|

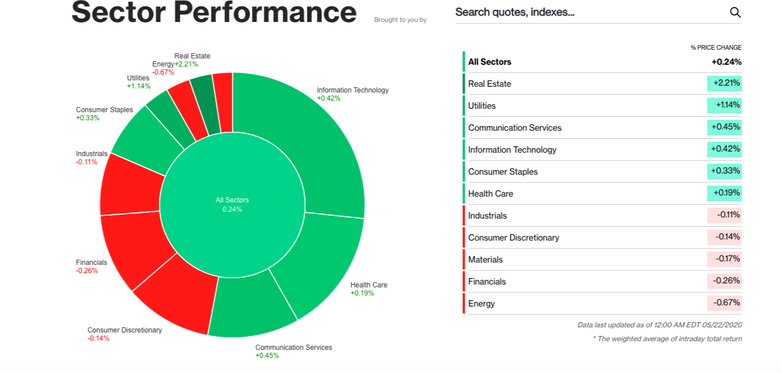

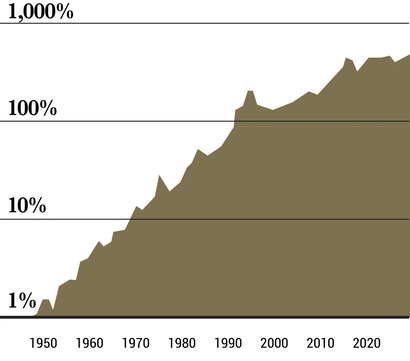

What do premium art, technology stocks and agricultural assets have in common? This might sound like a rather ridiculous notion to explore but bear with us for a little and it will hopefully make a little more sense.  Author: Sid Ruttala Author: Sid Ruttala Some Context Every so often, as investors, we come across situations that we cannot grapple with and it reminds us that one of the best things to do is to constantly question our own assumptions. To see what we take for granted and to flip it on its head. And so, despite the pre-programmed economist in me that insists that there is a fundamental disconnect between the real economy and valuations, let us posit an alternative, that just maybe the markets might have it right. To quote that great titan of a trader Jesse Livermore, “the markets are never wrong but opinions are.” After all, only 22% of investors responded that they are bullish with regards to the broader markets according to an AAII survey (Source: Seeking Alpha). Forgive us if this goes against the grain of everything we have been arguing up until now about the exogenous nature of current events and the idea that we would need to see a marked difference in the real economy before seeing a proper recovery in the markets. But one thing that constantly baffles us is the AfterPays, the Appens and the FAANGs of the world. This does not seem to us like a vanilla old bear market bounce. The outperforming sectors have been 1) hard assets and 2) technology stocks. Could it be that perhaps the markets are not in fact banking on a rapid recovery in the economy but rather that they are discounting a u-shaped recovery whilst being cognizant and rewarding sectors that are likely to perform well? Ask yourself the question of how much of the retracement in the US markets was led primarily by the top-heavy tech titans? And which sectors of the ASX performed well? Granted, we don’t quite have the FAANG equivalents in this country. A case can be made that our WAAAX stocks are where they are at least partially because the Australian market is so starved and underrepresented in the tech sector; average size fish in a small pond if you will. But in Australia, the performers have been the consumer staples, healthcare and gold (yes, AfterPay and Appen have done well too). Perhaps this isn’t a market that is unquestioning, but rather discerning?  The technology stocks benefit given key catalysts and the creation of long-tailwinds to their revenues and backed by an exceptionally amenable central bank policy. It does also help when the discount rate one uses to do valuations is 0-bound and, as a result, valuations increase in a similar fashion. Gold and hard assets are rallying not only because of uncertainty but, one could argue, due to pure debasement of fiat currency and the Japanification of the western countries. What we mean by this is the increased tendency across the western world, to go towards high indebtedness combined with low growth, without the advantage of owning your own debt of course (i.e. the Japanese owning most of the issuance and actually being net creditors to the rest of the world). The point here is this. Perhaps we (and many of our industry counterparts) might just be wrong in writing off the latest bounce as a fallacy. Judging purely by the outperforming sectors (see below), this market is creating significant dislocations. If it were not the case then the energy or airline segments would not be where they are globally. The overall index has been driven primarily by outsized returns from growth and defensive assets. Outside of equity markets, the latest trends have been the increased use of securitisation of agriculture, masters’ art (including arts-based bonds and private equity), and even collectables such as vintage wine and cars. Could the demand for these asset classes be a sign of rational markets working through the uncertainty in a perfectly reasonable manner? Granted, the number of retail investors in liquid markets, including those essentially using equity markets as a substitute for sports betting, has made for a rather interesting environment in terms of adding volatility. Overall we are slowly starting to change our views on the rationality of the latest bounce. After all, this financial strife was not rooted in economic issues (regardless of your view as to if a crash was due or not). We created this to address a health crisis. The problems actually related to the real economy will hit us in the coming months. The good news? We know it is coming. We know that there will be issues as when much of the population comes off the government teat as the health crisis subsides. We know that the unemployment and underemployment that has jumped due to this crisis will start to have an impact on the real economy in a few months. People shouldn’t be caught off guard when this rolls through, people have time to appropriately prepare their portfolios and adjust their risk management strategies accordingly. Where to Next? We have previously mentioned that our baseline case was for inflation to come back into the picture, something which we have been assuming since late last year. Recent events have changed this scenario rather markedly. One of the biggest threats to the markets and the economy is a deflationary spiral. One must remember once again that this isn’t the typical run of the mill recession, there was no decrease in productive capacity. What is likely is that supply in the short-run outweighs consumer demand globally. It would be rather naive to assume that consumers after going through the events of the past few months would revert back to the 2019 levels in terms of spending or in sentiment. Take the case of Chinese industrial production, which has started growing at 3.9% for the month of April, almost twice the consensus estimates. This is a scenario that has occurred without the economy even being fully opened up and consumers not getting back to business as usual. Where does this excess supply go? Well, in the absence of trade barriers, businesses will seek to export their way out of these problems. We could see similar trajectories across most western economies even in the absence of a second wave which requires further measures aimed at a second lock-down. However, this is the initial stage. A policymaker’s worst nightmare is an eventual stagflationary scenario. While the sheer amount of excess liquidity through fiscal and monetary measures does eat away at the real value of the currency in the long-run, this would not be an issue since it has the advantage of eating away the real value of additional debt. However, in the event of structural unemployment and excess productive capacity this would come at the same time as 1) low real-wage growth; and 2) freezing up of supply chains. Forgive us if this sounds rather pessimistic but, unfortunately, this is a scenario that is all too familiar for the history nerds, think the Great Depression or the 70’s post the dismantling of Bretton Woods. So what then are we to do? Herein lies what premium art, technology stocks and agricultural assets have in common. In every single one of these scenarios, investors would perhaps have been best served by holding real assets, whether in the form of businesses (i.e. equity), real estate or, for the more adventurous, agricultural assets and even fine art. Which, by the way, is one asset class that has a low correlation to other classes and has seen close 8.5% p.a. growth for the past twenty years. Sothebys Mei Moses Index This is also the result of a trend that is likely to get even worse, that trend is income inequality. The continued debasement of currency is only likely to get worse and makes it all the more reasonable to stay invested in spite of the volatility, perhaps not getting the returns that we are now used to post-GFC. So, you could say that one remains bullish for lack of a better option.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed