|

This week we visit perhaps one of the most prominent and divisive topics in investing at present. That is the future of energy markets and, in particular, where the price of oil heads to from here.

As always, take our ramblings with a grain of salt since, like you, we are trying to make sense of an investment universe that gets ahead of us. One recollects the words of Jean Baudrillard in this environment for “We live in a world where there is more and more information, and less and less meaning.” As such we shall try make use of our limited rationality to extrapolate as much meaning as we can.

Overview

We began the news cycle with a lack of resolution between OPEC and the Russians around production targets, followed quickly by the Tweeter-in Chief’s intervention. We saw an initial sell-off in both Brent and WTI with a bottom at close to $24 and $20 respectively. 20% -40% swings in the spot price becoming the daily norm. Implied volatility on the spot market is irrelevant in the context of this discussion, as buy and hold investors, we are more interested in the long-term implications. What matters for long-term price action is supply and demand.

Oil Supply & Demand Explained

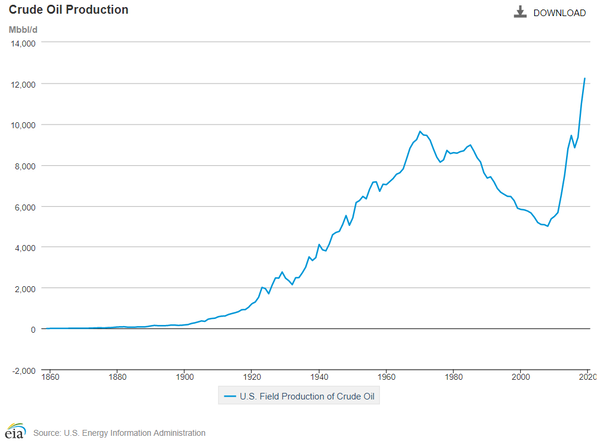

The past few years has seen an expansion in production capacity from the US shale producers such that the United States became the largest producer in the world with close to 12m barrels per day.

This production, based primarily out of the Gulf of Mexico and the Permian Basin, is usually attributed to the advent of new technologies. But here is the caveat that most people ignore, the technologies that made it possible have been in existence for well over three decades going back to the late 80’s and 90’s. What did change however, was the availability of credit, in particular a low interest rate environment and the creation of highly leveraged producers.

We’ve seen this story play out before. All the way back in 2016 oil hit USD $26 a barrel. Over 208 producers filed for bankruptcy and it involved close to $121bn USD in aggregate debt being wiped off. What is different now is the magnitude of recent events. For example, Exxon Mobil’s bonds were downgraded by Moody’s thus increasing the cost of production for even Energy majors (let alone juniors). In essence the shale boom was a result of a peak oil price of close to $150 USD a barrel in 2008 and the low interest rates that followed. That said, economies of scale did not follow suit with the Producer Price Index for Drilling Oil & Gas Wells sky-rocketing 350% from 2005 to 2014 (see below). Much of these accelerating costs were due to the depletion of easy to access wells.

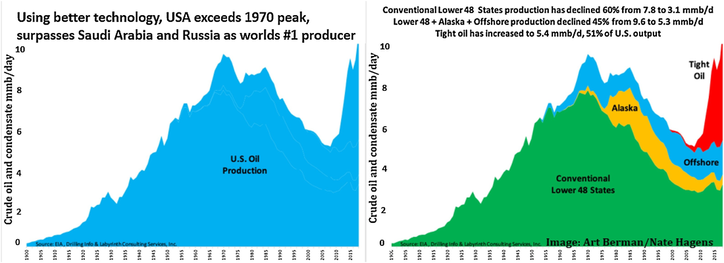

The end result has been the increased use of what is called “tight oil” which now makes up 52% of overall production (refer to graphs below). Tight oil is oil that is deeper and is more resource intensive to produce. For example, a typical new well in the US now requires 1200 truckloads of water, 100 train carloads of sand and $8-10m in drilling and completion cost.

Remember the above information and let us compare that with the Saudis and Russians. For Saudi Arabia, the cost of production is approximately $2.80 USD a barrel and it is approximately $16 a barrel for the Russians. This compares to a $38 cost base for US producers.

So given this cost advantage, why would the Saudis or even the Russians want a higher oil price and would they be able to sustain it for a prolonged period? On a reasonable basis and a purely commercial perspective, yes. However, one cannot think of energy without the politics. For a nation with no income-tax and an authoritarian regime (i.e. which would ideally like to keep the populace from asking too many questions), their budgetary break-even is more important. The break-even in this instance for the Saudis is $80 USD per barrel. The Russians on the other hand could handle $30 since the combination of a weak currency and energy independence (due to years of sanctions) allows them some leeway. The Saudis, by the way, are pegged to the USD.

Where to Next?

We continue to believe that both the Saudis and the Russians believe it is in their best interests to “cut production.” We would go so far as to suggest that the Saudis were never going to increase it in the first place. For one thing, there is no point producing if there is no buyer. Our view is that both MBS and Putin were in it for rhetorical purposes, moving prices just enough to have US producers up in a tiff. The simple logic for us? If there is no one to buy the product, what is the point of producing it? Most energy consuming nations are virtually in lockdown, including the likes of India and China, and not likely to go back to their previous decades capacity for the foreseeable future. We have a slight inkling that Trump's intervention was similar to a television drama. The Saudis’ only talking about increasing production by 3m barrels but really wanting a way out and maintaining the status quo at 10m. The Russians, we would guess, are in much the same boat. Trump will look like he has brokered a deal to take the imaginary extra 3-5m barrels offline and single-handedly save the US energy industry. Self-congratulatory tweets will ensue.

So, What Does This Mean for Oil Prices?

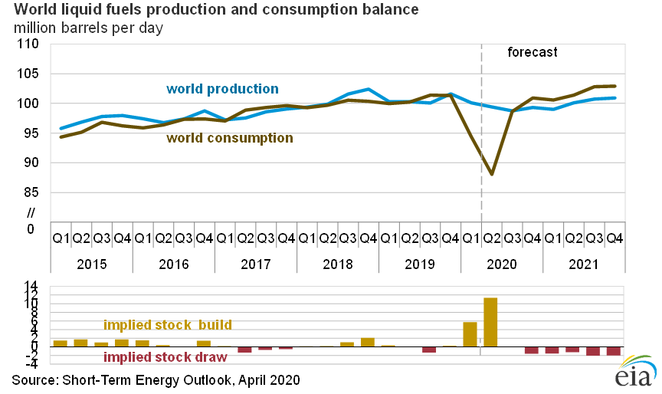

Supply is not the issue here, rather consumer demand is. Herein lies the biggest question mark. If we see unemployment rates tick up and GDP contract in large economies like the US, with some even predicting double digit contractions and unemployment figures, then demand will certainly fall on a scale not witnessed in the past. We could very well continue seeing a dip in the short-term as markets continue to search for a bottom. This would be in the absence of regulatory intervention such as the inclusion of an import tax in the US. However, the flipside of this is that we find it very hard to believe that companies go on to produce at rates that are uneconomical (duh). There is a bottom and a price below $20 is something we cannot fathom as even the inventory costs due to the lack of demand would outstrip the final price. Over the long-run, for those investors that have the wherewithal, this does certainly present the opportunity of lifetime (there seems to be a few of those going around right now). We find it very likely that there will be a period of bankruptcies running through the energy sector unless of course the Federal Reserve or governments around the world intervene in the name of energy independence or, in the US’s case, national security. In the absence of this, you would’ve taken a whole lot of production offline with the survivors having a competitive landscape vastly different from the one which preceded it. If we take the US Energy Information Administration (EIA) data as gospel, then the timeframe is likely to be around Q1 next year, assuming a v-shaped recovery (though this might be more like a messy u-shaped one, in which case Q2 next year). For time frame and numbers refer to the graph below.

We do see a reset to the longer term median at $35-40 USD a barrel. Anything higher is unlikely unless we somehow believe that global GDP growth will reset to “normal” by next year.

So How to Play This?

From our perspective, the key things to watch are sectoral dislocations. Use metrics like debt-to-equity, cash on balance sheet and production costs to buy decent companies at a discount. Our thoughts for the ASX are Woodside Petroleum (WPL.ASX) and Carnarvon Petroleum (CVN.ASX). Woodside has over $4.9bn USD cash on hand, total liquidity of $7.9bn USD and relatively low gearing at 13.8%, also having fixed the price for its LNG production. Similarly, Carnarvon is well capitalised and has no debt on the balance sheet. That being said, if prices continue to stay at these levels for an extended period of time, they may have to raise some debt or raise capital. From a global perspective, Exxon Mobil (XOM.NYSE) and Royal Dutch Shell (RDSA.AMS), with dividend yields in the 7.5% to 10% range, look reasonably attractive and should weather the storm given the flexibility of their supply chains. Australian investors also have the advantage of the AUD acting as a natural hedge against sell-offs since, on a relative basis, it is a rather weak currency in our view. For the more adventurous amongst you, given the lack of price-discovery in existing markets, consider companies that have been sold off irrationally as possibilities. One company that comes to mind is Australis Oil & Gas (ATS.ASX), a rather small market-cap company but one with good management and revenues hedged for the next 24-months at $54 a barrel. Our point is, the market tends to sell-off on themes and news without consideration for fundamentals. ATS, with its operations on the Permian Basin, might at face-value be front-and-centre in a price war but given the consistent paying off of debt on the balance sheet and revenues locked in at a significant premium for 24 months, we think they can weather the storm. Remember though, it is more important than ever to do your own thorough research and come to your own decisions.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Markets & CommentaryAt TAMIM we are committed to educating investors on how best to manage their retirement futures. Sign up to receive our weekly newsletter:

TAMIM Asset Management provides general information to help you understand our investment approach. Any financial information we provide is not advice, has not considered your personal circumstances and may not be suitable for you.

Archives

April 2024

Categories

All

|

TAMIM | Equities | Property | Credit

DISCLAIMER

The information provided on this website should not be considered financial or investment advice and is general information intended only for wholesale clients ( as defined in the Corporations Act). If you are not a wholesale client, you should exit the website. The content has been prepared without taking into account your personal objectives, financial situations or needs. You should seek personal financial advice before making any financial or investment decisions. Where the website refers to a particular financial product, you should obtain a copy of the relevant product services guide or offer document for wholesale investors before making any decision in relation to the product. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with the changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Tamim (or associated companies) products. Tamim does not guarantee the accuracy of any information in this website, including information provided by third parties. Information can change without notice and Tamim will endeavour to update this website as soon as practicable after changes. Tamim Funds Management Pty Limited and CTSP Funds Management Pty Ltd trading as Tamim Asset Management and its related entities do not accept responsibility for any inaccuracy or any actions taken in reliance upon this advice. All information provided on this website is correct at the time of writing and is subject to change due to changes in legislation. Please contact Tamim if you wish to confirm the currency of any information on the website.

magellen, kosec, clime, wilson, wam, montgomery, platinum, commsec, caledonia, pengana, tamim

RSS Feed

RSS Feed