|

The TAMIM Australian Equity Small Cap team take a look at the power of management incentives and the importance fo management's interests being aligned with those of investors. Summary One of the key attributes we look for in a management team is clear evidence that they have “skin in the game”. All the evidence suggests that this is a powerful mechanism to ensure shareholders benefit from the best management have to offer. In this article we discuss the significance of management incentives and two powerful examples from the TAMIM Small Cap IMA's portfolio. The power of “skin in the game”

The expression “skin in the game” is used a lot these days. So much so that it can be easy to forget just how powerful senior management incentives can be from a shareholders’ perspective. When we refer to senior management throughout this article, we are talking about both the top level management such as the CEO and CFO, as well as the executives and key managers who are responsible for overseeing and executing on the business’ strategy, and who often have as much influence on the success or failure of as a business as the CEO. As a starting point, let’s delve into the reasons why management “skin in the game” is such a powerful motivator for management to succeed – some are obvious whilst others are less so:

Two Powerful Examples from the TAMIM Australian Equity Small Cap IMA Portfolio For the above-mentioned reasons, we are impressed when we see a large number of a company’s senior management team genuinely aligned to the long term success of the company. Two recent noteworthy examples of initiatives to align managers’ interests with shareholders in our portfolio are: PIONEER CREDIT (ASX:PNC) Financial services company Pioneer Credit recently changed their management incentives to focus upon performance over the next 3 to 5 year period rather than a shorter term period, with fourteen executives and senior managers being issued long term performance rights. The following PNC management commentary summarises the benefits of this longer term way of thinking: "Over the past 12 months, the Pioneer Board and Remuneration Committee have been working towards optimally structuring the Company’s remuneration incentives to ensure that executives and senior management are both appropriately rewarded and aligned to the Company’s strategic goal of sustainable long-term earnings growth. Due to the nature of Pioneer’s business, as an acquirer of assets that typically liquidate over a period of up to 10 years, the Board recognises the importance of appropriately incentivising employees such that they are accountable for the most significant part of tenure of acquired assets. Pioneer’s updated remuneration structure is designed to ensure that executives and senior management are focused on continuing to acquire appropriate assets at the optimal prices, rather than driving short term results.” What this says to us:

BLACKWALL (ASX:BWF) Property fund manager Blackwall recently granted options to six senior executives and managers at a $1.00 exercise price which is at a premium to the current share price ($0.95). We were pleased to read the following commentary from the company’s management: “The Board of Directors is of the view that employee and executive remuneration should be linked to the success of the Company and be expressed as ownership of it. As we are ASX listed, we have the benefits of share ownership schemes to attract and retain key personnel. For junior staff this has and will be achieved through the Employee Share Bonus Scheme and for Board members and senior executives through the Employee Share Option Plan (ESOP). The aim of each program is to both reward and incentivise.” What this says to us:

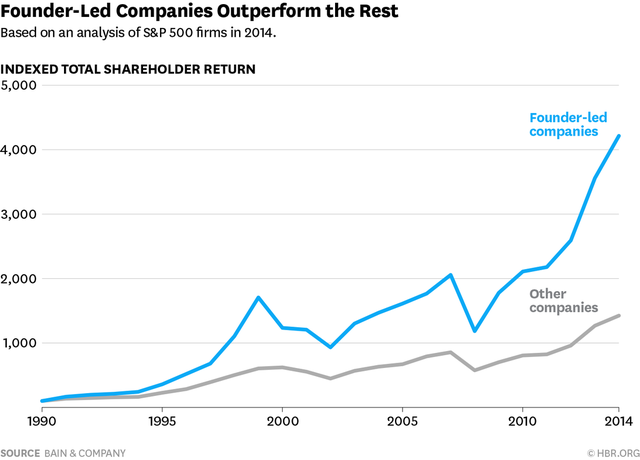

The Evidence The empirical evidence is clear…: Conclusion

Investing with the right management teams is a core part of our investment process, and ensuring management’s interests are aligned with shareholders is a key part of that assessment. We are always pleased to see our management teams well compensated for a job well done as it generally means our investors have done very well as shareholders, and are well placed looking forward.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed