|

This week Guy Carson takes a look at the Royal Commission into banking and examines what the impact could be for your bank shares. I have to be honest, when the royal commission into the Banking, Superannuation and Financial Services sector was first announced I was skeptical. I thought that the commission would be akin to a “Dog and Pony show” with banking executives grilled for hours about already known scandals and they in turn would focus the blame on the behaviour of individuals. I was wrong and that was fairly clear from day one when the revelation that Bank Managers at NAB were sacked last year due to accepting envelopes stuffed with cash in order to falsify mortgage applications. Whilst it is still early days and final determinations are unlikely until later this year or early next year (a final report has the cut-off date of 28 February 2019), there are some observations we can make from the initial hearings. These hearings have followed a case study format; the banks were asked to submit their internal knowledge of their misconduct over the last ten years and the public was also asked to submit about potential misconduct. To date 2810 submissions from the public have been received. The hearings over recent weeks have been widespread and we have heard about residential mortgages, car finance, credit cards, add on insurance products, credit offerings, and accounts administration amongst other things. To date, some of the misconduct exposed includes:

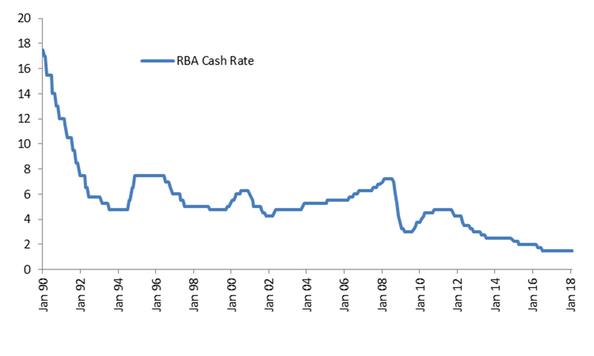

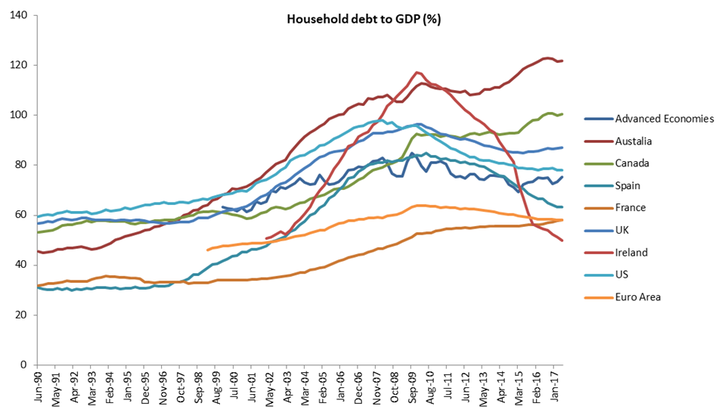

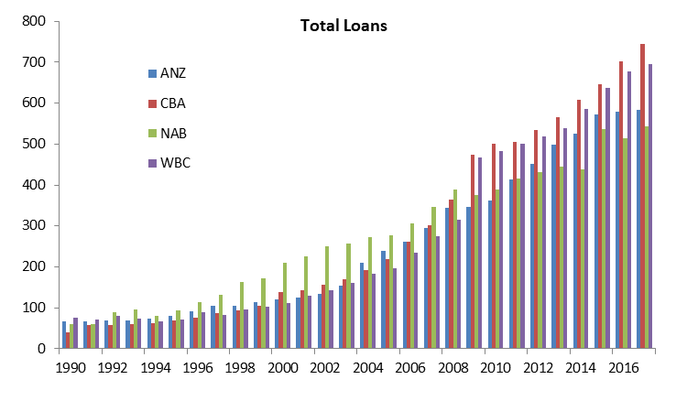

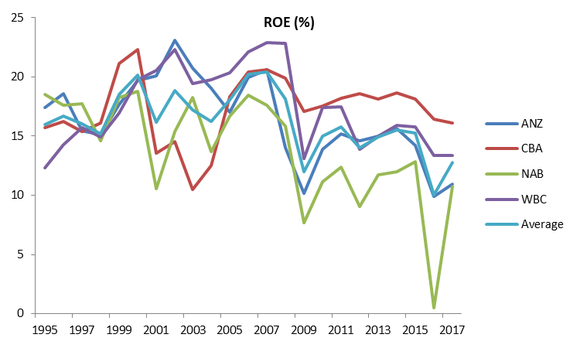

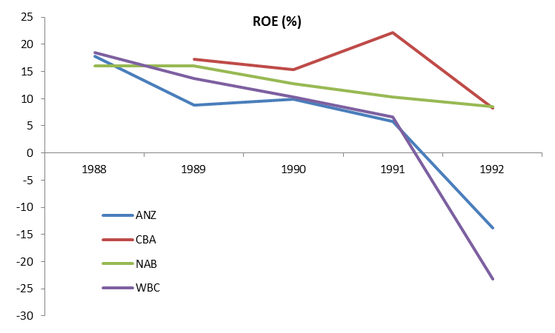

Remember these are in addition to the already known misconduct which includes the Commonwealth Financial Planning scandal, the Comminsure scandal and the recent AUSTRAC money scandal. Adding everything up suggests that the ability of the banks to blame the misconduct on rogue individuals is waning. Also the revelations go a long way to backing up the recent research from UBS around “liar loans”. So what does all of this mean for your bank shares? Well, in order to understand that, it’s important to look back at history. Last year we wrote a piece entitled “Australian Banks: The death of a 25 year bull market” which can be found here. In this article we looked at the rise the banks had had since the early 1990s and the remarkable success they had been as investments. Behind this success were two key macro factors. Firstly, the 1980’s which saw a significant amount of deregulation for banks and the beginning of the Basel capital requirements. The original Basel accord in 1988 looked at minimum capital levels and the risk weightings of different types of loans. For residential mortgages, risk weights were set at 50%, hence banks had to carry half as much equity against them and could in effect leverage their balance sheet twice as much. This helped kickstart a boom in Australia. Adding to this was a falling interest rate environment. Interest rates over the last 28 years have gone from 17.5% to 1.5%. Amazingly over that period, Australia has barely been through a tightening cycle. Basel 2 in 2007 added a further tailwind with the banks effectively allowed to set their risk weights through their internal risk models. The banks moved to a 17% risk weighting for residential mortgages. Given an 8% minimum tier one capital ratio at the time from APRA, banks were allowed to leverage their equity 83x. A 17% risk weight means they only have to hold 17% of the 8% minimum capital requirement. In other words for $1 of equity, a bank could lend out a staggering $83 in residential mortgages. The combined impact of reduced capital requirements and low interest rates allowed Australian households to take on more debt. This debt sat inside the banking system and was the key driver behind the growth in their loan books. The four banks as a whole have grown their loan books from $242bn in 1990 to over $2.5tn today, more than a 10 fold increase. The problem for the banks now is that the two major tailwinds (deregulation and lower interest rates) of recent decades have either stalled or started to reverse. In our opinion this reversal is the key reason why the share prices of the big four remain below their highs seen in 2015. Interest rates are sufficiently close to zero that further scope for lending growth from rate cuts is limited. It also suggests that the capacity of households to take on more debt is limited. Hence for the banks it will be a struggle to grow their loan books. Furthermore, after a long period of supportive regulatory changes, APRA has started to reverse course. In recent years they have increased the risk weightings the big four apply against residential mortgages and have imposed speed limits against investor mortgages. From our perspective, further regulatory action is one of the four areas where the risks from the royal commission lies. The others are potential fines, changes to remuneration structures away from a sales focus to softer targets, and changes to commission structures for broker networks. Potential Regulatory Action Fines will be one-off in nature and whilst they offer shock value, they won’t overly impact the long term value of these businesses. The banks have already started to shift towards softer targets in their remuneration (something senior management is probably happy about at this point) and the brokers will be the ones likely to feel the impact of commission structure changes. It really is regulatory action that will most likely carry the biggest problems. After cracking down on growth, the focus from APRA will potentially turn to risk management. Internal risk processes will be reviewed, most likely at a cost to the banks. In addition staff numbers in risk associated roles will most likely increase. Of course these cost increases will be offset by the large amount of job cuts that the banks have been undertaking over recent years. Over the two years from 2015 to 2017, ANZ reduced their staff numbers from 50,152 to 44,896. Meanwhile, NAB has recently announced plans to reduce their workforce by a net 4,000 employees out of a total of 33,422. Banks have reduced their cost to income ratios significantly over the last 25 years dropping from above 60% to close to 40% with technology being the key driver. Technology has brought down the cost to income ratio for banks by allowing them to work more efficiently with less staff concentration. This trend will continue with the significant job cuts listed above being the key driver of a falling cost to income ratio. However, increased regulation will continue to put pressure on the banks profitability. Return on Equity for all of the Big 4 has dropped over the last two years on the increased capital requirements from APRA. Further regulatory action will continue to put pressure on this. The Outlook So what is the outlook for the profitability of the sector and ultimately the shares? Our view remains unchanged from a year ago when we wrote:

Credibility

The final impact that this royal commission will have on the banks is their credibility. In 2008, financial systems around the world started to crumble and property markets went into freefall. In Australia, the economic fallout was much less and the banking system came through in much better shape. We were told we were different, that our banks were better behaved and that is a key component behind what saved us. The reality of the situation is our economy and banks were saved by a central bank with more firepower, a government that engaged in aggressive fiscal stimulus and of course China. Anyone who suggests that our well behaved banks were part of the solution just needs to read the list of transgressions above and reconsider that position.

2 Comments

Phil Whish-Wilson

29/3/2018 04:42:28 pm

Good luck with finding a stock with limited downside risk and plenty upside potential that pays a dividend of around 5% yield and isn't already too expensive.

Reply

Guy Carson

3/4/2018 12:55:08 pm

Hi Phil,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed