|

Kevin Smith, of Delft Partners and portfolio manager of the TAMIM Asia Small Companies Fund, addresses Japan in the wake of some of the negative news associated with the market. Japan forms an integral part of both the Asia Small Companies and Global High Conviction portfolios and it is important to stay abreast of what is happening in one of the world's largest economies. Our October article highlighted that the Japanese equity market is changing with:

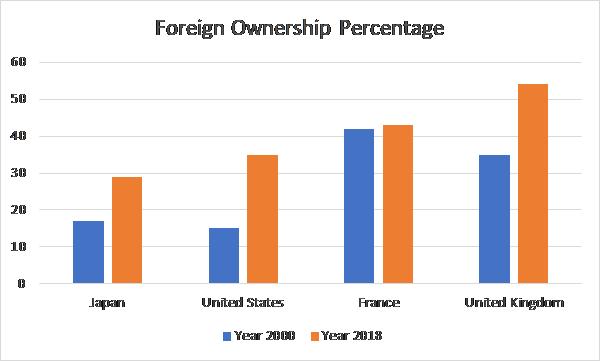

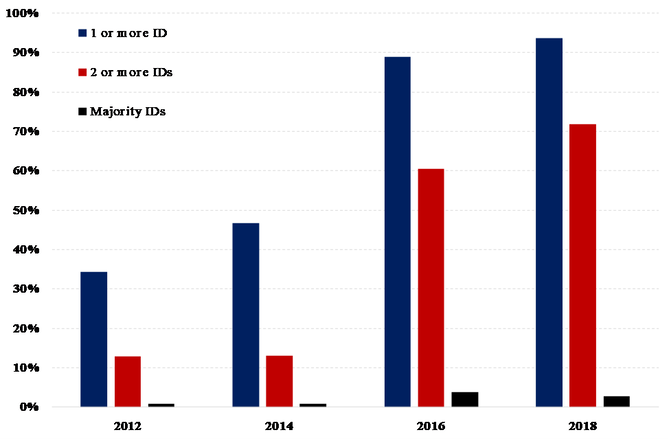

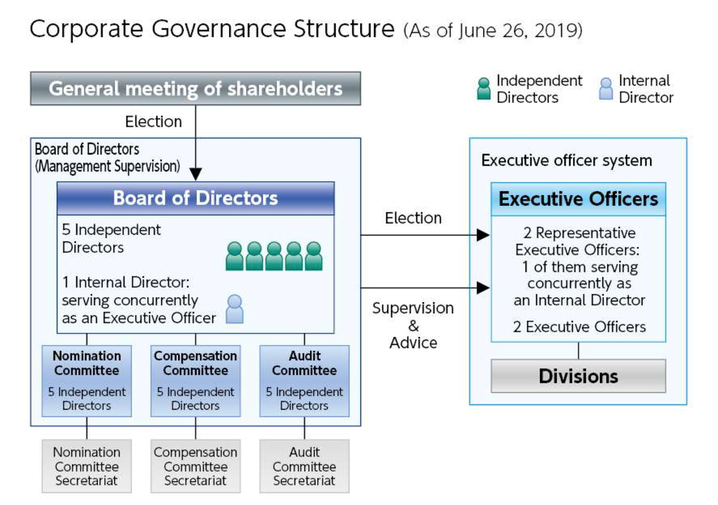

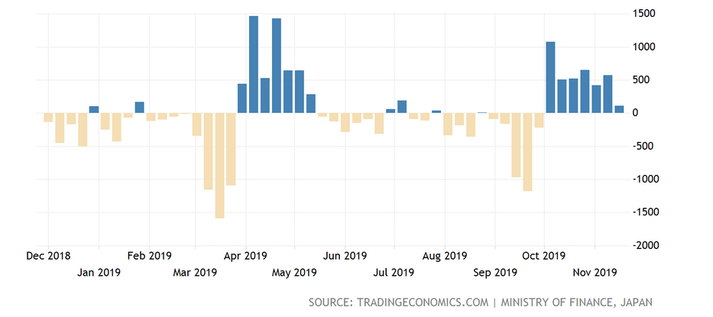

We would like to reiterate our positive view of Japanese equities with this follow up article and address some of the negative news associated with proposed amendments to the Foreign Exchange and Foreign Trade Act (FEFTA) which are designed to control foreign investments that could threaten Japan’s national security. If the Bill is passed before the end of the extraordinary session of the Diet this month, the new rules would come into force in the first half of 2020. The main source of concern is the proposed 1% threshold (reduced from 10%) above which prior notification is needed for international investors to hold an equity stake in Japanese listed companies in key industries. By way of background, the listed equity market in Japan has a relatively low percentage owned by foreign investors, currently 29% up from 18% in the year 2000. Some international comparisons are shown in Table One, each country has higher percentages of foreign ownership, the United States having changed dramatically in the past two decades while France and the UK have always maintained relatively high levels. Table One: International Ownership of Equity Markets in Japan, US, France and UK An example closer to home would be Taiwan that currently stands at 40% foreign ownership which has increased from zero in 1990. Taiwan suffered from a very similar financial bubble to Japan in the same timeframe of late 1980s to early 1990s. Taiwan responded to their financial crisis by allowing direct foreign participation in the equity market for the first time in 1991 when foreign ownership of the Japanese market was at 10%. The opening of the market has seen much larger foreign participation in Taiwan than that of Japan, although the latter is now at least showing signs of catching up. A key factor in the opening up of Japan has been the reduction of defensive cross shareholdings. During the 1990s cross shareholdings accounted for more than 30% of the market capitalisation and today that number is less than 10%. Excessive cross shareholdings were associated with poor capital efficiency and complacent management in protected companies who were not motivated to deliver strong returns to their shareholders. There was a strong negative correlation between the number of cross shareholdings held in a company and return on equity achieved by that company. Aggregate return on equity for the market in Japan wallowed in low single figures for more than two decades and has only started to approach the double figure level in the past two years. The Corporate Governance Code of 2015 has seen a dramatic reform in corporate leadership, ensuring transparent and fair procedures are used in the appointment and dismissal of senior management. The job for life culture has been eliminated in Japan. The Code recommends that companies appoint at least two independent directors, you can see in Table Two that more than 70% of companies have complied with that requirement, a dramatic change from 2014 when only 12% of companies had two or more independent directors. Table Two: The Rise of Independent Directors in Japan We expect to see big steps taken towards Boards with majority independent directors in the next five to ten years. Medical technology business Hoya Corporation is an example of a company that has made the transition to a majority of independent directors. Hoya Corporation has a structure that should be a model for other companies in Japan with 5 independent directors plus the CEO comprising the Board and all sub-committees are controlled by the five independent directors, see Table Three. Hoya Corporation therefore scores well on our assessment of corporate governance and is included in our concentrated portfolio of global equities. We like their rule that directors must attend at least 75% of meetings in order to qualify for re-election. The Board conducts an annual survey of effectiveness, operates clear rules regarding conflicts of interest and has a strong disclosure policy. Hoya Corporation specifically has a policy of not maintaining cross shareholdings and employs no anti-takeover measures. Table Three: Board Structure of Hoya Corporation We have seen strong international buying of Japanese equities in recent months, Table Four shows the weekly flows in 2019 with positive numbers apparent in April/May and October/November. Table Four: International Participation in the Japanese Equity Market The average level of weekly net buying of Japanese equities by international investors since 2005 is just ¥37 billion which is equivalent to USD 18 billion per annum. In the past two years we have seen weekly outflows as high as USD 20 billion (March 2018) and annual outflows of more than USD 50 billion.

In our October article, we highlighted that a key change in Japan is the rise of activist shareholders, buying significant stakes in companies then demanding changes in strategy, structure and management. A survey by Nikkei found that 139 new stock purchases in the first eight months of 2019 were made with the intent to encourage companies to change how they do business. We suspect that the pace of change has caught the Japanese authorities and companies by surprise, perceived domestically as too much pressure to change too quickly. The existing disclosure rules leave companies wide open to unexpected changes in the shareholder registers which historically didn’t happen in the era of defensive cross shareholdings. The scale of recent inflows has been impacted by the news surrounding the proposed amendments to FEFTA. We have seen industry bodies challenging the Ministry of Finance regarding the consequences of the changes to FEFTA and the response has been to start to modify and moderate the impact of the Bill. For example, international pension funds and sovereign wealth funds are excluded from the prior notification requirements together with international investors who do not intend to seek board seats. The Ministry of Finance will publish a list of companies to be included in these rules, that list is likely to be limited in scope and not the restraint on investment that was initially feared by industry participants. In conclusion, we believe that Japan has adopted the correct path of improved corporate governance in recent years, significant progress has been made in a short space of time which has helped to increase the extent of international participation in the Japanese equity market. The proposed amendments to FEFTA are a short-term step backwards, a reaction to rapid change and not a change in the overall direction which should see international ownership of the Japanese equity market rise to the 35-40% level in the next decade.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed