|

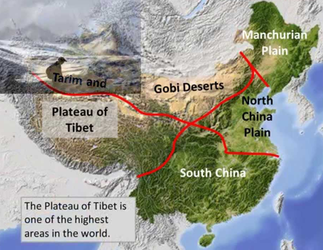

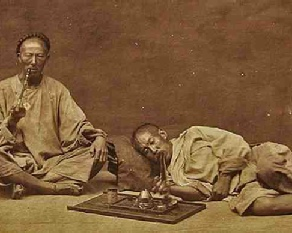

This is the second in a series of articles that will ultimately look to explore the potential impact, both short and long term, of a trade spat between Australia’s largest investor and Australia’s largest trade partner. This installment looks at the way growth is done in China; an important dynamic to understand in order to truly examine the impact of a trade war on Australia and the broader global economy. Read Part 1 here. Since the publishing of the first article in this series last week we have seen further developments with the Trump administration now announcing sanctions against Huawei. The United States Department of Commerce added the firm onto a list of companies that are considered a national security threat, thus effectively banning US technology companies, including the likes of Intel and Broadcom, from doing business with Huawei. This new development puts into focus the bigger picture around Sino-US relations, this is not a question of trade but rather a question of leadership in the fourth industrial revolution. Indeed with the department of commerce reporting that 40% of US businesses have decided to relocate their businesses or have done so already, the issue might in fact run deeper than is made immediately obvious. As discussed in one of our previous articles, published in the Australian Shareholders Association Equity magazine around the trade war this trend will have broader implications for Global Supply Chains and geopolitics as both governments look to untangle their supply chains. These developments fit well into this weeks article where we look at the evolution of the Chinese polity and economy to understand the motivations and likely outcomes of this increasingly complex relationship between the worlds great powers. Growth - Chinese Style Since the establishment of the People's Republic of China fifty years ago, the country and economy have seen tremendous change. But it is easy to look back on its history and try to draw some semblance of linearity to this change. Its growth and evolution has been anything but orderly. Its government is not a function of some preconceived or even intentional process but rather a result of its unique history and geography. And so, while the traditional narrative places the beginnings of its economic miracle to the actions of Deng Xiaoping’s market reforms in the 70’s, this is in our view rather simplistic and downright misleading. It is a narrative that we in the west try to use to explain and make sense of what is undoubtedly the greatest economic transformation in modern history in the space of four decades. As our simple stories last week proved, this is a misconception. Business in China does not, and in our view will never, fit our western ideals of commerce and neo-liberal economics. If we think of modern China, there are two main transitions to consider. The first is the transformation from a largely rural to an urbanized society and the second from a bureaucratic to a much more mixed system, both of which remain incomplete. A country covered by mountains and vast deserts, its population has always been historically agrarian in nature, yet its land is largely inarable. Its landmass rugged and it’s only access to the coastline along the historically foreign dominated Treaty Ports which, in the modern day, dominate its economics (Shanghai, Nanjing etc). China’s history has always been inward looking, we think the Great Wall not only tells the story of a populace trying to protect itself against unruly raiders but also of a society that was not outward looking. Its experiences with the outside world, apart from the explorations of Zheng He over 600 years prior, had always been minimal and whatever they did have built into its psyche a sense of mistrust and immense national embarrassment. The imposition of treaty ports, the opium wars and the Japanese occupation shaped modern China’s history and left a largely mistrustful people intent on overcoming and rebuilding their pride. Of these, the opioid wars probably laid the foundation to how trade came to be viewed in China. By the 1800’s when China had become a leading exporter of Porcelain and other manufactured goods in the world , it received a steady flow of silver that allowed expansion. When British merchants, unhappy with the state of affairs, used opium as the commodity to balance out the trade imbalances this caused increased friction between the government in Beijing that eventually culminated in war. Opium addiction had gotten to be such an issue that Opium grown in India had become the bulk of imports into China. The nations subsequent defeats, as foreign encroachments and great powers carved up spheres of influence, made the humiliation all the more poignant. Indeed at their peak there were over 80 Treaty Ports in China, Shanghai being the most important.  With such a history, it is easy to see why in the first few decades after the rise of the Communist party, especially in the decades leading up to the great leap forward, the priority was always about self-sufficiency and independence. In a sad convoluted way, Chairman Mao’s intent on his GLF initiative was a way to catalyse this process. However, what the Communist Party did create was the skeleton and tools with which the later economic development was to depend on. Initially, priority was given to industrialisation in the northwest frontiers where heavy industry was given primacy. To this extent a party bureaucracy was created and quota systems implemented. This bureaucracy and the command economy was not, as one might imagine, alien to the population. China has had a long history of meritocratic based civil service with roots in the imperial examinations as early as the first millennia This is a system where merit based promotions were given priority over birth. This was not a completely feudalistic society but rather a mix of the two. The communist party functionaries effectively replaced the imperial civil service with their own brand, where the mandate and overall strategy would be set from Beijing but implemented by those beneath the hierarchy right down to petty provincial officials who were then motivated to prove themselves in return for promotions. Inside the party, politics was not authoritarian but rather distributed power. Moving up the party ranks would be contingent upon developing networks (Guanxi) within and a combination of merit based promotions. To illustrate the point, take for example a GDP growth target set in Beijing for the year by the politburo, the instructions would be passed down the hierarchy in such a way that from a village level they would be told the output for a certain period of time whose numbers would feed up to the township, the province and so and so forth. Xi Jinping’s career trajectory itself took him from the youth league of the party to provincial offices to the governor's office to eventually the national level. This unique system evolved in such a way as to ensure that the party was constantly rejuvenating itself with fresh leadership and perspectives as well as transitions that were mostly bloodless (with the odd exceptions). This also ensured that discontent did not get out of hand and new officials were motivated to maintain status quo. All this also ensured that Beijing had an extremely effective tool with which to promote its agenda and policies with relative ease. All organs of state from the Judiciary to the Army are effectively the organs of the party. Such tight control is what enabled the government to provide stimulus in a relatively short-time in 2016 and why earlier this year credit was allowed to be expanded so quickly. For example, the classic way that officials look to stimulate is through building projects, especially in local government. If GDP or employment figures are not up to scratch in any given year, with relative ease they can implement new projects in a short space of time. When considering such tight control one must also consider the wise words of Voltaire (or Spider-Man’s Uncle Ben, depending on your choice of literature); “with great power comes great responsibility” or, in our own much more cynical words, responsibility for the good and the bad. Which means that the party also has an incentive to ensure that economic growth continues at any cost. The survival of the establishment has become predicated on rebuilding the national pride after humiliation and lifting people out of poverty. The lack of short-term electoral incentives (unlike most western democracies) also enables the party to make decisions for the truly long-term meaning that when they set energy policy they think about the next fifty years rather than the next three. All this is ultimately to to say that we can not apply our own conceptions and frames of reference when considering the Chinese economy. Things are done differently, they are operating in a different way with different motivations and timelines. It is important to understand this point as we work our way toward understanding what the impact of these turbulent times will be on both the Australian and the broader global economy.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed