|

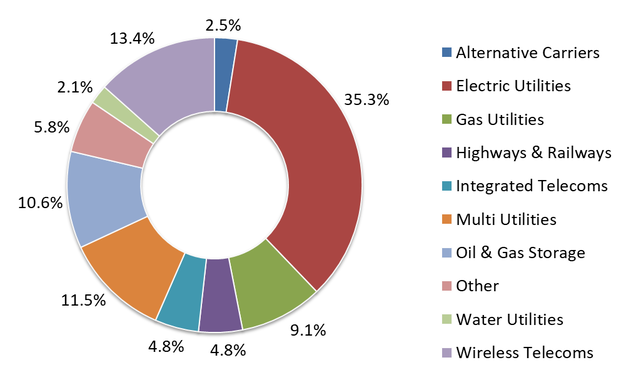

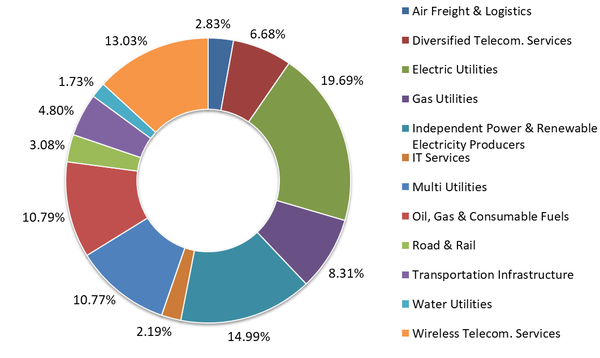

We won't beat around the bush, this is a simple suggestion to look at listed Infrastructure equities as a source of dividend yield, reliability and yes, even capital growth.  Author: Robert Swift Author: Robert Swift There are over 300 globally listed infrastructure companies and that list is likely to grow if we are correct about the anticipated increase in investment in the capital stock of major economies. The current opportunity set is illustrated in the pie chart below. There are some characteristics of this stock universe that should appeal to investors who wish for capital preservation and yield. Something which used to be available from government bonds, but these are no longer a risk-free return but a return free risk. Over 1/3rd of the available government bond market now yields nothing or negative in nominal terms, let alone in real or inflation adjusted terms. Listed Infrastructure equities offer:

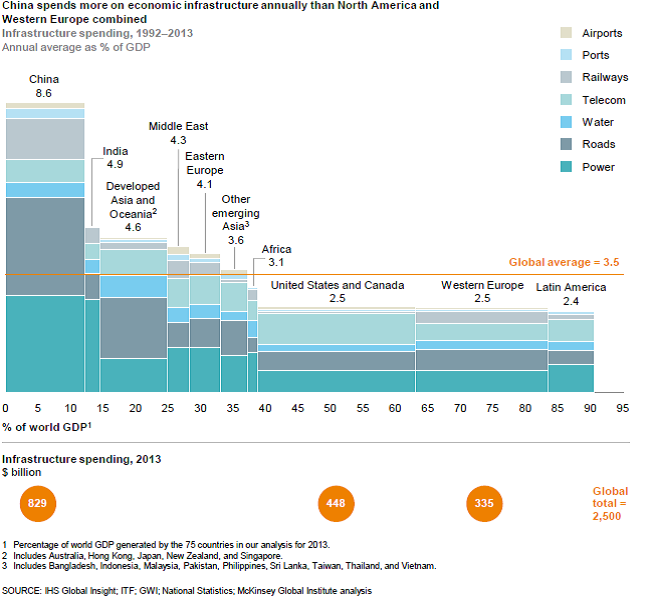

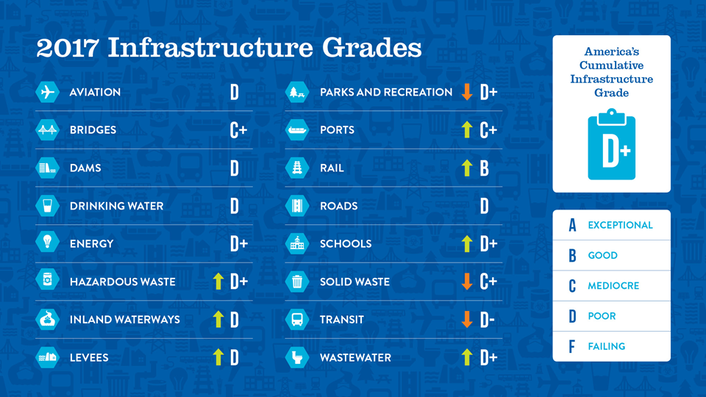

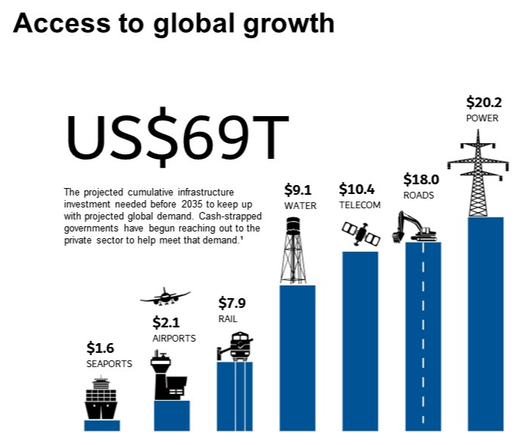

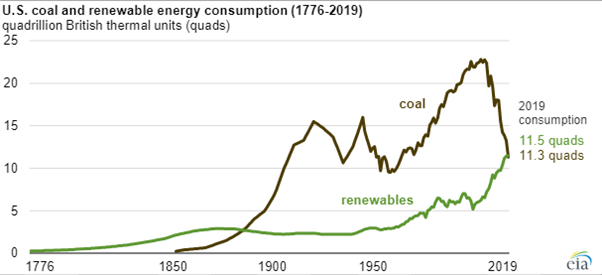

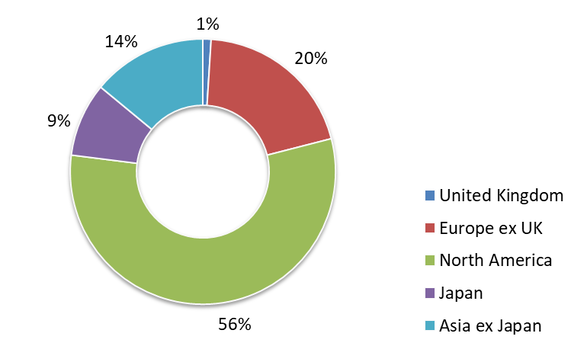

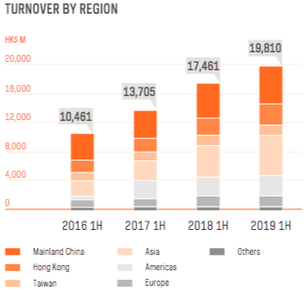

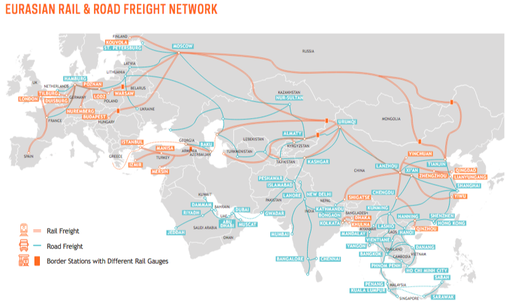

This increase would be a welcome return to investment levels required to maintain capital stock; and which used to be routine. It’s in the last 25 years or so in the West, that investment has failed to keep pace with urbanisation and population growth. It has been clearly flagged by policy makers that they would now like to play catch up. In the Victorian and Edwardian eras, as much as 20% of the economy went on public works – bridges, railways, hospitals, schools, sewers, parks, and then roads. Check out the below chart where it is clear that the West has fallen behind Asia. The paucity of investment has not surprisingly caused economic problems. The table below, compiled by the American Society of Civil Engineers, will tell you all you need to know about USA infrastructure. This report comes out every four years. We highly doubt the grades will be better next year. Both Republicans and Democrats have committed to spend more on infrastructure, so this represents an investment with a good political hedge built in; unlike others such as healthcare stocks or even technology companies. In terms of the increase in spending, it is huge. Almost $70 trillion is calculated as being needed in the next fifteen years to play catch up and to cope with increased populations and required connectivity. Some of this will come from the private sector and this is why the number of listed opportunities will increase. As active managers that is a good thing in that it provides opportunities for stock selection to work. For all investors it means they will have to consider how to get representation in this sector. It could be relatively soon that there are over 400 global listed infrastructure companies – there aren’t as many liquid listed companies on the Australian Stock Exchange. The chart below divides this anticipated investment into the major categories. Additional attractions of investing in this area for some, will come in the form of cleaner types of infrastructure investment, and “renewable” as an investment theme. Quietly, the USA now produces more electricity from renewables than it does from coal. This is happening now under a Republican administration. Europe is likewise getting there. China’s solar installation is the highest in the World. We have adopted the (corny?) theme of 3R’s for the global infrastructure opportunity– Renovation of existing capital stock; Reinvigoration of economies through productivity enhancing capital investment; Renewables – cleaner, sustainable, opportunities for innovation. Our current infrastructure portfolio (available as a TAMIM Individually Managed Account) is invested in many sectors:- And many regions:- A stock we would highlight is Kerry Logistics (636:HK). We own this in the Asia Small Companies strategy and in the Global Infrastructure strategy. It’s been a good stock to own (its share price is up over 28% over the last 12 months); there is more to go for because the logistics’ supply chains are going to change as we see the continued switch from global sourcing to politically directed sourcing. Companies may have to sacrifice optimal sourcing where optimal means ‘just in time’ and to switch to optimal sourcing where ‘optimal means ‘robust’ and able to cope with politically motivated instructions from governments? It is still cheap:- It has a broad network and a diversified revenue base. Source: Kerry Logistics company filings And it was carefully assessed by our team from a fundamental perspective. The Accounting Strategic and Governance lens we use for the analysis of all investee companies gave us no concerns. Accounting, Strategy and Governance Comments Accounting

Strategy

Governance

Conclusion

The era of ever lower interest rates has produced little sustainable growth. Global economies need fiscal investment to correct this. If Covid-19 has a bright side, it is the excuse to unleash public fiscal spending. This is happening. The better led economies will spend on productivity enhancing projects including broad infrastructure enhancements, and thus be better prepared for the next version of the global economy. These economies will pull ahead and attract more people who wish to participate. Investors who catch this early will prosper too.

1 Comment

Robert Oser

22/1/2021 04:05:27 pm

This is a well researched analysis of the infrastructure sector which has been hyped by most investment advisers for some time. Unfortunately, the performance of the listed entities and managed funds fails to live up to the positive outlook. Many analysts play down the risks in infrastructure such as volume risk and regulatory risk. Buying into existing projects will not yield a good return but new projects where a development profit can be seized would be worthwhile. When Mrs Thatcher was privatising infrastructure, idealism was not the driving force, contrary to the furious criticism. The grocer’s daughter was concerned with the funding of maintenance and capital expenditures and the backlash if tariffs were increased. Let the private sector deal with it and cop the opprobrium.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed