|

This week the small cap team take a look at the importance of a good management team when investing in a company. They take the time to spell out exactly what they look for when considering management. Summary:In our experience management quality is arguably the number one determinant of a company’s long term success. We believe this is more leveraged in a smaller company because each strategic decision can have a larger impact on the future of the business from a relatively lower base. This means getting to know management is an essential part of our investment process. In this article we discuss what we look for in a high quality management team. Why management are so important in smaller companies? We believe management quality is the most important single factor to get right when investing in a smaller company for the long term. There are a number of key reasons for this:

1. Clear communication regarding strategy In our experience, it is best if management can explain their strategy to investors simply and clearly, and without the use of too many words. This elevator pitch concept is a great way of filtering out complex business models as our best performing stocks have almost always been simple and easy to understand businesses. We believe the simpler the business model to understand, the less moving parts in general, and thus the less unforeseen risks lurking in the background. Stock example: Joyce Corp (ASX:JYC) management are great example of a clear communicating management team. Whenever we meet management or read through the company’s investor presentations we are 100% clear on where the business is going longer term. 2. A long history of successfully working in the business We like to invest with management teams who have worked their way through the ranks of an organisation over an extended period of time. These types of managers tend to understand the business better than newcomers who go straight into a top level executive role. And importantly, long term managers will have seen the business through different economic cycles, and thus tend to understand what needs to be done to manage sustainable long term growth. Stock example: Pioneer Credit’s (ASX:PNC) CEO and founder, Keith John, has been working in the business since the company’s beginnings and in our opinion knows everything there is to know about his business. 3. Shareholder friendlyWe are looking for management teams who will put their shareholders first which tends to reflect itself in:

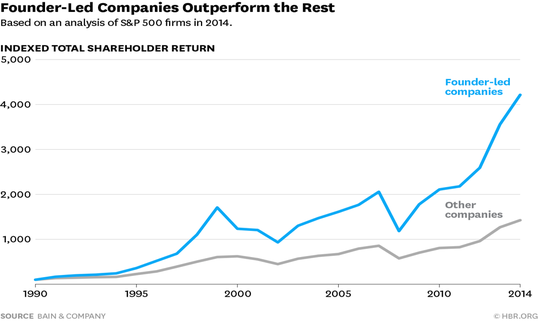

4. A passion for the business This one seems obvious but it is relatively unusual in our experience. We like to come out of management meetings inspired by management’s energy in the room, and with the feeling that management are having fun in their job. This can only really be gauged through face to face management meetings. Stock example: (We will need to keep this stock’s name confidential so as not to cause offence.) We recently had a meeting with a management team who were clearly down in the dumps about their business prospects. And importantly, their energy had turned negative after a difficult year whilst their thinking had become defensive. We left the meeting exhausted by the negative energy from the meeting. This is clearly the opposite of what we look for. 5. Humility We have found ourselves increasingly aware of how humble (or not) management teams are in recent years. In hindsight, this can be explained by our belief that that the least humble, most arrogant management teams have tended to disappoint us over the long term, whilst the most humble management teams have tended to perform the best. There is a great Conversation article on this subject (see website link in references) which confirms our sneaking suspicion that humility in management tends to correlate with long term stock out-performance, and goes on to explain that it is remarkably hard to find humble CEOs these days for the very reason that they have reached the top of the corporate ladder by being highly confident: “CEOs tend to score higher than the general population on personality attributes such as achievement-orientation, ambition, assertiveness, and risk-preference. Individuals with some, or a combination, of these traits may be particularly adept at pretending to fit ideal criteria for a specific role. For instance, studies show that narcissists are particularly skilled at appearing charismatic at first sight. Charisma, in turn, has long been considered a desirable feature of CEOs. CEOs perceived as charismatic, accordingly, receive higher pay. Genuine humility may thus be a scarce personality feature among candidates for CEO positions.” 6. Skin in the game In recent years having skin in the game has become a widespread market expectation as the empirical evidence shows that companies run by management with significant stakes in the business significantly out-performs over the long term: We concur, and aim to invest alongside management teams who are significant shareholders in their business. Conclusion:Finding the right management teams to invest in takes a significant portion of our time. In our experience, picking the right company leadership is highly likely to have positive knock on effects throughout the companies being invested in. As a result, we believe time spent looking for the best of the best management teams is time well spent.

1 Comment

Donald Swain

28/9/2017 04:36:01 pm

As trouble in an organisation can be blamed, ultimately, on the monkey at the top of the tree, so success down through the ranks and community performance, reflects just how effective that top chimp manages those on the lower branches.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed