|

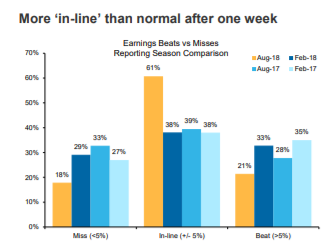

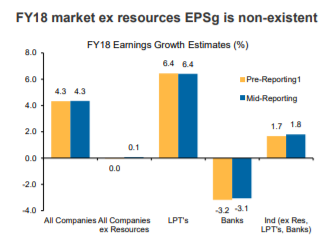

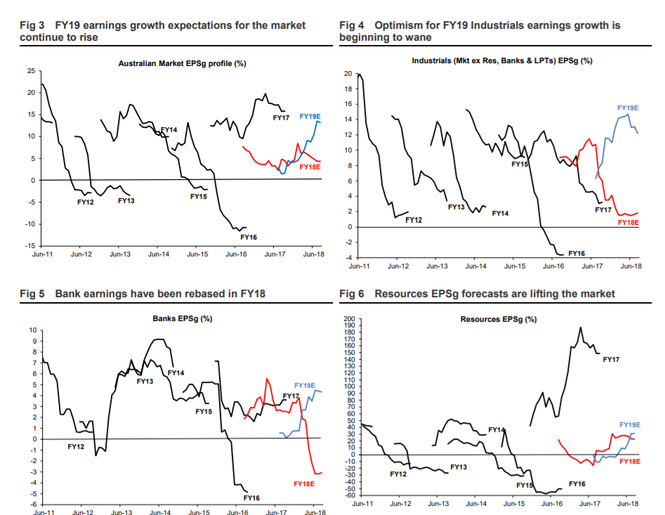

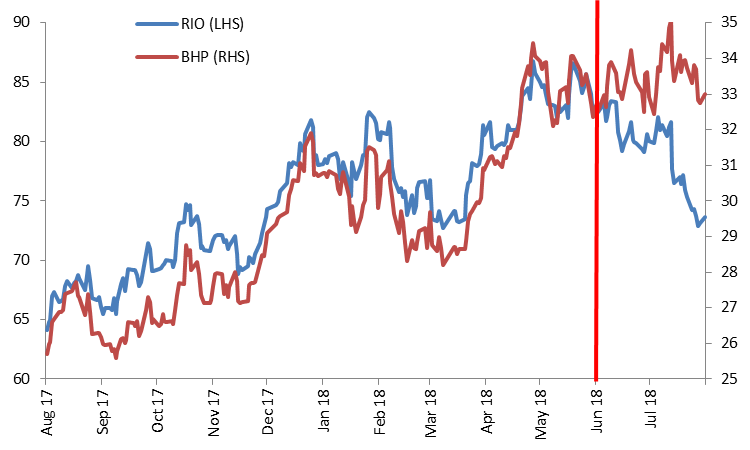

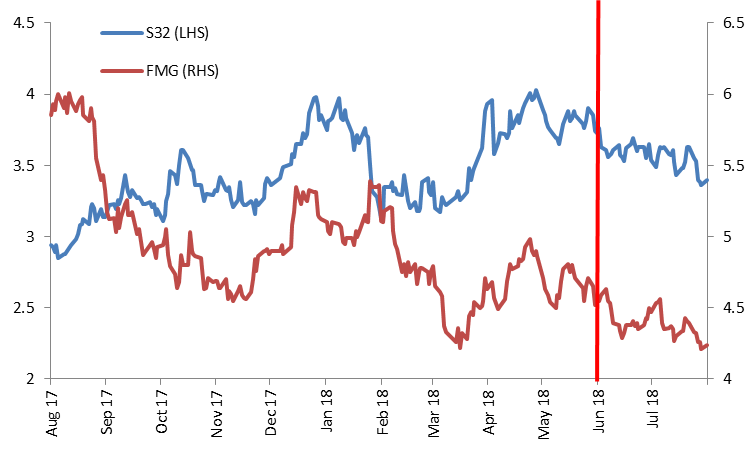

Guy Carson took some time out of reporting season to examine three key risks he sees in an Australian market that may be getting a little ahead of itself. The Australian Equity market this month has broken out into fresh 10 year highs. Whilst we don’t like to speculate on short term movements, this feels to us like a market that wants to go higher. Reporting season has been fairly benign and, in our opinion, risks are by and large being ignored. The P/E multiple of the market continues to trade ever higher and is heading up towards the highest level in multiple decades. With all the noise around, we believe the market is overlooking three key risks. These risks are a slowdown in Chinese growth (most notably on the fixed asset side), valuations at very high levels and a slowing residential market. In order to understand the drivers at play, we need delve down into recent events. It has been the start to reporting season that has dominated the market headlines over last few weeks. Overall the market has been happy with the majority of results. Interestingly, the amount of companies reporting “in line” with expectations has been much higher than usual at 41% (this can be seen in the charts below from Macquarie). This means that a lower proportion of companies have been beating or missing. This in turn means that volatility has been lower. The market has typically rewarded companies that have reported in line and in the cases of those that have missed, most selloffs have been minor and have tended to rebound (Seek for example). Source: Macquarie Group It is also worth highlighting that expectations were low heading into reporting season, with earnings growth of 4.3% expected. This growth was coming entirely from resources with the companies ex-resources expected to deliver flat earnings (they are slightly ahead of expectations at this point). Banks are the major drag on FY18 earnings with a regulator induced fall of over 3% in earnings per share. Growth in the industrials sector has also been anemic at below 2%. So with earnings broadly in line with low expectations, why does the market continue to rally? For an answer to that we need to look forward to the expectations for FY19. What we find here is that FY19 expectations have been rising over the last few months. They currently sit in double digits so next year is expected to be a bumper year for corporate profits. Although historically we see this number typically starts high and gets revised down over the course of the year. Breaking these expectations down across various sectors tells an interesting story. Banks are basically expected to recover what they lost this year. Industrials are expected to have earnings grow by a solid 12% (although these expectations are falling, more on this below). Resources are again left to do the heavy lifting with expected earnings growth of over 30%. This growth in resource earnings is coming despite a Chinese economy that is clearly slowing. We first wrote about our concerns around China back in June (see here). Since then the Chinese data has continued to deteriorate with Fixed Asset Investment sliding to its lowest growth in 20 years. As a consequence share prices have fallen across the board (led by weaker commodity prices) despite the above positive earnings reversions. The charts below show the share prices of BHP Billiton, Rio Tinto, South 32 (S32) and Fortescue (FMG). Source: Thomson Reuters Rio, South 32 and Fortescue have all sold off since June (denoted by the red line). BHP has held up better due to their Oil exposure. Oil is less exposed to the Chinese economy as they represent only around 20% of world demand as opposed to 50-60% for other commodities. In the near term we expect that earnings downgrades will be driven more by the miners and less by the energy plays. We believe the market is just starting to wake up to the impact of the falling commodity prices.

Moving back to industrials and FY19 earnings expectations have been revised down slightly in the early part of reporting season but still stand at a very respectable 12%. Some of the key companies behind the slight downgrade have been CSL, Seek and AGL. CSL is an example of how much positive momentum is in the market currently. The company reported a FY18 result in line with expectations (28% EPS growth) and provided guidance for 10-14% earnings growth in FY19. This guidance was around 5% below prior expectations. Ordinarily, you would expect the shares to sell off given the lower than expected guidance but instead we saw the shares surge to all-time highs. We understand why people want to own CSL. It is in our opinion the highest quality Australian company; it has a dominant global market position and has proven its ability to reinvest capital at very high rates of return. However, the company currently trades on around 34 times FY19 earnings, well above its long term average of 22x. In our recent study of valuations (see here) we found that this was a common feature amongst the Australian market with almost every sector trading above its long run historical average. The only exceptions were Telcos and Energy. The market doesn’t care about valuations at the moment but eventually it will. The final risk we believe the market is overlooking is the weakening residential property market. This sector has been a key driver of economic growth and employment since 2012. Last year, the construction industry was the 2nd biggest driver of employment growth and it now represents 9.6% of the labour force. According to the RBA this is the highest level in a century and residential construction represents approximately 75% of those jobs. Recently, we have started to see a drop in the demand for dwellings. Credit has been squeezed slightly by the Royal Commission and this has led to fewer dwellings changing hands. Those that have transacted have seen prices fall slightly. A lot of analysts suggest there is nothing to be alarmed about currently and point to similar declines at various points of recent history. They typically point to the fact interest rates are not rising (and the RBA isn’t in a position to raise them anytime soon) and the fact that unemployment is relatively low. Typically, you would need one of these to reverse in order for a substantial decline. Whilst both of these are true there are a couple of things that that we believe make this time different. Firstly, this boom since 2012 has been coupled with a record boom in residential construction. With demand starting to fall, supply (construction) is likely to fall and lead to a rise in unemployment. The multiplier effect from construction activity is large with all ranges of employment from developers, constructors, trades, property agents and financiers impacted. We can see the impact of a fall in construction via the United States where 9 out of the 11 recessions they have had since World War II have been preceded by a fall in residential investment. Secondly, all of the previous declines in house prices locally have been reversed by the RBA entering an easing cycle. Typically when the RBA starts cutting, the market starts to rebound. This time is different for two reasons, firstly with interest rates at 1.5% there is very little scope to cut rates and secondly, the RBA has been very firm on the fact they won’t cut just to save the property market. In addition, recent increases in wholesale funding costs are starting to flow through to “out of cycle” rate hikes from most of the second tier banks and forced switching from interest only to principal and interest is expected to pick up over the course of 2019 and 2020. The property market is set in our opinion to have a significant impact on the equity market. If the RBA, APRA and the government can engineer a soft landing then the equity market as whole will be an ok investment. Investors will pick up solid dividends but limited earnings growth. However, it has to be acknowledged the risk of a hard landing is building. The impact in this scenario will be felt broadly with Residential REITs and building companies at the front line. It will spread through the financiers (Banks) who have residential exposures well above international peers (mortgage books equivalent to c. 60% of their assets as opposed to 30-40% globally). It will also impact retail stocks most notably those exposed to furnishing new dwellings (Harvey Norman, Nick Scali, JB Hifi through The Good Guys). We are not sure how this plays out but we do believe the overall market is too sanguine about the risk currently. Whilst momentum in the Australian Equity market continues to build we note that risks are rising. China is slowing, the market is not cheap and property market fears have been pushed to one side. Shorting stocks has become fraught with danger and share price falls have typically been brief. We are always hesitant to stand in the way of a bull market and will always try to take advantage of the market situation. To this end we have taken several new positions (small in size) that either have strong earnings momentum or are trading on depressed valuations and we feel they are primed for a rerating. On the other hand, our core positions remain in companies with regulated yields (Spark Infrastructure), exposed to Infrastructure construction which is set to boom (Cimic, SRG, Veris) or have limited cyclicality and exposure to offshore earnings (Gentrack).

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed