|

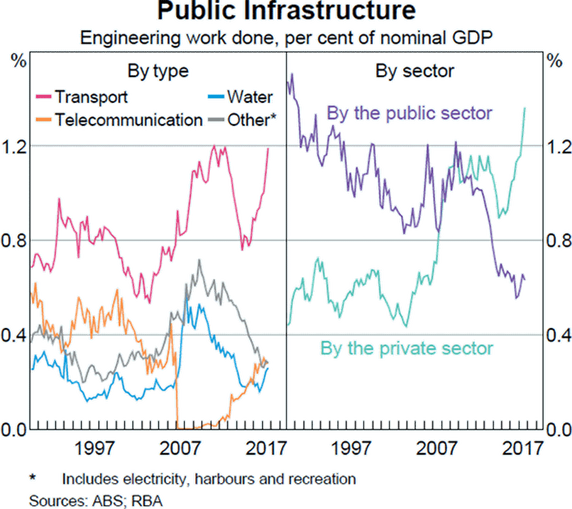

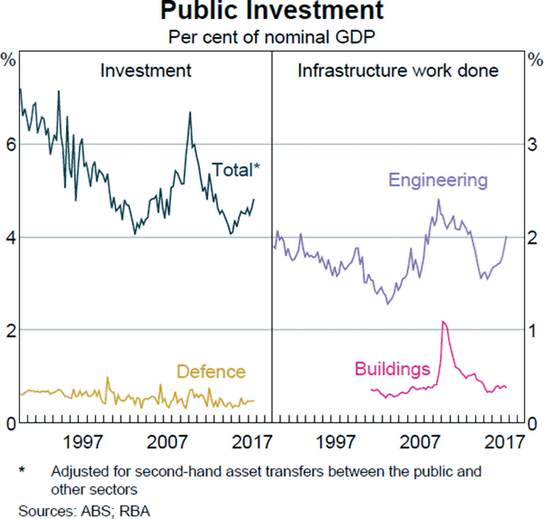

This week we would like to put forward our thoughts on the impact of bush fires specifically from an economic and investment perspective. While we understand that any topic of this kind might be open for criticism given the equating of human lives in monetary terms, we are by no means being callous about the devastation that the past few months have reaped upon the lives of thousands across regional Australia. It is a tragedy. But as with any major event like this, there will be winners and losers, especially on the stock market.  Source: The Guardian, 'Sifting through the ashes: Mallacoota residents after the bushfires – in pictures' Source: The Guardian, 'Sifting through the ashes: Mallacoota residents after the bushfires – in pictures' The Costs Estimates of costs from a purely economic perspective range from Terry Rawnsley’s (i.e. SGS Economics & Planning) 1.5bn to Moody Analytics’s 4.4bn AUD. Others have taken an even more creative path in adding in the cost of human life which, according to the Commonwealth's standards equates, to 3.7m AUD per life. In addition, when you add the repercussions related to human health such as smoke-related cardiovascular or lung diseases and damage to species and habitats, the long-term implications become less obvious. Dr John Quiggin from the University of Queensland, for example, estimates that the long term costs could be as high as 100bn AUD. To put that into context, Australia’s GDP for 2019 was approximately 1.323tn. If one were to take Dr Quiggin at face value, one might be forgiven for thinking that the National Bushfire Recovery Fund, with all of 2bn AUD in Commonwealth funding, might be rather inadequate. Yes, the 2bn AUD is sufficient from a purely tangible cost perspective. For example, the direct resources used up in immediate action such as the cost of relocating residents, firefighting, destruction of properties and assets. However, what is not so clear is the cost of rebuilding entire regional economies to vibrancy, replacing and upgrading of infrastructure. This is not a state issue but a national one. One in which the nation can make the best out of the rather unfortunate hand it's been dealt with. In terms of the impact upon GDP, this is where things get rather murky. For example, GDP doesn’t necessarily take into account the houses that have been destroyed but top-line can grow once the new houses are built. On the other hand, the rebuilding process can also add to household debt and stifle credit growth and consumer sentiment over the long haul. More specifically, one recent impact we felt was Mosaic Brands (MOZ.ASX) which was a significant holding for us in the domestic equities portfolios. The stock is down about -30% since the beginning of November as it derived much of its business from regional Australia. Apart from GDP, with all its shortcomings, what is also uncertain is the long term impact upon communities and quality of life which doesn’t immediately make itself known on top-line GDP growth but undoubtedly can impact both long-term productivity growth. For example, Post-Traumatic-Stress disorder, increased healthcare costs etc. What Next? Just as the phoenix which regenerates out of the ashes, we see a very plausible scenario where regional Australia is greatly rejuvenated. Out of the bad news, we can see new rounds of infrastructure spending and jobs created as part of the rebuilding process. In an era of historically low-interest rates that are an outlier from a historical perspective, we are sure many of you were alive during the era of double-digit rates, it might make sense for governments to take a little bit more of a liberal (pun fully intended) approach to budgetary discipline. In fact following the rate cuts last year, the RBA governor already indicated that more needs to be done on the fiscal side of the equation. The bush fires might be an opportunity for the Commonwealth to step up to the plate and not only get some runs on the board in terms of the regional electorates and maybe have the public forget about the Hawaii trip but also stimulate nascent growth numbers. In a situation such as this where the RBA continues to lower rates (and we have already made a call well in advance that we see another two rate cuts through this year with news around COVID-19 and global growth figures front of mind), it might very well make sense for the fiscal side of the equation to get a little more expansionary. To spell it out one more time: while the cost of capital is so low (almost zero even if one considers inflation), now is the time to be spending big on the infrastructure upgrade that this country so desperately needs. The tragedies of the last few months, floods included, just mean that this is a requirement as opposed to a “luxury” (we would argue that, if Australia is to keep up with the world, it was already required). As the above graph shows, public sector investment has been rather lagging from historical standards. Though much of this has to do with the privatisation of capital-intensive public-sector undertakings like utilities and the proliferation of public-private partnerships (PPP’s), Australia still remains lackluster when it comes to new investments. A scenario that seems even more ridiculous given that Commonwealth bonds are trading at a yield of 1.028% which means that governments can finance any new debt relatively cheaply with the added advantage of a fiscal multiplier of close to 1.3 according to the OECD. A fiscal multiplier, for those of you who were fortunate enough not be economists, is the impact that every additional dollar in public infrastructure spending has on GDP growth. In this instance, a fiscal multiplier of 1.3 means that for every billion that the government spends on infrastructure there is an addition 1.3bn AUD added to GDP growth. In the medium term this year, we actually see a scenario, thanks to Australia’s notoriously short election cycles, of significant expansions in terms of fiscal stimulus and additional spending on not only rebuilding but upgrading existing water and road infrastructure. One can only hope that this gets consumer sentiment back on track and will see significant tailwinds to sectors like infrastructure and materials. Retail in regional areas, on the other hand, might take a lot longer to recover but much will be contingent on job creation and, more specifically, construction activity which let’s not forget still employs 15% of the country. The last few months have been an absolute tragedy for much of regional Australia but it is our job the keep an eye out for opportunities in the market and the reality is that events such as these inevitably present opportunities for the savvy investor. There will be construction companies with a regional focus that are set to benefit, infrastructure as a sector should receive a boost from the rebuild/upgrade effort and, digging into further niches, insurers will have to make a lot of payouts but third party claims assessors will see their business jump as they process an abnormally high number of claims. For every company that was impacted negatively there will be one that can take advantage of the recovery, it is just a matter of being able to identify the right sectors and companies. Sources: The Guardian, Sifting through the ashes: Mallacoota residents after the bushfires – in pictures The Conversation, Take care when examining the economic impact of fires. GDP doesn’t tell the full story Source: The Guardian, 'Sifting through the ashes: Mallacoota residents after the bushfires – in pictures'

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed