we think the language has shifted and how it points to more fiscal; and the flip side, a continued steepening of the US yield curve with that of certain other countries to follow.

This is the start of a global paradigm shift or pivot.

- John Williams the President of the Federal Reserve Bank of New York, one of the 12 Banks in the Reserve System effectively stated recently – we may have had interest rate policy that unduly benefitted wealthy people.

- Janet Yellen, the Treasury Secretary in charge of spending and budgets, stated in selling the $1.9 trillion package to Congress, that with this fiscal package we now have a chance to come out of this recession strongly rather than the anaemic recovery we had from the GFC in 2008. In other words monetary easing alone did ‘naff all’ but raise debts.

- And the dog in the night that still doesn’t bark – there was no mention of Yield Curve Control by Jerome Powell in his latest testimony to the House Financial Services Committee in February.

- USA Banks’ Supplementary Leverage Ratio or the ability to use Treasuries, was NOT renewed by the Fed, and will end on March 31st. This ability was conferred as part of the Covid response and shows the confidence in the economic recovery. It may also see the banks sell Treasuries.

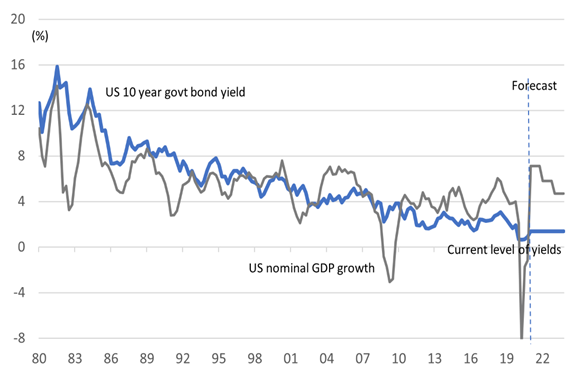

- With economic growth at 4, 5, maybe 6% annualised, the 10 year note has no business being at 1.6%. Typically nominal long term bond rates mirror nominal GDP. So, we should be approaching at least 3%?…assuming we revert back to long term trend growth after the easy comparisons are over?

See the chart below from our colleagues at GCIO in Singapore, with whom we run an Asset Allocation service.

- Japan may be following – we also know that central bankers talk to each other and was it a coincidence that the Bank of Japan, announced recently that it is now pulling back from asset purchase programmes (monetary injections) by removing guidance on ETF buying AND it widens the band for long bond yields albeit by a very small amount

- The ECB won’t and so we fully expect the Euro to weaken from here as interest rate spreads widen. This also makes the financing of the 20% US budget deficit (yes that’s right) easier since yield spread will attract foreign buyers of US government paper.

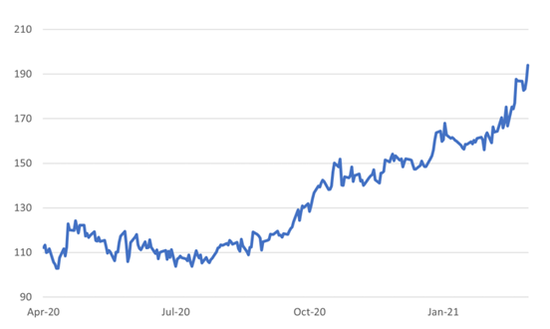

See the chart below for the spread between US and German backed Euro bonds.

Powell is a genius tight rope walker here. He can’t abuse the notion of fiat money much more than it has been in the last 20+ years. Greenspan, Bernanke and Yellen did that to excess during their tenures, leaving with him with a nasty condrum – the markets need the opium of easy money and a free put option; this dependency is not good for their long term health; weaning them off it may cause a tantrum.

However at 100% debt to GDP he can’t really let rates get too high as he administers ‘cold turkey’ since debt service costs will be usurious as a drain on the budget. By using calming language now and talking UP the economy, he is tempering the inflation threat early; calming the markets about his attitude to fiat money and their elevated prices, and yet letting some element of doubt or risk back in. If you are calmed by his thoughts on inflation and how it isn’t present (oh yeah?), then remember that NO asset price crash has occurred without the CPI or PCE being ‘under control’. Essentially they have to deflate this bubble WHILE stating that the economy is on a sound footing AND prepare us for a shift in macro policy away from what has clearly not worked. We hope we can be talked down calmly.

(If you want an apology about the horrible policy errors conferred on us all, forget it).

(The inflation statistic is a horror show once you try to understand what is in there and frankly horribly adulterated. So if you don’t look out for ASSET bubbles then you will miss the danger signs. I think it was Bismarck who said that the 2 things you should never see being made are sausages and the law. I think we can add ‘inflation statistics” to that?)

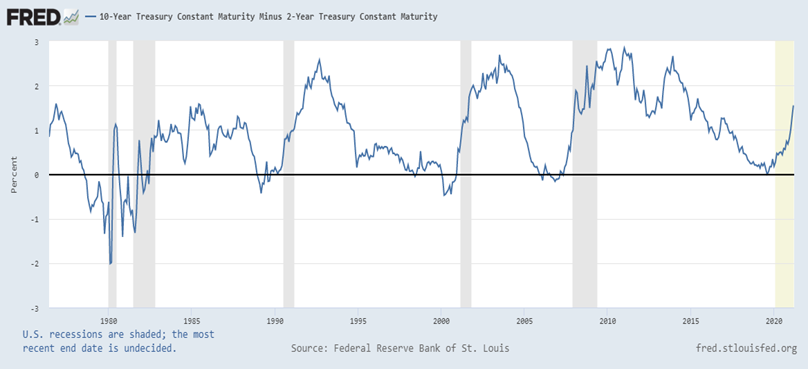

We are nearer the end of the long rate rise vs short rates than the beginning but they ain’t going down below 1.5% again.Charts from ‘FRED’ or the St Louis Federal Reserve Bank, show the average 10s vs 2s spread is about 1.2% over the last 50 years…we are just above average now.

Now maybe we should be using the ratio rather than the arithmetic difference since the steepness is relevant, and if so then we are certainly closer to the above average point.

Implications for equities and bonds are (we think) clear:

- The SHAPE of the yield curve will benefit dividend paying companies

- More fiscal spending will benefit industrial companies and smaller companies

- More regulation and higher taxation may take away some of the tailwind to equities of the last few years

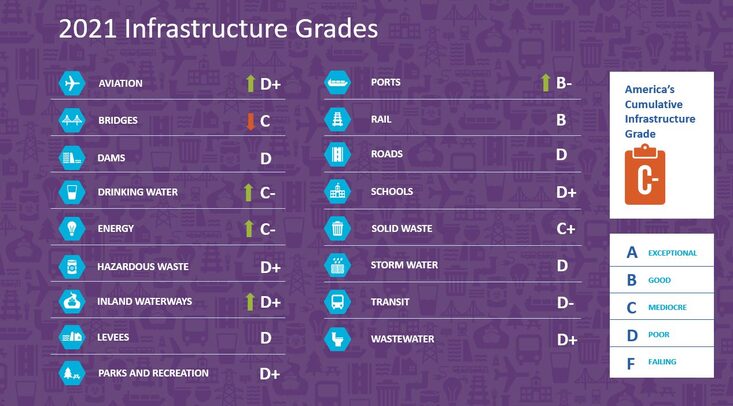

- The targeted fiscal programme will benefit US Infrastructure stocks (a theme we have been boring everyone on for a few years now) and it will be more than Utilities that benefit – we own Quanta, Johnson Controls, and others whose products will be essential as the grid and capital stock are upgraded.

See: Nextera Energy – Having your Cake and Eating it?

- Add in the geopolitical shifts with the Quad alliance and Japan becoming a key partner, then Japan continues to look very good – here we have long argued that Japanese technology is ludicrously overlooked especially in the area of Semiconductor Production Equipment – here we have owned Advantest, Tokyo Electron, Ibiden etc for a while. It’s not too late. While ‘Technology’ may be vulnerable to this shift in macro policy, not all Technology companies will be. Valuation spreads are wide, business models different, and balance sheets and cashflows too.

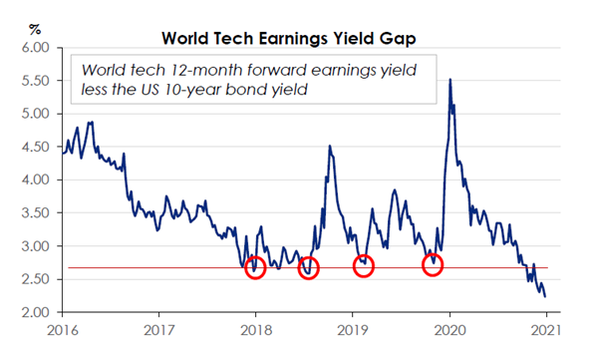

- In short Technology is a sector in which stock specific risk will be rewarded – if your manager has skill. If you have a manager who buys all of it regardless, we show the chart below. You have been warned!

- Do not be greedy about equity returns. Profitability is above average, wages relative to profits must rise, companies have underinvested and need to catch up, taxes should go up, and the world is becoming less price efficient as trading blocs are fragmented by political alliances.