|

This week the TAMIM Small Cap team take a look at the embedded value within their portfolio. Summary:As the portfolio underlying the TAMIM Australian Equity Small Cap IMA approaches its 3 year anniversary we believe the embedded value opportunity within the portfolio is as compelling as when the portfolio was launched. The strategy is invested in high quality smaller companies which are trading well below our view of fair value. The portfolio is currently trading at a 32% FY18 P/E discount versus the All Ords despite the fact that expected FY18 earnings growth is expected to be almost four times greater. What is embedded value?Embedded value is generally defined as being the underlying value of an asset based upon:

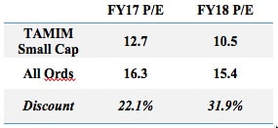

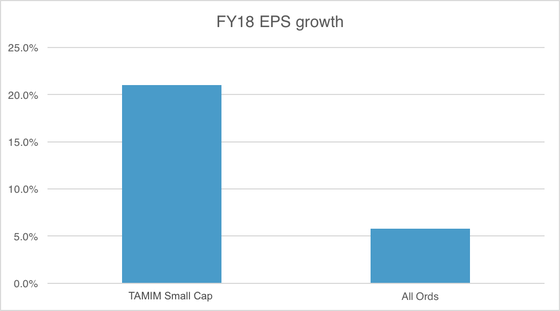

In the TAMIM Small Cap strategy, we are looking for high quality smaller companies in which embedded value is far in excess of the current market cap. The TAMIM Small Cap portfolio embedded value opportunity in numbers:The TAMIM Australian Equity Small Cap IMA portfolio currently owns 17 high conviction stocks which we believe are the “best of the best” high quality smaller company opportunities listed on the ASX. At present, the vast majority of these positions are earnings based positions – i.e. stocks in which we believe the discounted value of these companies’ future cash-flows is far in excess of their current market caps. At a portfolio level the most effective way to present the earnings based embedded value opportunity is to show the underlying portfolio’s weighted average P/E valuation versus the weighted average for the All Ords, and then to compare the weighted average expected earnings growth for FY18 with the All Ords. TAMIM Australian Equity Small Cap underlying portfolio weighted average P/E vs the All Ords (assuming portfolio is fully invested as cash has no P/E): The TAMIM Australian Equity Small Cap portfolio is trading at a significant valuation discount versus the broader market. TAMIM Australian Equity Small Cap underlying portfolio weighted average expected FY18 earnings growth vs the All Ords (assuming portfolio is fully invested as cash has no EPS): The TAMIM Australian Equity Small Cap portfolio's expected earnings growth is 3.6x that of the broader market. It is the combination of the above table and chart which shows the TAMIM Australian Equity Small Cap portfolio's embedded value opportunity: i.e. The portfolio is trading at a 32% valuation discount versus the broader market and yet earnings growth is expected to be almost four times the market average. In our experience, this is an usual combination within the investment company universe, and highlights the size of the strategy's opportunity looking forward. How will the embedded value opportunity be realised for investors?Earnings positions: Typically for earnings based positions the value opportunity will be realised through earnings reports which highlight cash flow growth rates above market expectations, and thus lead to an increase in market expectations regarding future cash flow growth rates. Example: Zentias (ASX:ZNT) is a typical TAMIM Small Cap portfolio earnings based position in that it ticks all our boxes for a high quality company, is trading at a significant sector discount, and its expected catalysts are earnings upgrades driven organically and through acquisitions. We believe the stock is trading significantly below its embedded value at present. ZNT has been covered in a recent research article (again here). Asset positions: Asset based catalysts tend to be less predictable than for earnings positions as they are often driven by one significant catalyst as opposed to regular quarterly earnings reports. The key major catalysts we generally expect for asset based positions include: asset sales, asset purchases, and growing sum of the parts visibility based on improved market communication/disclosure. Example: Elanor Investors (ASX:ENN) offers a compelling asset valuation opportunity at present in our opinion as the stock is currently trading roughly in line with its current net asset value which implies its highly profitable fund management business is trading at a significant discount to fair value. This is a typical example of the sum of the parts becoming increasingly visible in an asset based position over time. ENN was covered in a recent newsletter. A generally long term perspective: We believe we have a significant advantage over shorter term focused investors/traders over the long term. By “not caring” about the short term market noise we find that we are well positioned for the value creation in our stocks as and when it arrives. This long term perspective will be absolutely key in realising the embedded value within the TAMIM Small Cap potfolio. Conclusion:Buying stakes in ASX listed companies in which embedded value is far in excess of the current market value is what we are focused upon day in, day out. We believe this underlying value will be realised through catalysts such as earnings upgrades, as well as our old friend, time.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed